MrJohnRoss

Market Veteran

- Reaction score

- 58

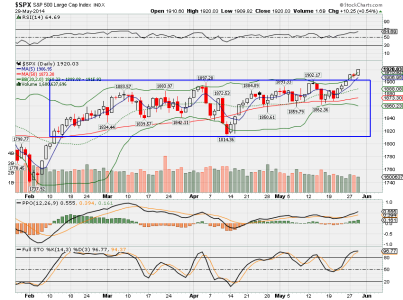

I'm liking the action in the markets this morning. It won't be long before the "box" the S&P has been playing in since mid February is in the rear view mirror. I'm thinking that the market is finally going to make up it's mind and start heading a little bit higher, one tiny baby step at a time.

We got spoiled the last few years, when the market just shot up every day like a rocket. Those days are over, and the market is just gonna bounce around with a slight upward bias. Very hard to time this beast, unless you glue yourself to your monitor and watch every zig and zag.

The metals markets are about as dull as a lead weight. Not much up or down moves right now. I'm still almost completely in stocks, holding only a little cash, but I may deploy it in the next few days if I find a beaten down gem. Bought a little TNA last Thursday at 62.30 when it was oversold for a short term move higher. Waiting for a short term overbought signal.

Between the pressures at work, and even more pressures in my personal life (buying and selling homes), I've had very little time to post, and even less time to read other posts. My apologies for not being a part of the friendly banter in the last few weeks. This too shall pass.

Good luck to us!

JR

We got spoiled the last few years, when the market just shot up every day like a rocket. Those days are over, and the market is just gonna bounce around with a slight upward bias. Very hard to time this beast, unless you glue yourself to your monitor and watch every zig and zag.

The metals markets are about as dull as a lead weight. Not much up or down moves right now. I'm still almost completely in stocks, holding only a little cash, but I may deploy it in the next few days if I find a beaten down gem. Bought a little TNA last Thursday at 62.30 when it was oversold for a short term move higher. Waiting for a short term overbought signal.

Between the pressures at work, and even more pressures in my personal life (buying and selling homes), I've had very little time to post, and even less time to read other posts. My apologies for not being a part of the friendly banter in the last few weeks. This too shall pass.

Good luck to us!

JR