nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Just wanted to make sure I didn't miss one!:laugh::blink:Ditto the above.... I hope yesterday was a great day...seeing that nnuut did a double for you, surely it was !!

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Just wanted to make sure I didn't miss one!:laugh::blink:Ditto the above.... I hope yesterday was a great day...seeing that nnuut did a double for you, surely it was !!

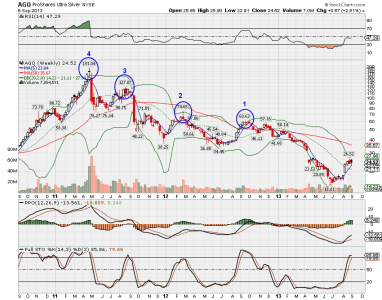

MrJohnRoss...For those that are interested, the NUGT/DUST system had a turning point on Aug 27 to DUST. I believe the metals had just gone too far too fast, and had become overbought. The RSI on SLV and AGQ had gone well into the 80's, which is very extreme. GLD was also getting overbought. The $HUI, GDX, and GDXJ had all had a nice run up, and were due for a short term pull-back, so we're getting one now.

My personal opinion, if you're holding NUGT, I wouldn't want to sell for a loss here. Sentiment is likely to change again, and the pendulum will swing the other way, eventually. The Stoch is still falling, so we're likely to have continued weakness for at least a little while longer.

Just keep in mind... the lower BB is near 57. If you can't stomach a fall that far, then get out now. These ETF's are not for the faint of heart.

Welcome back and thanks for your comments. From what I see checking NUGT chatter, there is some buying interest at these levels and with the Syria strike pending a reversal may come. Also NUGT swung from approx. 55 to 106 from 8/8 to 8/27, during 13 trading days confirming the volatility.. I'm holding here and read the 96 area would be a good top point. I'm worried about the "bleed" in this fund though. I've read you should not hold these Inverse ETFs more than about 10 days, at the longest, because of "bleed" ...

Your thoughts ? Thanks.

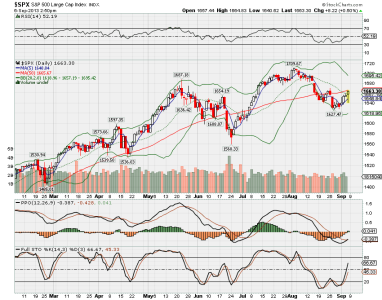

Liking that we broke through 1660 on SP500. Hopefully we can close above 1660. Saw on the MB where someone posted that 5 of 6 systems they follow are now short. Have to love being contrary.The markets continue to look like they're wanting to climb this wall of worry. Despite all the sudden swings, both down and up, the current short term trend still looks like it's wanting to move higher. Also, despite the fact that Sept is statistically the worst month of the year for the markets, I'm planning to stay invested as long as the technicals continue to look positive.

Liking that we broke through 1660 on SP500. Hopefully we can close above 1660. Saw on the MB where someone posted that 5 of 6 systems they follow are now short. Have to love being contrary.

Of couse, my track record this year sucks, so don't listen to me

I'm still holding AGQ

Me too. It had a nice run last month, but got a little too hot, so not surprised to see it cool down before heading back up. Here's what I'm looking at...

View attachment 25124

The first target I'm looking for will be the 60 area. Then, I'll be looking for the 70-75 area. It may not get back up to the 127 area or the 191 area any time soon (probably a couple of years), but won't THAT be nice!

Those would be nice. Not counting on it, but nice to dream about. Then again, if we get drawn into another war/military action that nobody wants, your targets could happen.Doing some quick calculations for symmetrical time lines for the above targets yields the following dates:

Target 1: $60.63 is 3/31/14.

Target 2: $74.65 is 9/20/14.

Target 3: $127 is 5/3/15.

Target 4: $191 is 8/23/15.

MrJohnRoss...That's probably pretty good "professional advice". However, I'm going to have to disagree. Let me give you an example to illustrate my point.

If you had a crystal ball on the markets, you could have bought DUST last year (9/21/12) at the closing price of 11.31. Had you then held it until it's recent high (6/26/13), you could have sold it at the closing price of 82.85. That's a gain of +632.5% in just over 9 months.

If you would have taken the "professional advice", and sold it after 10 trading days, you would have sold at 11.77, and only gotten a return of +4.1%.

I don't know about you, but I'd prefer the +632% return vs the +4% return.

In other words, the internal costs of the ETF are already in the share price. What you see is what you get.

That being said, take a look at UVXY, the $VIX short term futures ETF. The $VIX has had some wild swings in the last year, but has basically has gone sideways. However, in the last year, UVXY has gone from 495 to it's recent close of 43.12, a loss of -91.3%! Talk about internal bleeding! I'd stay away from UVXY unless you're absolutely positive the $VIX is going to go higher in the next few days!

BTW, if anyone has a different opinion on this, please show the error in my thinking.

Hope that helps, Dutchy!

Thanks for your reply, just returned from the "Windy City", was visiting Dad since Thursday. I reviewed the thread and have to continue to hold my NUGT hoping that it is basing and will turn up soon. Also holding SPXL and watching for a close above 1663 area. CoolHand says FED liquidity is increasing and that should support the Markets despite Syria uncertainty. The Syria vote is looking like it will fail in the House, I would think that would boost the Market ?? Here's to a good week !!

NUGT is selling off some, late day. Dust at 28.50, which is closing in on 29.29 which you said is bullish for DUST. I heard when oil prices start to wane, post Syria, NUGT/GDX heat up again, does that make sense ? Would a stop at about $70 be reasonable for NUGT? I would hate to sell at 70 though, a 33% loss, should probably just hold forever or until it reaches 90-95 range whenever that might be !!

For me, I know the tide comes in and the tide goes out, and I tend to wait for the markets to turn in my favor.