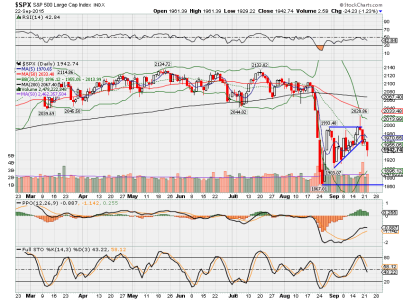

It's been an impressive rally. Personally, I'm going to wait it out for a better entry point. IMHO, we are closer to a short term top than we are to a bottom. It'll be interesting to see if the long term buy/sell signal gets a head fake "buy", only to see the market get whacked in the knees.

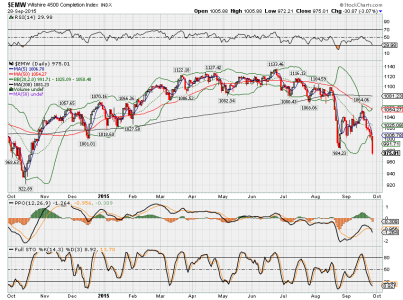

The long term S&P buy/sell signal is still on a sell, but the Oct rally has pushed the short term 10 week EMA sharply higher. It looks like we'll likely have a crossover this week, even if the week finishes down. There may be some whipsaw action taking place, so buckle up and hang on tight.

Like I said... Those indicators are turning back down now. Been wondering about the above long term buy sell signal, and if this could be the rare occurrence in it's 16 year history where it didn't work out. It's still possible that we have a failed sell signal, but the market sure looks like it's giving up on last month's rally.

I waited too long to get back into equities, and decided to hold on to the relative "safety" of bonds. Wow, did they get whacked because of the Fed fears! I'm thinking that bonds may have gotten a bit oversold, and with the market going over a cliff, bonds could stage a pretty nice comeback.

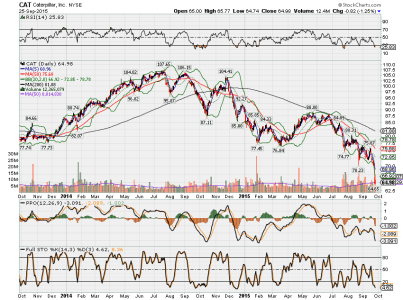

As for stocks, we may see some oversold rallies in the next week or so, but my guess is that we continue down from here, and possibly retrace at least 50% of Octobers gains, which would put us in the S&P range of 1994ish before a decent bounce. I just don't see the market going gangbusters higher for any good reason, so intermediate term, I think the markets might chop lower until there are more positive catalysts to move it higher.

It's been interesting to see so many indicators roll over with the market this last week. An interesting one has been the BPSPX. It peaked just prior to the market, and began rolling over quite nicely to forewarn those of us who watch it. Just another arrow in the quiver, there is no magic bullet.

Good luck!