MrJohnRoss

Market Veteran

- Reaction score

- 58

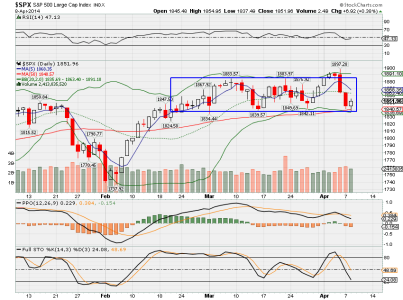

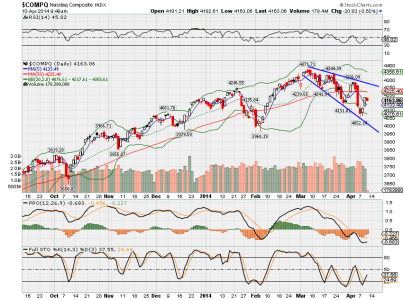

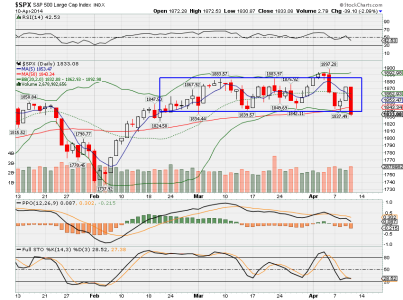

There it is, the first white candle on the 1 hr chart. Next candle spiked higher before heading lower. Looks like a short term bottom may be in place. Tomorrow should provide a temporary bounce, IMHO.

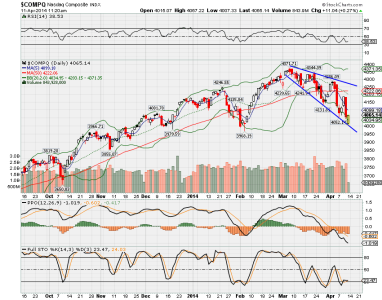

There she is! We have our bounce just getting started. The short term downside momentum on the 1 hr charts has changed to the upside. Now let's see how much of an upside impluse this market is going to give us.

Short term traders could easily make money watching the 1 hr charts and using SPXL/SPXS, TQQQ/SQQQ or TNA/TZA. Wish I had the time to devote to this, but it probably won't happen until I retire.