MrJohnRoss

Market Veteran

- Reaction score

- 58

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

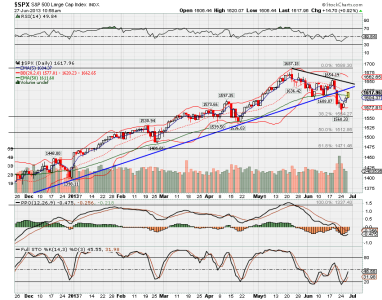

Wow. Down 300 points and accelerating. I keep waiting for the dip buyers to step in... hullo? hullo?

looks like correction time, now waiting for a good time to get back in.

Until yesterday, I was actually thinking this sucker could actually go back up another thousand points, and was thinking of jumping back in.

Glad I held off on that impulse, but it was getting close. This looks like this might be the start of something more significant.

We all knew it was not a question of if, only a question of when.

The housing market is going to be fine and even robust - this negative cycle will pass too and the economy will sing. The time is now to stay the course. Even amoeba has finally discovered the point of recognition of our 3 of 3 of 3 mega trend major wave 3. But we need G funders to balance the boat.

What would happen if...

The bond market tanked.

The stock market tanked.

Commodities tanked.

Maybe we're about to find out?

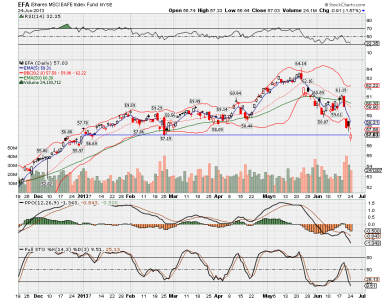

Makes me wonder if our market is going to follow the International market this time. Often, the global market takes its cues from us.

I'm tending to lean towards the "global deflation" camp. Where's growth going to come from? That's like asking when Superman is going to come save the day.

All those trillions of dollars created out of thin air, and about all we got was a little pop in the stock market for a couple of years. Whoopie. IMHO, THERE IS NO REAL RECOVERY.

I think the Fed is now trying to back away... very... slowly... so as to not cause a panic.

I've been convinced for some time that growth is not an objective for some of our pols. But this could take me down a road I don't particularly want to travel. :suspicious:

I'm tending to lean towards the "global deflation" camp. Where's growth going to come from? That's like asking when Superman is going to come save the day.

All those trillions of dollars created out of thin air, and about all we got was a little pop in the stock market for a couple of years. Whoopie. IMHO, THERE IS NO REAL RECOVERY.

I think the Fed is now trying to back away... very... slowly... so as to not cause a panic.