Good morning

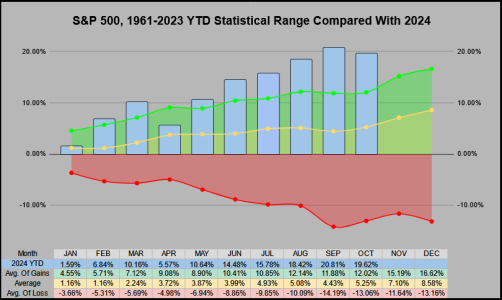

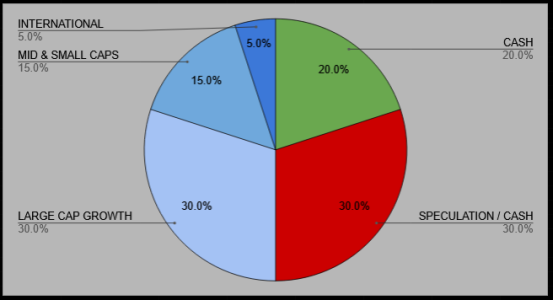

This being a holiday week, I suppose we can expect some lighter volume with a slight upside bias. This also takes us into the end of month which seems to have it's own upside bias. I did take (and exit) some leveraged trades this month, it's been a great year, so I'm starting to lay of the throttle a bit. I plan to be 25% cash by year end.

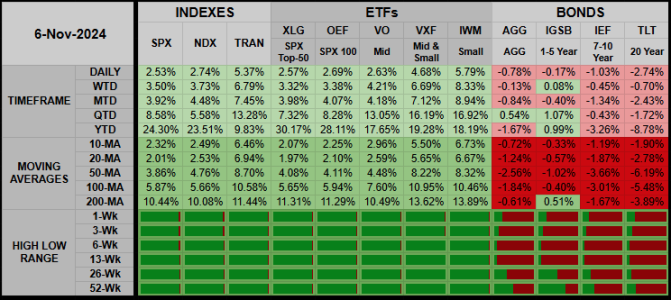

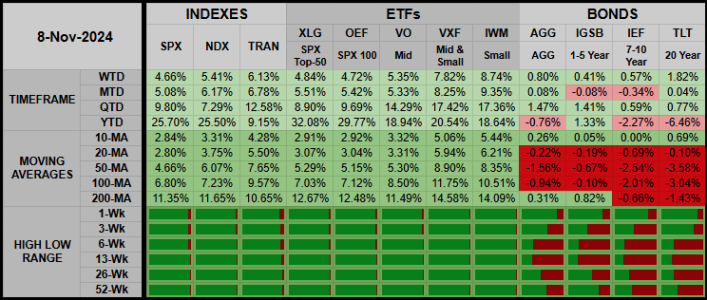

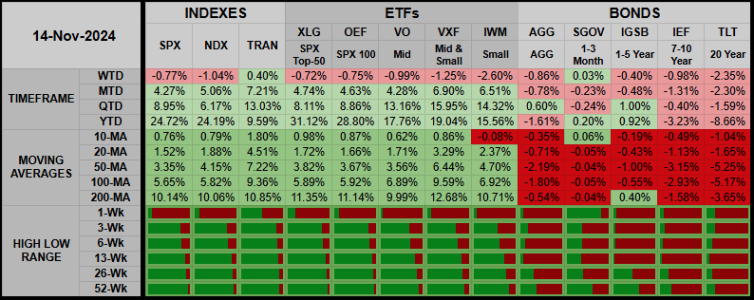

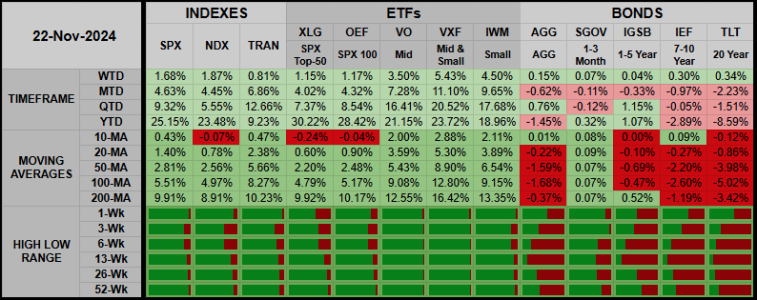

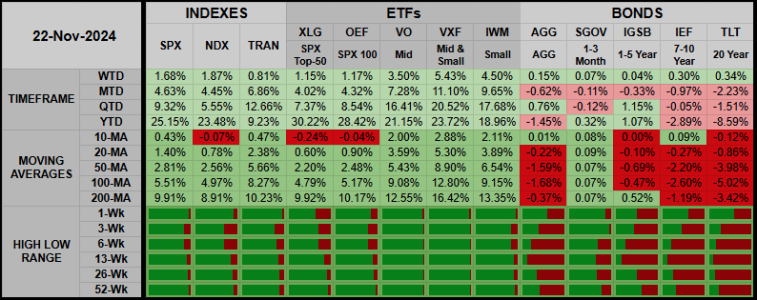

At present the indexes are holding up well, the Mid & Small Cap ETF VXF (I hold) gave us a 5.43% gain on the week.

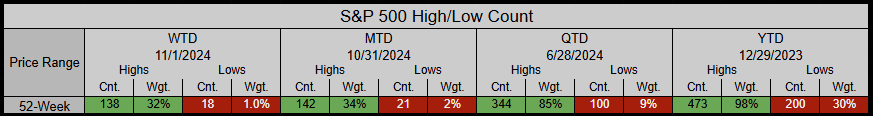

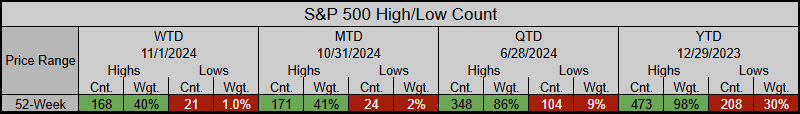

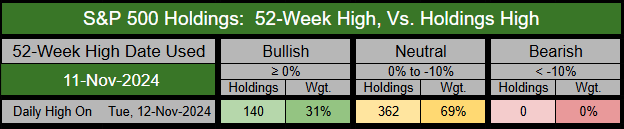

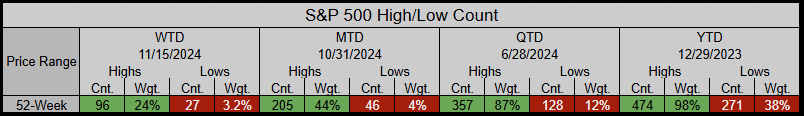

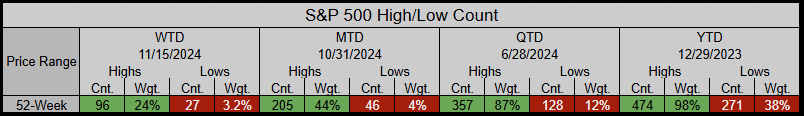

The 52-Week Highs are still outpacing the lows. For the week, the S&P 500 gave us 96 new 52-week highs weighted at 24% of the index.

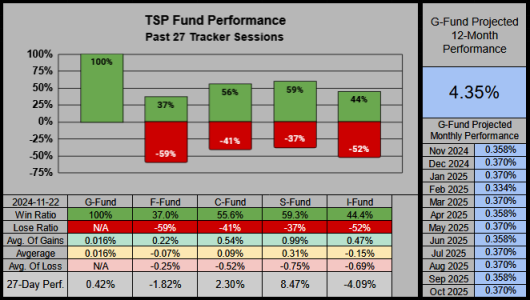

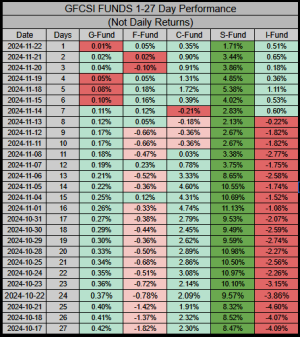

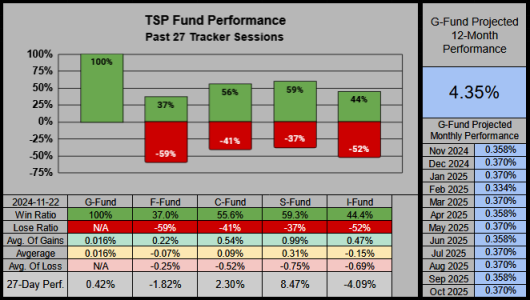

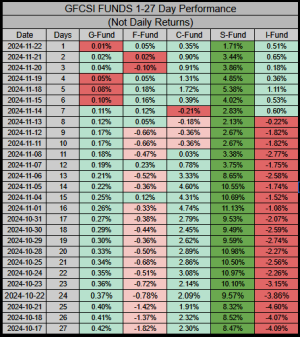

For the TSP Funds, the S-Fund has gained 8.47% over the past 27 sessions and the I-Fund has lost -4.09%

Are we entering the season for small caps? On the 1-27 day performance chart, the S-Fund is dominating all other funds.

In Poland a lot of folks get their tires swapped out for winter tires, (it's a thing here). Mind you I've been here since 2015 and have not saw the need to change tires, but truth be told if there's ice on the road, then I won't drive. But my wife changes her tires and the winter tires are stored at her father's village, so on Friday we take a road trip.

Somebody eat an extra serving of turkey for me and take a nap, have a great week!