coolhand

TSP Legend

- Reaction score

- 530

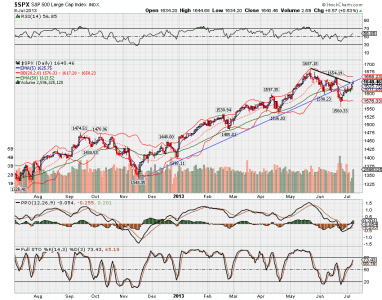

It looks to me that the S&P touched that 38% Fib line around 1555 and decided that was enough... for now. The market got a bit oversold, and the three day rally looks like it will move us back above the 50 DMA. What's impressive is that it sliced right through it, no hesitation. What I'm looking for next is the convergence of the uptrend and downtrend lines near 1630-1635. Wouldn't be surprised to see some struggling between bulls and bears in this area. Decided not to chase this rally, as the upside appears limited in the short term, although this market has been able to frustrate many of us short term traders. I would have been more willing to put my money back into equities if the MACD and RSI had gotten deeper into the oversold area.

View attachment 24288

That's what I see. Bounce off the 38% line and now were testing resistance and the 50 dma. I am not surprised by the rally given the weekly Top 50 buy signal and bearish sentiment. I am a bit impressed by how much this market was able to retrace this week. Longer term, I'm can't be a buyer here. While a lot of short term stuff has turned up, my intermediate term indicators aren't there yet. Monday was a great day to take a shot at some short term gains as we were down hard that day and we knew sentiment was supportive at the time. If I'd had an IFT, I may have moved something back in just for the short term. No big bets, but the short term opportunity was definitely there.