Good morning

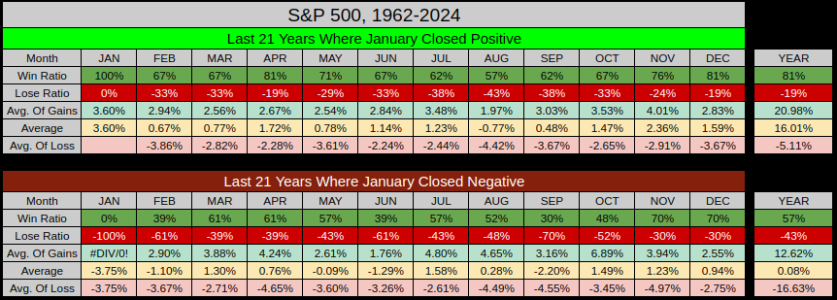

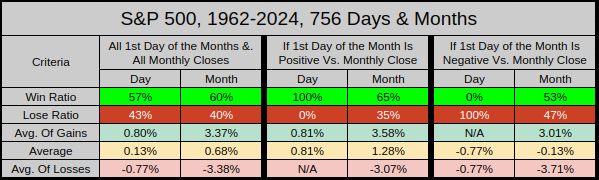

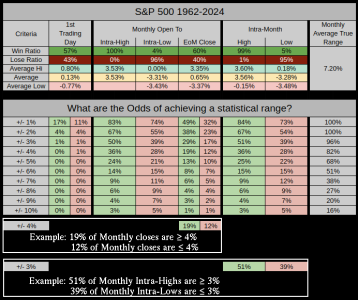

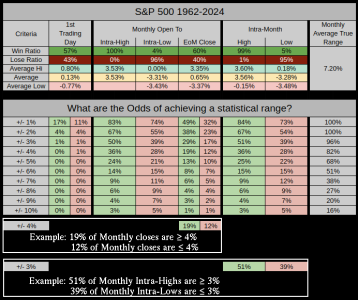

I wanted to take some time to digest and sort the previous 63-Years, which comprises 756 days/months. While win ratios are good info, the real meat is in the average gains & losses (and more importantly) the statistical probability of achieving those gains & losses.

For Monthly data, perhaps you're looking for a conservative +/- 2% edge (not wanting to get greedy).

___For sellers, an Intra-Month high of ≥ 2% occurred 67% of the time.

___For buyers, an Intra-Month low of ≤ 2% occurred 54% of the time.

___For Buy & Hold, 13% of monthly closes ranged ≥ 5%, with 10% ranging ≤ -5%

,

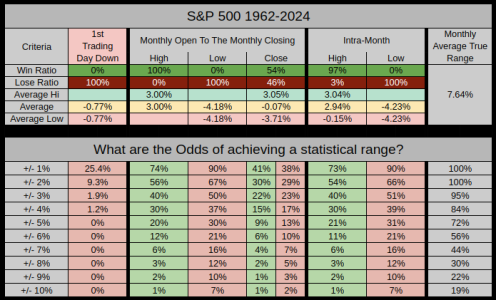

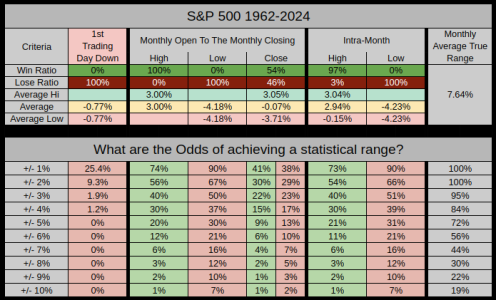

So the above chart was all 63-years. Since our current first day of this month closed down, let's only use data where the first day of the month closed down. In this case this reduces the sample from 756 to 323 months (roughly 27-years). Using this data set, we've decreased the probabilities for sellers, and increased them for buyers.

___For sellers, an Intra-Month high of ≥ 2% fell from the norm of 67% to 54%.

___For buyers, an Intra-Month low of ≤ 2% rose from the norm of 54% to 66%.

___For Buy & Hold, 9% of monthly closes ranged ≥ 5%, with 13% ranging ≤ -5%

Thanks for reading... Jason