MrJohnRoss

Market Veteran

- Reaction score

- 58

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

=MrJohnRoss...... and BAM! I'm back to being able to read and post from work. Thank goodness! :nuts:

NUGT/DUST System continues to hold DUST, but just barely. Price oscillations seem to be dampening, so we may be getting ready for a powerful move one way or the other. Looking at DUST, the 5 day, 20 day, and 50 day are all converging at this price point simultaneously, so I suspect there may be a clash to see which one is right (5 and 20 say up, 50 says down). It'll be interesting to see how this plays out.

I made a mistake by not looking at the F Fund when I got out of my S and I Funds. I rarely look at the F Fund as an alternative, but it obviously has all the momentum right now. Although I won't get hurt in the G Fund, I could have been making at least a little bit of money while I'm out of the market. Lesson learned. Always look at all your options when making a switch.

View attachment 25351

I know the S fund chart isn't very impressive but right now it's the little engine that could... hang on that is...

Are u still holding dust? I made a quick 15% off of NUGT yesterday.

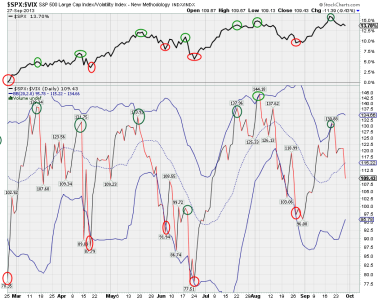

Hmm very interesting chart. But at first glance it seems like the S&P tells you more of where the SPX:VIX is going than the other way around.Here's an updated look at the SPX:VIX ratio.

Again, it appears that when the ratio reaches it's upper BB, it often reverses course and heads back down to the lower BB. Then the cycle repeats.

It's not a perfect timing model, but it's something worth keeping your eye on. It often times shows when and where tops and bottoms may occur.

Hello! Mr. JohnRoss,

NUGT has been on a downtrend, since inception, when equities are rising. DUST has been on the uptrend because of the favoring of equities. (Therefore, being against NUGT that is investing in gold/silver & gold/silver miners.)

How do you come to the assumption to accelerate towards NUGT and not DUST coming up towards the beginning of the year? Are you thinking that equities is getting ready for a down spin and NUGT would be the better choice on the short term? Considering long, would't DUST be the better choice?

Being in NUGT seems more riskier than DUST at any given time, however; can be rewarding on the very short term. I actually feel safer in DUST than NUGT. Other words, if your in too long with NUGT (against equities and remaining on a downtrend) it's difficult to get above water. This is why I like DUST more! Going "Long" for equities would mean DUST is the better choice between the two and safer. Do you agree! By looking in the past history for NUGT and DUST, the time frame is not favoring NUGT (unless your "short playing").

Respectively, just asking what you think...

Hmm very interesting chart. But at first glance it seems like the S&P tells you more of where the SPX:VIX is going than the other way around.