MrJohnRoss

Market Veteran

- Reaction score

- 58

Just got a chance to check on the markets. Holy crap! Did the bull just get executed? Short term indicators say we're deeply oversold, so I would expect a bounce within the next trading day.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Nah, it was just me getting back in the market. I'm always in for these 3% drops but not the recovery. Sorry, but I don't plan on exiting any time soon so it could take a while to come back.Just got a chance to check on the markets. Holy crap! Did the bull just get executed? Short term indicators say we're deeply oversold, so I would expect a bounce within the next trading day.

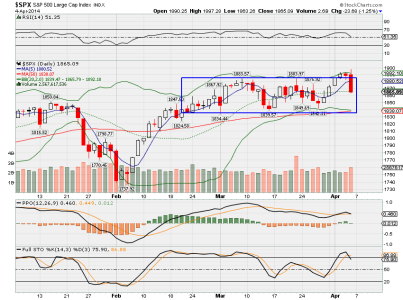

Here's my take on the short term view of the S&P. We've been in a trading range (see box) for over a month now. The markets broke out of the box to the upside this week, but chickened out like a skeeredy cat on Friday. However, the trend of the 50, 20, and 5 DMA are up, and we continue to make higher lows. My opinion is that we'll break out of this box to the upside.

The market likes to fake out as many people as possible, hence the down move. Wouldn't be surprised to see a strong move higher out of the box, possibly as early as this week. I do have a concern that the higher highs are divergent with the lower highs on the MACD (PPO). I'm going to stick it out unless the box is broken to the downside in convincing fashion.

Interesting perspective, I can't disagree with it or confirm it, it's just one of those situations where I'll wait for Monday to get a feel for it. I would like to add that volume on SPY was more substantial than SPX, with an 11-bar high.

I believe Tom noted the huge spike in volume in his weekly wrap up.

Interesting perspective, I can't disagree with it or confirm it, it's just one of those situations where I'll wait for Monday to get a feel for it. I would like to add that volume on SPY was more substantial than SPX, with an 11-bar high.

JTH,

How does volume affect the outcome of Mr.Ross's hypothetical expectation? I hope I asked an intelligible question... Tia.

MrJohnRoss,

Are you still holding SGMS? I have been watching it since just before they most recently announced earnings.

Would you be buying more here, or wait to see if the 10.50 level holds?

Thanks,

WW

I don't own any momo stocks and never will - they may now be out of favor for the next 12 months or longer. These things seem to run in cycles and there is a rotation happening with momo stocks.

I remember well the days in 2000 when everyone was making gains in internet technology momo - I was not. I stayed with the boring and dull stuff and survived that crash in fine shape. Many cycles have a tendency to repeat so for now there will be no momo for me. I'm a contrarian investor so I'll keep dollar cost averaging into banks and other financials. Now if some of these momo stocks start doing some splits then I might bite But for now I've got plenty other places to lose money.

I just wish the Fed would taper their taper and hold at +$55B for several more months.