WhoDey....I appreciate the conversation regarding NUGT/DUST. I have yet to trade these, but have been keeping an eye lately on NUGT.

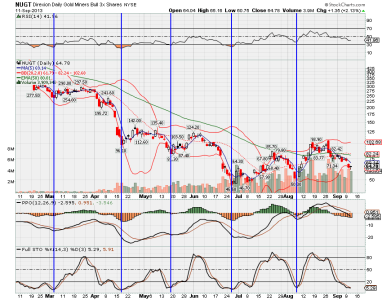

I've been trying to learn that bit of wisdom! It looks like NUGT is drawing close to offering an entry point, but patience is still required IMO.

Dutchy ... I've locked in more than my fair share of losses this year, so I feel the pain. I think I'd be inclined to hold a bit longer, but that's easy for me to say. Good luck.

Thanks Who Dey.... NUGT down another 8% this morning, bounced off 65 area so far. Avida Capital called for 60's this week which hit this morning. Scary thing is, they call NUGT 30-40 range end of 2013 with small rallys between.. Not good. Should have cashed out @ 85 last week but was on the road, oh well.. Only can hold and pray now.