JTH

TSP Legend

- Reaction score

- 1,160

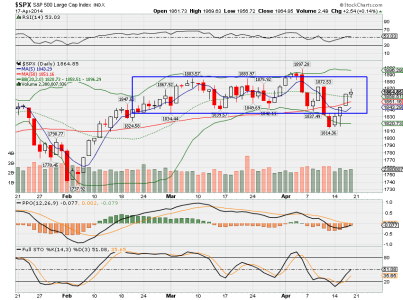

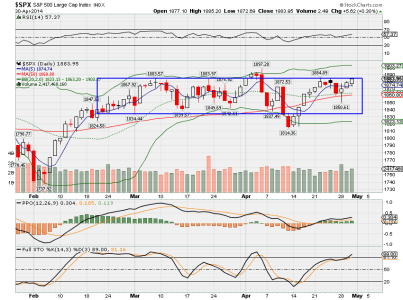

Since I just put skin in the game on Friday close prices, I would prefer some sideways consolidation. Unless I am off, Monday should be fairly stable (we all know Citigroup) and earnings should move markets on Tuesday. JTH - Isn't that why you picked Monday entry? I picked Friday because of a possible DCB in advance of earnings on Tuesday. I also had one IFT that you lack.

Maybe I am getting old, but these market moves at these levels don't seem the same as I remember as a younger lad. Less than 1% on the S&P on Friday and people are singing the blues?

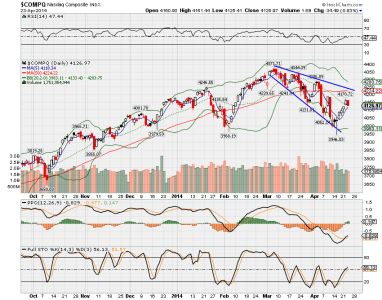

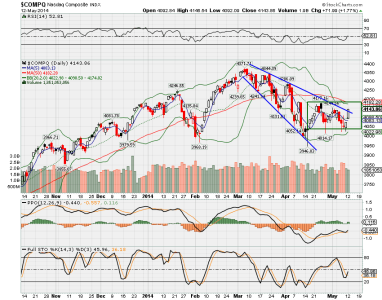

Honestly, I'm not watching earnings, there are just too many variables I can't correlate to Index price action. The Monday IFT projection is based off of seasonal data and the charts in relations to this data. I'm also looking for specific oversold conditions, don't ask me what that looks like but I'll know it when I see it (or I'll be wrong).