MrJohnRoss

Market Veteran

- Reaction score

- 58

Ditto what Craigerv said. But it also sounds like you think the risk is worth it, eh? And nice gains already - congrats on that!

Thanks Khotso and craigerv, but I could lose it all tomorrow. Until I sell, I've gained nothing.

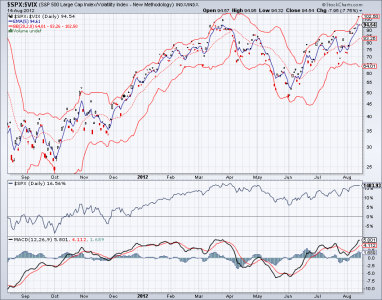

Looks like stock futures are down this evening. The market needs a breather. Perhaps we'll have a few mild down days before a resumption above 1422 on the S&P, which was the high for the year.

Good luck!