MrJohnRoss

Market Veteran

- Reaction score

- 58

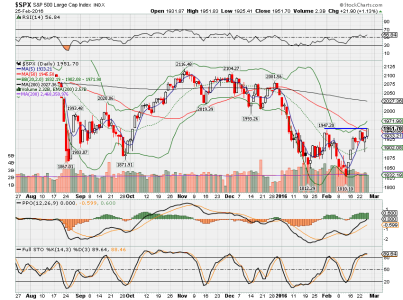

The bear market rally appears to be fizzling out. Moving 100% to the G Fund at the close of business today.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

The bear market rally appears to be fizzling out. Moving 100% to the G Fund at the close of business today.

Kicking myself for not going into the F Fund. Bonds may be overbought, but it looks like they might stay overbought and climb higher during this market downturn. 10 Year Treasuries down to 1.735% today.

Another interesting viewpoint is how the big high tech names (Facebook, Amazon, Netflix, Google, etc.), aka the FANG stocks have crashed. Was just looking at the chart of AMZN. It's down almost 30% from it's peak of 696 in late December. Today's close put it at 488. Talk about a haircut! Things are not going well when your big name stocks that were carrying the market are now crashing through the floor.

Look on the bright side -- you could still be in the C Fund.Kicking myself for not going into the F Fund. Bonds may be overbought, but it looks like they might stay overbought and climb higher during this market downturn. 10 Year Treasuries down to 1.735% today.

Another interesting viewpoint is how the big high tech names (Facebook, Amazon, Netflix, Google, etc.), aka the FANG stocks have crashed. Was just looking at the chart of AMZN. It's down almost 30% from it's peak of 696 in late December. Today's close put it at 488. Talk about a haircut! Things are not going well when your big name stocks that were carrying the market are now crashing through the floor.

This uhh, technique, was mentioned here last year. Here is the update. Gave a sell on January 8th, which the S&P 500 closed at 1,922.03. Its several weeks of positive gains away from giving a buy signal.

Several months ago, I and only one other mentioned that with the price line being removed from the chart, you have no way of knowing how well the signals correlate to actual prices. The response was that the price line cluttered the chart. The price line is the most important part of any chart.

I suspect the 'unknowing' falsely believe the crossovers also indicate the actual price levels of the underlying. Even so, if the masses like it; I love it. I decided to drop the matter unless someone else noticed the obvious. I'm amazed it took so long.

Jan 8 Back into a SELL Signal.

Nov 6 Back into a Buy, because there is nowhere else to put the $$$. (Fed Funds near 0%). Market internals are very weak.

Sep 4, 2015 Red crossed Green. Sell Signal... S&P 500 could still easily rally up to the Green Line of 2022.

Caution! FED could easily start Printing again, which could Abort the Sell Signal.

Aug 28, 2015 Red did not cross Green. Still a Buy Signal. Wait for the Close on Friday, since this is a weekly Chart.

Jul 8, 2012 Thank you Dave G for the 'anti-whipsaw' Indicator!

Jeffrey C writes' I love your weekly timing indicator.'

Dec 28, 2011 Crossing back up.

Interesting that both the S&P PMO system and VIX system produced buy signals on Friday. IMHO, I'm expecting only a short term bounce, and doubt that it will last the average 14 trading days. Sovereign wealth funds, mutual fund managers, and hedge fund managers (the elephants) will be looking to reduce exposure on these rallies. Can you imagine being in their shoes? What must it be like to try to sell thousands and thousands of shares of stock of hundreds of companies, all while trying NOT to drive the price down and tip your hat to everyone else? In times like these, I believe we little investors can be so much more nimble, and make much bigger profits than any of the elephants.

Chart of the S&P: I see several reasons why we might pause in the 1950 area.

1) 50 DMA is near 1960, and dropping

2) Top of the Bollinger Band is at 1948

3) Previous Feb 1 high of 1947 may act as resistance

View attachment 37157

That being said, there is very strong momentum over the past three days, so we'll have to see how it plays out. A strong move above this area could mean that this rally may continue longer than expected. One of the keys will be the price of oil - so far we're in a trading range, but a move out of the range, either up or down, may tell us which way the market wants to go.

PMO and PPO systems remain on a buy, just barely. The VIX system just triggered a sell signal today. Cumulative system: (+1+1-1) = +1, which is a weak buy signal. The fact that the S&P still can't break the 1950 level is not very positive. Unless it can go through that level convincingly, I'm guessing we're going to go back down and re-test the February lows in the 1810 area.

There's something ROTTEN in Washington DC!