RealMoneyIssues

TSP Legend

- Reaction score

- 101

It was actually the "Like" program. I think I have it fixed

I swear, I haven't touched the Dislike button... especially not on JP :nuts:

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

It was actually the "Like" program. I think I have it fixed

I swear, I haven't touched the Dislike button... especially not on JP :nuts:

100% F Fund as of C.O.B. 08/07/15.

Great long ball call! :smile:

Smart move, especially after this week's sell-off.

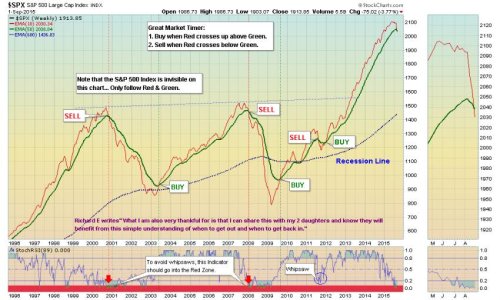

For those of you who like to "buy & hold" stocks, you may want to keep your eye on the long term timing system that I've shown before. Here's an updated look. It may just keep you out of the big bear markets.

We've just met the first condition for a sell signal, which is when the Stoch RSI reaches 0.00. That's the first time we've hit that level since the 2008-2009 bear market. All that remains is the weekly 10/50 MA crossover to create the official sell signal. Looks like it's creeping ever closer. I just added the PMO window this morning, so you can use that as a confirmation if/when it crosses the zero line.

View attachment 34759

Good luck!

So Monday did your crossover big time. What your chart does not show was what was the actual price of SPX when it made the weekly crossover. If I sell tuesday because the lines crossed Monday, I will be locking in almost 9% losses. I guess to avoid a 30+% loss(?). And looking at Oct '11, you did not mark that a 'sell' even tho the lines crossed. And if you did sell then, it looks like you would have lost overall by locking in that loss. We are there. What do you suggest? Of course, you were already out of the market before this crossover, but if you had stayed in like me and lots of others, would you still recommend selling at these low (but maybe not bottom) prices?

I mentioned previously, when this or a similar chart was posted, about it not having the most important metric--price. I seemed to be alone in my concerns. Bravo to you. :smile:

Current price isn't shown, because it's not part of the equation for a buy or sell signal, even though the price is called out at the top of the chart. Adding the price just makes the chart too busy. In this case, simpler is better, IMHO.

BTW, Oct '11 did not constitute a sell signal, as only condition (1) was met. Current price isn't shown, because it's not part of the equation for a buy or sell signal, even though the price is called out at the top of the chart. Adding the price just makes the chart too busy. In this case, simpler is better, IMHO.

As far as selling after a 9% drop, that's an individual choice. If I were still in, I certainly wouldn't want to ride another bear market all the way down and back up, which could take years, but that's just me. Perhaps we won't really get a bear market. No one has a crystal ball to predict the future, but I thought I'd share this handy chart, since it would have kept you out of the last two major bear markets.

As with everything else in life, there are no guarantees. This is just info that I thought I'd pass along, and I hope it's helpful to at least some of you.

Best of luck with your investments.

The two conditions for a sell are (1) the EMA crossovers, and (2) the Stoch RSI reaching 0.0. I added a third condition, (if you need one), in that the PMO crosses the zero line. We should get that momentarily.

BTW, Oct '11 did not constitute a sell signal, as only condition (1) was met. Current price isn't shown, because it's not part of the equation for a buy or sell signal, even though the price is called out at the top of the chart. Adding the price just makes the chart too busy. In this case, simpler is better, IMHO.

As far as selling after a 9% drop, that's an individual choice. If I were still in, I certainly wouldn't want to ride another bear market all the way down and back up, which could take years, but that's just me. Perhaps we won't really get a bear market. No one has a crystal ball to predict the future, but I thought I'd share this handy chart, since it would have kept you out of the last two major bear markets.

That chart looks a lot like this one, a Public Chart at StockCharts.com It's #57. Above the Green Line - Sep 1, 2015 Buy high, and Sell Higher: Momentum Investing - Joanne Klein - Public ChartList - StockCharts.com

Pretty good return for the long-term investor.

Here are the last five signals:

8/8/94 Buy $SPX 462

11/6/00 Sell 1366

6/2/03 Buy 988

1/7/08 Sell 1401

8/24/09 Buy 1029

That chart looks a lot like this one, a Public Chart at StockCharts.com It's #57. Above the Green Line - Sep 1, 2015 Buy high, and Sell Higher: Momentum Investing - Joanne Klein - Public ChartList - StockCharts.com

Pretty good return for the long-term investor.

Here are the last five signals:

8/8/94 Buy $SPX 462

11/6/00 Sell 1366

6/2/03 Buy 988

1/7/08 Sell 1401

8/24/09 Buy 1029

I think you are missing the last two signals. Sell in 2011, and buy in 2012. Do you know what those numbers were?

On edit: Never mind, those weren't actual signals because of the RSI.

Also remember this is weekly... so technically it can't give a Sell signal until this Friday.

BTW, it did give a sell signal on Friday, Sept 4.