MrJohnRoss

Market Veteran

- Reaction score

- 58

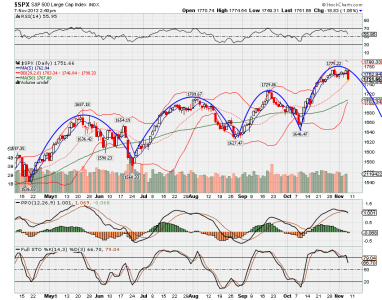

Here's How Friday's Jobs Report Will Move The Markets

"...an unambiguously good number should cause the dollar to rally, Treasuries to sell off, and rates to rise as investors re-calibrate toward the possibility of tapering sooner rather than later — whereas a bad number may or may not have the opposite effect."