DreamboatAnnie

TSP Legend

- Reaction score

- 831

Yep...seems Oil is the big driver right now...has been. Best wishes!Have a Merry Christmas and a Happy Holiday.

I'm hoping for a Santa rally next week but oil and energy sure aren't helping.

:smile:

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Yep...seems Oil is the big driver right now...has been. Best wishes!Have a Merry Christmas and a Happy Holiday.

I'm hoping for a Santa rally next week but oil and energy sure aren't helping.

:smile:

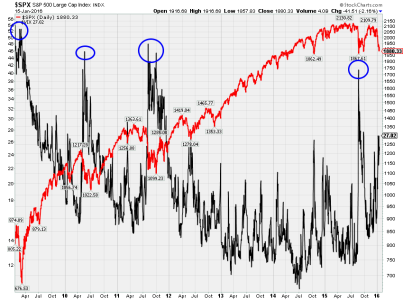

Sadly...I must agree with your assessment. Thanks for the great breakdown!! Best wishes to you and to everyone!!!!!!!!! :smile:Nice big down day to start the year, which seems like an ominous sign of things to come. I really haven't seen much in the charts to be bullish about. I tried to time a Santa rally, only to get my hat handed to me. Volatility has gotten extreme, with wild up and down days.

Here's what I see:

The Dow Theory is still bearish.

Rounded top formations of the Dow, S&P, Trannies.

Small caps are getting crushed during their seasonal strong period.

The Nasdaq seemed to be holding up... until today's rout of the big 4.

The commodities index is near an all time low.

The NYAD and NAAD are looking bad.

THe NYHL and NAHL are looking even worse.

The BDI is within a smidgen of it's all time low.

High yield bonds are caving in,

EEM is rolling back down near all time lows.

WTIC is going lower, lower, lower...

Other than that, everything is hunky dory.

2015 was a year when the G Fund beat all stock funds. My guess is that we're going to continue that vein for a while longer. Oh sure, we'll have some massive up days, where everyone (including myself) will be left wondering if the worst is over. But unless the technicals can first give us some sure footing, and secondly some sustainable higher highs and higher lows, I'm afraid I'll remain in the bearish camp. I may occasionally play a few moves to capitalize on extreme down moves to scalp some points of the relief rally, but my guess is that Mr Market has topped for a while, and we're likely to see lower prices in the months ahead. I hope I'm wrong.

Best of luck in 2016.

Taking a risk here, and moving to the C Fund today. I'm thinking we're getting a little bear market rally that may take us up to the 2000 area on the S&P before we encounter resistance. This may be completely wrong, but the technical indicators look promising several days ago. Just didn't follow them at the correct time, and missed out on Friday's nice gain.

Good luck!

Bear market volatility bit me today. Would like to see the S&P at least re-claim the 1912 to 1914 area tomorrow, which are about where the 5 and 20 DMA are. If not, it may be time to bail. "Cut your losses early, let your winners ride."

The F Fund is doing extremely well, perhaps too well, as the RSI on AGG just went over 70. Haven't seen that level since Feb 1 of last year, so perhaps it needs a cool down. On the other hand, if the market downdraft continues, it may not make much difference what the RSI level is, as money will flow out of equities and into bonds, driving interest rates lower still. It doesn't help that Japan has joined Europe to drive interest rates all the way down into negative territory. ZIRP was so yesterday now that we have NIRP.

Meanwhile, the investigation continues into the study of timing systems. One caught my eye last night that uses several variables of the PMO on the S&P. Can't say much more than that, but it looks promising, at least in a back test of 2015 data.

One last note... has anyone seen how far the BDI has fallen since August? Believe it or not, it's down 75%. The global slowdown continues...

Good luck!