MrJohnRoss

Market Veteran

- Reaction score

- 58

Is the 10 year bull run in gold over? It appears that may be the case. Check out this chart:

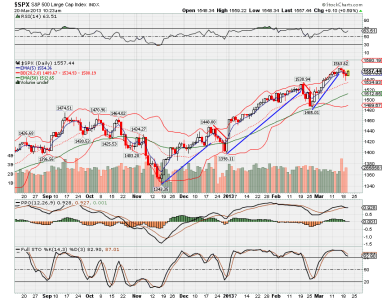

A couple of things to note here.

1) The uptrend line that has been in place for 10 years was broken at the end of last year (blue line) That's a major violation, and does not bode well for precious metals (PM's).

2) Only twice in that 10 year run did gold take a pause, and when it did, the PPO went below zero (see red boxes). We're going back below zero again.

3) The RSI is collapsing and the weekly Stoch is going dead. Two more bad signs for any kind of strength.

Unless something changes soon, I'm not expecting gold or silver to shine too much in the near term.

The other item to consider is the strength in the dollar. A strong dollar does not bode well for PM's, and the dollar has had a LOT of strength this year. Although we had a big down day in the dollar today, one day does not change much in the big picture.

One final thought... money tends to flow where it finds the best return. Money leaves bonds and PM's when it can get stellar returns in the stock market. Yet another reason to expect continued weakness.

I continue to hold my 2X leveraged silver ETF, AGQ, but I now have to consider it a "longer term" investment than I was expecting.

I know these conditions won't last forever, and the likelyhood of a stock sell off (sell in May and go away?) could come at any time.

Money printing may eventually put an end to this downtrend, but we've been saying those words for years, haven't we?

Good luck!

A couple of things to note here.

1) The uptrend line that has been in place for 10 years was broken at the end of last year (blue line) That's a major violation, and does not bode well for precious metals (PM's).

2) Only twice in that 10 year run did gold take a pause, and when it did, the PPO went below zero (see red boxes). We're going back below zero again.

3) The RSI is collapsing and the weekly Stoch is going dead. Two more bad signs for any kind of strength.

Unless something changes soon, I'm not expecting gold or silver to shine too much in the near term.

The other item to consider is the strength in the dollar. A strong dollar does not bode well for PM's, and the dollar has had a LOT of strength this year. Although we had a big down day in the dollar today, one day does not change much in the big picture.

One final thought... money tends to flow where it finds the best return. Money leaves bonds and PM's when it can get stellar returns in the stock market. Yet another reason to expect continued weakness.

I continue to hold my 2X leveraged silver ETF, AGQ, but I now have to consider it a "longer term" investment than I was expecting.

I know these conditions won't last forever, and the likelyhood of a stock sell off (sell in May and go away?) could come at any time.

Money printing may eventually put an end to this downtrend, but we've been saying those words for years, haven't we?

Good luck!