MrJohnRoss

Market Veteran

- Reaction score

- 58

Dollar up, market up

Dollar down, market up

POMO up, market up

Dow going to 14200+ to drag more people into the market... then the rug thing

Hahaha! Yeah.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Dollar up, market up

Dollar down, market up

POMO up, market up

Dow going to 14200+ to drag more people into the market... then the rug thing

With a stronger dollar let's party like it's 1995 all over again - it was straight up with nothing larger than any 5% consolidations. It was all good for the decade essentially.

Now I wish I could believe that - the dollar will strengthen as the economy gets stronger and the Dow will continue to rally as the economy strengthens - that's how it usually works. With a stronger dollar we can save Europe with tourism. QE will support GDP and then GDP will grow with improved business. The mega trend secular bull market will last for decades and wealth will be distributed. The sad story is that the new membership will not participate fully because they haven't built a TSP base yet and it will be more difficult going forward because pricing is going to explode. Us old guys are in the cat bird seat.

Are you still holding AGQ? Looking to add any more?

Yes, I am holding AGQ, but I think we may some more weakness in gold and silver in the near term. I also think we're going to re-test the recent low of 37.79 soon.

I already have a pretty substantial position, so I won't be adding more. But if I was looking to add more, this is what I'd look for:

I'd look for that double bottom near 37.79 to hold. If it keeps dropping, there could be serious trouble. I would also like to see the PPO stabilize, or at least stop dropping as fast. I'd also wait until the Stochastics turns up and cross the 20 line as confirmation that prices are likely in the beginnings of an uptrend. The low RSI is a good indication that we may be near the bottom, but it could bounce around there a while if prices continue to drop.

Since they aren't making any more gold and silver in our world, I'm rather surprised to see such weakness in the PM's, especially with all this paper currency printing around the globe. This may turn out to be one of the better opportunities to get some shares at some excellent prices soon.

Good luck!

I agree that it is a bit surprising to see the weakness in this sector. I'm holding SLV, ABX and NEM and all three have been tracking lower. I also have a modest position in NUGT that I picked up recently. I expect to see these issues pick up before too much longer; perhaps within the next month or so. Hopefully, these sectors are not too far off the lows at this point.

The fact is the smell of greed is in the air and that will lead to excess and more excess as we move higher into uncharted territory - if this is a true breakout, aggressive traders and investors will want to position and reposition early. There will eventually be a 3% consolidation but from much higher levels. How can I help.

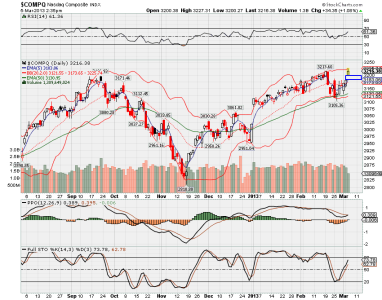

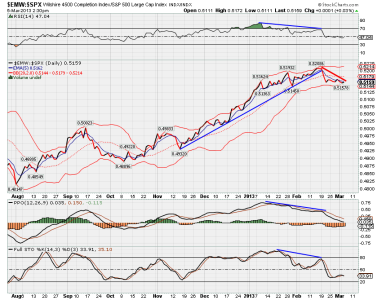

If you're looking to get back into equities in your TSP, you may want to see this next chart.

View attachment 22746

This is a chart of the S Fund vs the C Fund. (The S Fund is trouncing the I Fund, so let's put that aside and just compare S and C). The S Fund has been strongly outperforming the C Fund since Nov of last year (uptrending line). However, as we got into the new year, some divergences began to appear. Note that as prices rose, the RSI, PPO and Stoch all failed to produce higher highs. On Feb 19, the uptrend line was finally broken, and the C Fund began outperforming the S Fund.

For those of you who follow the LMBF System, you know that it switched to the C Fund at the beginning of March, as C beat S in the month of February. So if you're looking to get into equities, expect the C Fund to continue to outperform both the S and I Funds, at least for the time being.

Good luck!

Inflation will become accustomed to. Hope that made sense. We're already used to paying $20,000 or more for a car, or at least some of us are. I need to wrap my head around the fewer shares accumulated in the future. I look at the percentage increase, or if I must, the percent decrease each day. So in a scenario where the market climbed 125 pts in the distant future, a 40 dollar per C fund share would increase only .5% instead of the approximate 1 percent it did today. (a C fund share costs today's about $20). Do I have a clear picture of the inflated cost of the fund pricing and how it would affect gains?RMI is correct about divergences - there is the force of liquidity and it has been overpowering negative divergences. In fact, negative divergences may have no power until after this bull starts to contract and they may be awhile yet - like months. Those that get in late will just have to pay more and that ultimately means fewer shares accumulated. 2008 pricing is gone forever. It's not fair to those members just entering the work force but it is what it is.

2008 pricing is gone forever.