MrJohnRoss

Market Veteran

- Reaction score

- 58

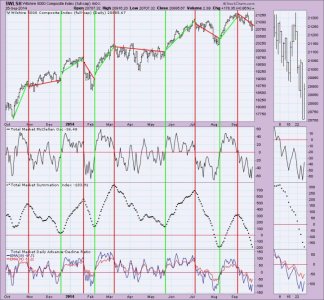

Glad to see the markets move a little higher today, since it was a sell day for me. Rode the S Fund proxy $EMW from 1015.10 on 8/11/14, to today's close of 1042.31, which is a gain of about +2.7% in just under a month.

I still believe we're heading lower for short time in order to "pause and refresh". Markets don't go up every day, so it's time for a little down wave. The gas pedal has eased off considerably, and momentum is dropping quickly. Will likely watch the market coast downhill, and wait until I see the accelerator pedal start back up before getting back in.

I still believe we're heading lower for short time in order to "pause and refresh". Markets don't go up every day, so it's time for a little down wave. The gas pedal has eased off considerably, and momentum is dropping quickly. Will likely watch the market coast downhill, and wait until I see the accelerator pedal start back up before getting back in.