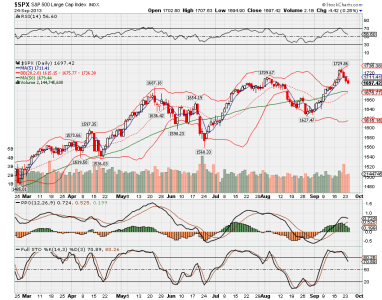

NUGT/DUST looks like it just barely produced a switch at the end of the day to NUGT. Since I can no longer post from work (my work computers still think this site is contaminated with MALWARE and a TROJAN VIRUS), technically, it now holds NUGT. For those of you paper trading this system, if there is ANY upside at the open tomorrow for NUGT, that would be the time to get in. (If it's a negative day for NUGT, I would hold off on making the switch). I find it amazing that the uptrend line and the timing band coincided almost perfectly to the day to produce this signal. Now let's see if it pans out, and if it does, how long it will last...