-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

JTH's Account Talk

- Thread starter JTH

- Start date

JTH

TSP Legend

- Reaction score

- 1,158

Re: Tuesday

Very good question, a nice acronym would suffice, I'm thinking of calling it Putz, but there aren't so many cool words starting with letter z.

Anyhow, I'm running into some issues, don't have enough computational power & bandwidth to run the sheets. It's taking about 42k cells to run 1 sector, and that doesn't even divide the sector down into the sub industries, nor have I fully added the weighted data.

But I do think I like the visual transposed format better, so I may tinker with some other projects in this format.

Cool. Do you have a name picked yet for your ETF?

Very good question, a nice acronym would suffice, I'm thinking of calling it Putz, but there aren't so many cool words starting with letter z.

Anyhow, I'm running into some issues, don't have enough computational power & bandwidth to run the sheets. It's taking about 42k cells to run 1 sector, and that doesn't even divide the sector down into the sub industries, nor have I fully added the weighted data.

But I do think I like the visual transposed format better, so I may tinker with some other projects in this format.

- Reaction score

- 2,466

Re: Wednesday

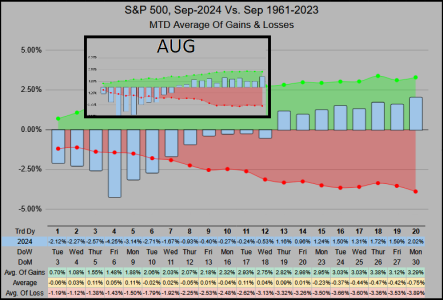

That is interesting -- something you might hear in a down year for stocks.

That is interesting -- something you might hear in a down year for stocks.

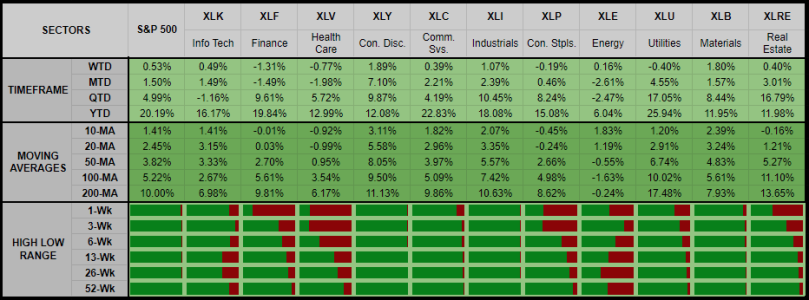

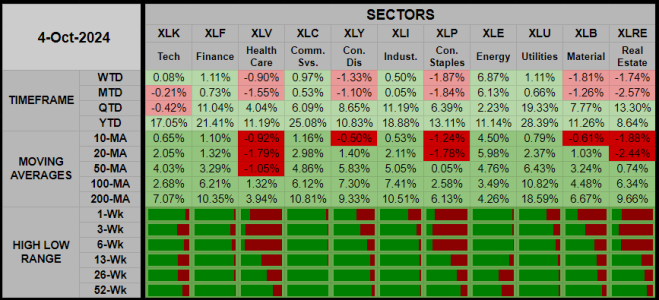

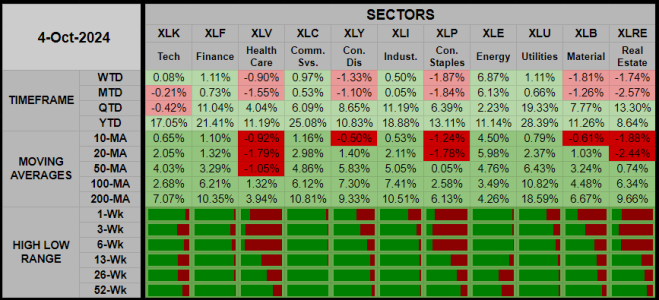

Interesting, the top performing Sector ETF this year.... Utilities at 25.94%

JTH

TSP Legend

- Reaction score

- 1,158

Thursday

Good morning

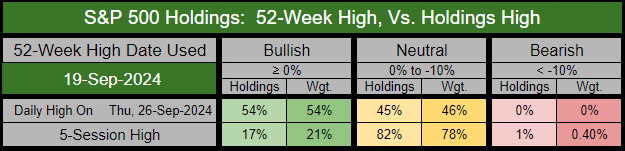

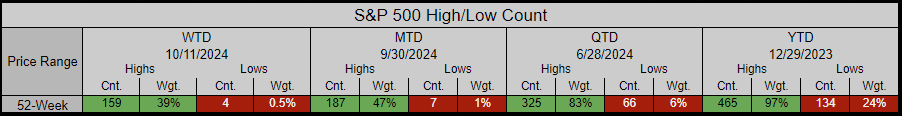

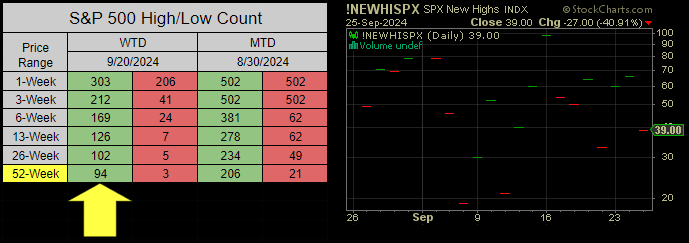

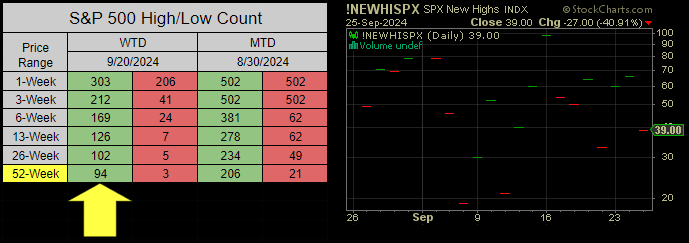

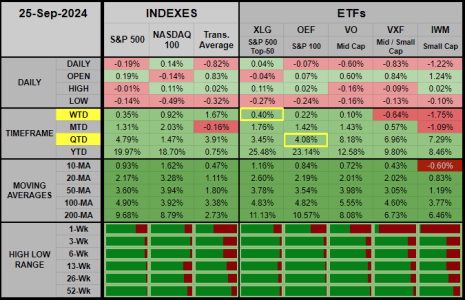

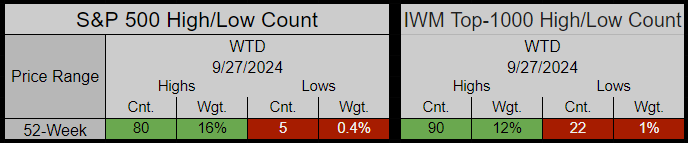

At present, the S&P 500 has made 94 distinct 52-Week Highs WTD (this week).

Once a holding is counted WTD, it’s not counted a 2nd time. As an example META (Facebook) has made two 52-Week Highs this week, but on the left table below it’s only counted as 1 of 94.

So while the chart on the right shows Mon/Tue/Wed gave us 60/66/39 new 52-Week Highs (total of 165) in reality that 3-day number is 94 and the index has 71 duplications over this 3-day WTD span.

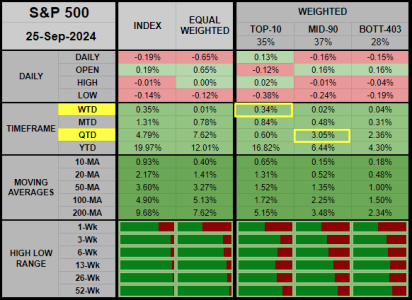

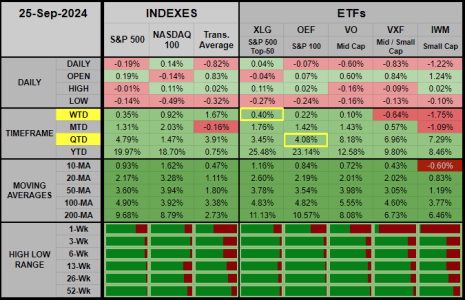

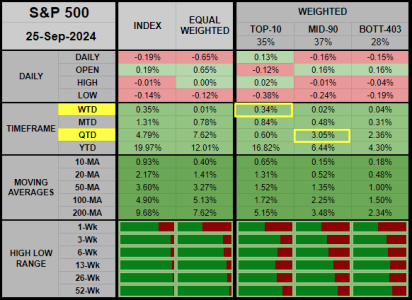

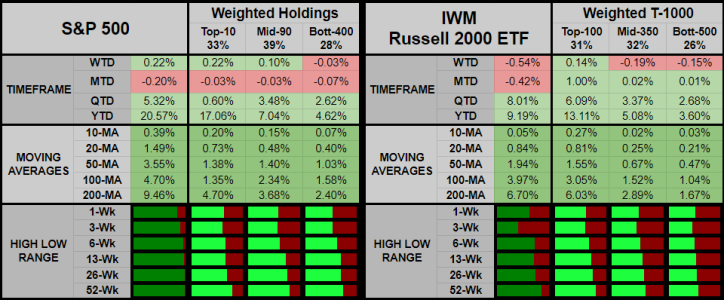

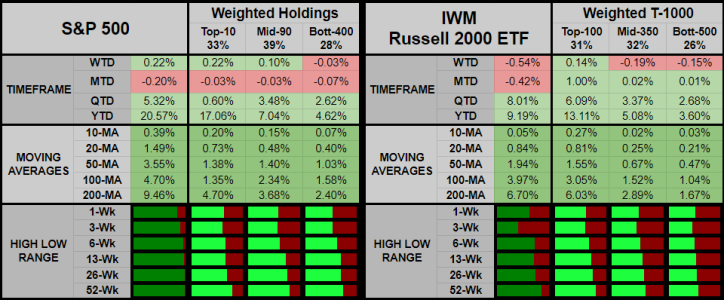

This week WTD, the S&P 500’s Top-10 has contributed nearly all the gains to the index. But QTD it’s the Mid-90 which has given us the most gains.

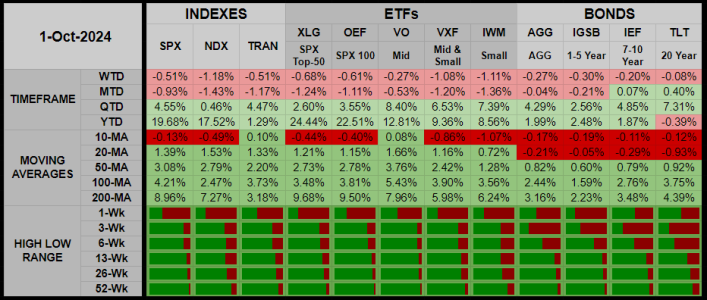

To confirm the previous observation, we can see that WTD the XLG Top-50 ETF is outperforming the OEF’s Top-100. But QTD OEF is outperforming XLG.

Good morning

At present, the S&P 500 has made 94 distinct 52-Week Highs WTD (this week).

Once a holding is counted WTD, it’s not counted a 2nd time. As an example META (Facebook) has made two 52-Week Highs this week, but on the left table below it’s only counted as 1 of 94.

So while the chart on the right shows Mon/Tue/Wed gave us 60/66/39 new 52-Week Highs (total of 165) in reality that 3-day number is 94 and the index has 71 duplications over this 3-day WTD span.

This week WTD, the S&P 500’s Top-10 has contributed nearly all the gains to the index. But QTD it’s the Mid-90 which has given us the most gains.

To confirm the previous observation, we can see that WTD the XLG Top-50 ETF is outperforming the OEF’s Top-100. But QTD OEF is outperforming XLG.

JTH

TSP Legend

- Reaction score

- 1,158

JTH

TSP Legend

- Reaction score

- 1,158

Vacation

Good Sunday

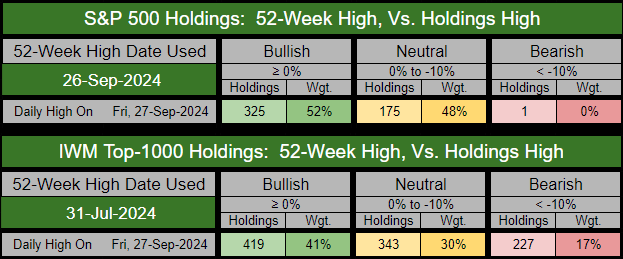

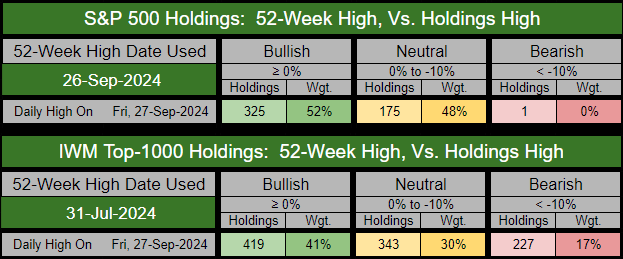

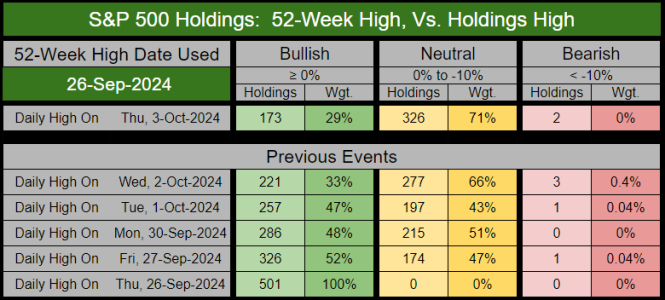

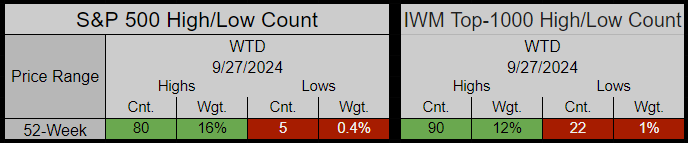

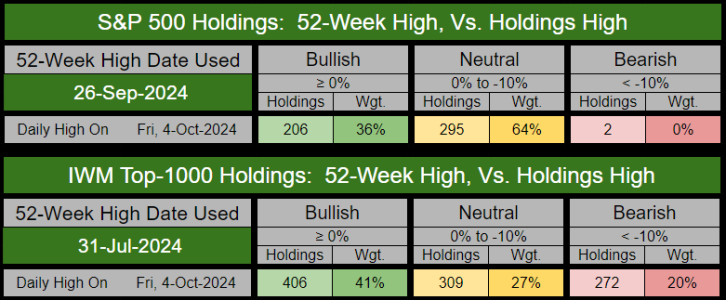

The S&P 500's last 52-Week High was on 26-Sep. On Friday 27-Sep 325 holdings went higher (than their 26-Sep high) with an index-weight of 52%. So while the index did not push higher, we still have plenty of holdings gaining higher prices.

For reference, IWM's Top-1000 holdings account for a weighted 90% of the ETF. It's last 52-Week High was on 31-Jul, at present 419 of the these Top-1000 holdings have pushed higher than on 31-Jul. But, there are 227 holdings < -10% below their 31-Jul high, this weighted 17% is hindering the ETF's performance.

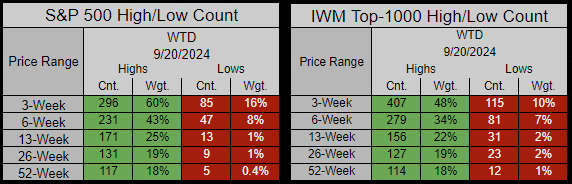

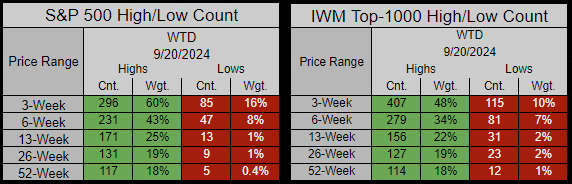

Last week the S&P 500 made 117 new 52-Week Highs, and IWM made 114. What's good, on all price-ranges & timeframes, the highs are outpacing the lows.

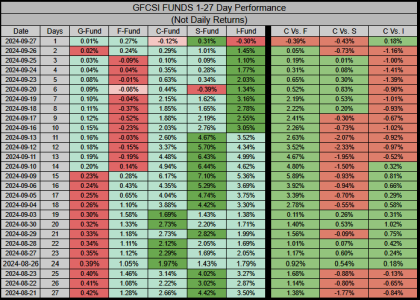

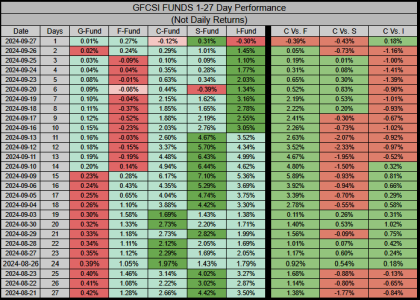

Across the past 1-27 sessions, the G&F funds have been the poorest performers. The I-Fund mostly leads out to session 11, then it's a mix between the C&S funds.

One of the reasons I posted the The Final Four Months blog, I'm going on vacation for the next 2 weeks, plus have family visiting. This likely means there will be some awesome move in the markets I won't time correctly, thus I may just sit on my hands a bit. But since I don't have any hot coals in the fire, there isn't much risk.

Have a great week and October... Jason

Good Sunday

The S&P 500's last 52-Week High was on 26-Sep. On Friday 27-Sep 325 holdings went higher (than their 26-Sep high) with an index-weight of 52%. So while the index did not push higher, we still have plenty of holdings gaining higher prices.

For reference, IWM's Top-1000 holdings account for a weighted 90% of the ETF. It's last 52-Week High was on 31-Jul, at present 419 of the these Top-1000 holdings have pushed higher than on 31-Jul. But, there are 227 holdings < -10% below their 31-Jul high, this weighted 17% is hindering the ETF's performance.

Last week the S&P 500 made 117 new 52-Week Highs, and IWM made 114. What's good, on all price-ranges & timeframes, the highs are outpacing the lows.

Across the past 1-27 sessions, the G&F funds have been the poorest performers. The I-Fund mostly leads out to session 11, then it's a mix between the C&S funds.

One of the reasons I posted the The Final Four Months blog, I'm going on vacation for the next 2 weeks, plus have family visiting. This likely means there will be some awesome move in the markets I won't time correctly, thus I may just sit on my hands a bit. But since I don't have any hot coals in the fire, there isn't much risk.

Have a great week and October... Jason

JTH

TSP Legend

- Reaction score

- 1,158

Re: Sunday

To be honest with you this is the first I've heard of it. I find it interesting nobody in my sphere is concerned. We had the same issue with the railroads last year, so maybe there's some expectation President Biden will step in and block the strike again. It might be a bit too early for the markets to react and price it in, but we certainly do need a catalyst for the markets to give us a retracement.

Thanks for bringing it up, it should be interesting if they do go on strike.

JTH, Any thoughts on what might happen to the markets on Tuesday if the longshoremen go on strike?

To be honest with you this is the first I've heard of it. I find it interesting nobody in my sphere is concerned. We had the same issue with the railroads last year, so maybe there's some expectation President Biden will step in and block the strike again. It might be a bit too early for the markets to react and price it in, but we certainly do need a catalyst for the markets to give us a retracement.

Thanks for bringing it up, it should be interesting if they do go on strike.

- Reaction score

- 821

Re: Sunday

Have a great vacation. I take one in two weeks.

To be honest with you this is the first I've heard of it. I find it interesting nobody in my sphere is concerned. We had the same issue with the railroads last year, so maybe there's some expectation President Biden will step in and block the strike again. It might be a bit too early for the markets to react and price it in, but we certainly do need a catalyst for the markets to give us a retracement.

Thanks for bringing it up, it should be interesting if they do go on strike.

Have a great vacation. I take one in two weeks.

JTH

TSP Legend

- Reaction score

- 1,158

JTH

TSP Legend

- Reaction score

- 1,158

Friday

Good morning

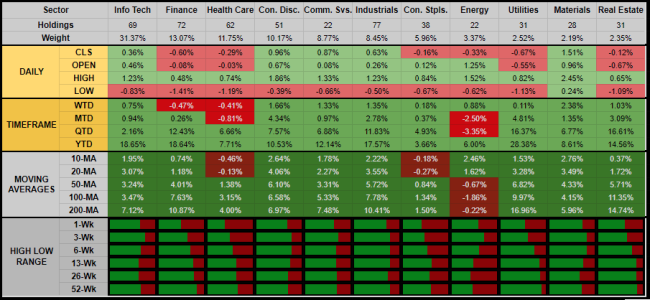

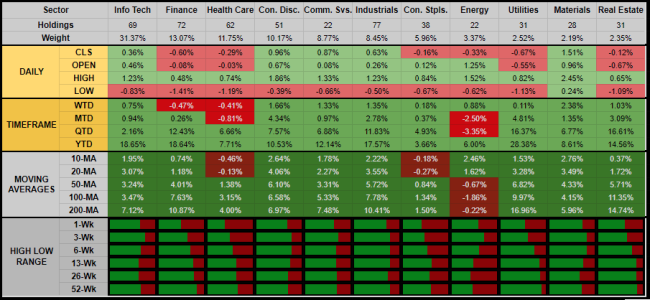

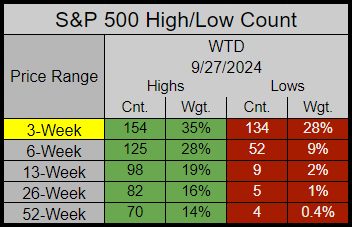

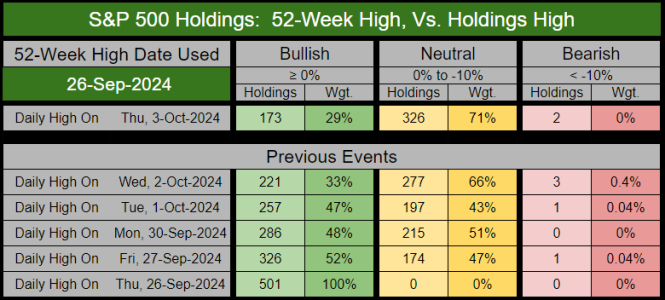

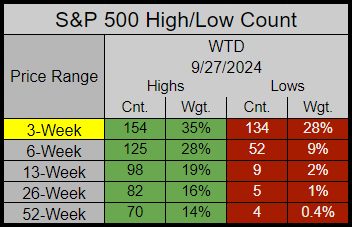

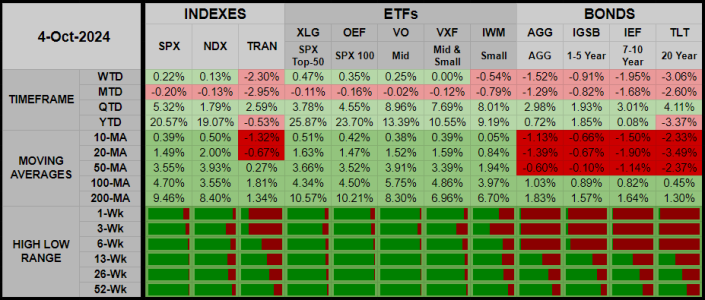

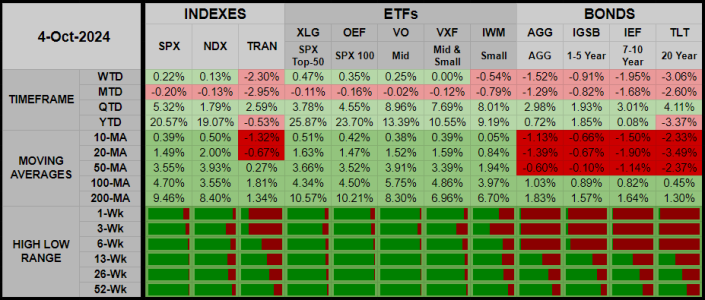

On the Week-To-Date Time frame & the 3-Week High/Low Range, the new highs are still outpacing the lows, but those new lows have gained some ground.

WTD we have 154 new 3-Week Highs vs. 134 new 3-Week lows.

On Thursday 173 holdings had an intra-day-high higher than the high they made on 26-Sep. Only 2 holdings are in a Bearish -10% "Correction state, they are Humana & Micron

Good morning

On the Week-To-Date Time frame & the 3-Week High/Low Range, the new highs are still outpacing the lows, but those new lows have gained some ground.

WTD we have 154 new 3-Week Highs vs. 134 new 3-Week lows.

On Thursday 173 holdings had an intra-day-high higher than the high they made on 26-Sep. Only 2 holdings are in a Bearish -10% "Correction state, they are Humana & Micron

Last edited:

JTH

TSP Legend

- Reaction score

- 1,158

Sunday

Good Sunday

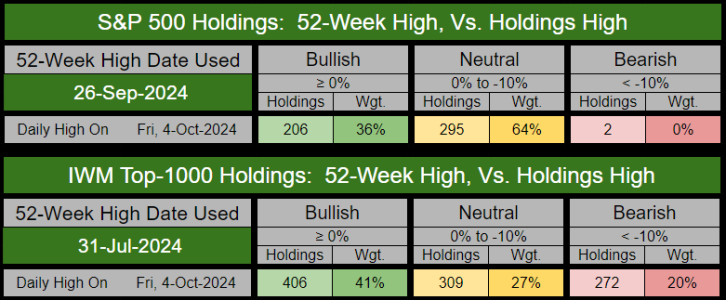

On Friday, for the S&P 500 & IWM, less than half of holdings had an intra-day high higher than then their 52-Week High dates from 26-Sep & 31-July.

For the week, for Weighted holdings, most of the gains came from the S&P 500’s Top-10 and IWM’s Top-100.

Highs are still outpacing lows. For the week, the S&P 500 put in 80 new 52-Week highs, and IWM put in 90.

The Transports closed towards the bottom of their 1 & 3 week high/low range. Bonds closed below their 10/20/50 MAs and towards the bottom of their 1/3/6 week high/low range.

The Health Care Sector ETF XLV closed below the 10/20/50 MAs and towards the bottom of the 1/3/6 week high/low range.

Leaving the mountains Monday and heading to Kraków for some city entertainment, have a great week.

Good Sunday

On Friday, for the S&P 500 & IWM, less than half of holdings had an intra-day high higher than then their 52-Week High dates from 26-Sep & 31-July.

For the week, for Weighted holdings, most of the gains came from the S&P 500’s Top-10 and IWM’s Top-100.

Highs are still outpacing lows. For the week, the S&P 500 put in 80 new 52-Week highs, and IWM put in 90.

The Transports closed towards the bottom of their 1 & 3 week high/low range. Bonds closed below their 10/20/50 MAs and towards the bottom of their 1/3/6 week high/low range.

The Health Care Sector ETF XLV closed below the 10/20/50 MAs and towards the bottom of the 1/3/6 week high/low range.

Leaving the mountains Monday and heading to Kraków for some city entertainment, have a great week.

JTH

TSP Legend

- Reaction score

- 1,158

Good morning

The S&P 500's most important 52-week low was on 27-Oct-2023, now that a year has expired, this means our 52-Week Low is rising with each new session.

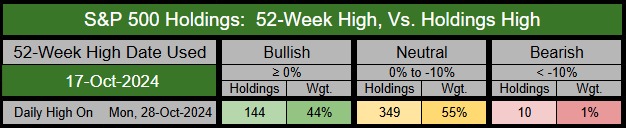

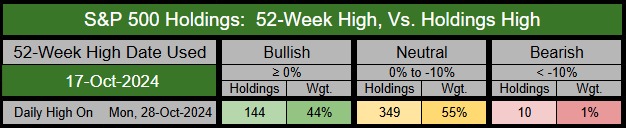

On 17-Oct the S&P 500 had it's last 52-Week High. Since then 144 holdings have reached higher than the high they made on 17-Oct. Those 144 holdings are weighted at 44% of the index, so as of this writing, the internals still look healthy.

For myself, while I haven't been active on the auto-tracker, I do expect to IFT something in before November starts.

The S&P 500's most important 52-week low was on 27-Oct-2023, now that a year has expired, this means our 52-Week Low is rising with each new session.

On 17-Oct the S&P 500 had it's last 52-Week High. Since then 144 holdings have reached higher than the high they made on 17-Oct. Those 144 holdings are weighted at 44% of the index, so as of this writing, the internals still look healthy.

For myself, while I haven't been active on the auto-tracker, I do expect to IFT something in before November starts.

FAAM

TSP Strategist

- Reaction score

- 117

Hi JTH. Like your photo (from before ya went to Krakow)... assuming that was you walking dog in forest/hills.Good morning

The S&P 500's most important 52-week low was on 27-Oct-2023, now that a year has expired, this means our 52-Week Low is rising with each new session.

On 17-Oct the S&P 500 had it's last 52-Week High. Since then 144 holdings have reached higher than the high they made on 17-Oct. Those 144 holdings are weighted at 44% of the index, so as of this writing, the internals still look healthy.

For myself, while I haven't been active on the auto-tracker, I do expect to IFT something in before November starts. View attachment 67224

In your forum-post today, you say you expect to IFT "in" before NOV, yet the bottom of your post says you're at 80% C & 20% G; is that incorrect balance of your current TSP spread, or are your going to put more of that 20% G into C, S, or I??

,,, Thx again for your sharing/posts!

Similar threads

- Replies

- 0

- Views

- 86

- Replies

- 0

- Views

- 87

- Replies

- 0

- Views

- 108

- Replies

- 1

- Views

- 213