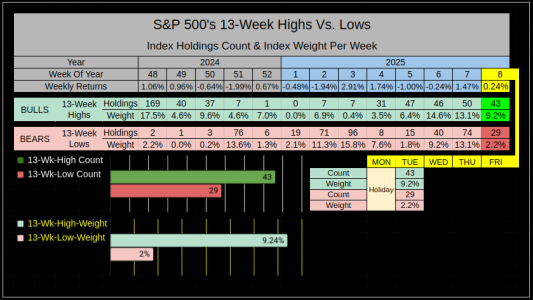

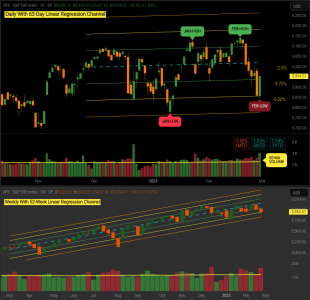

Here's what might be important to consider.

1. January closed positive

2. The February High is higher than the January High

3. The February Low is higher than the January Low

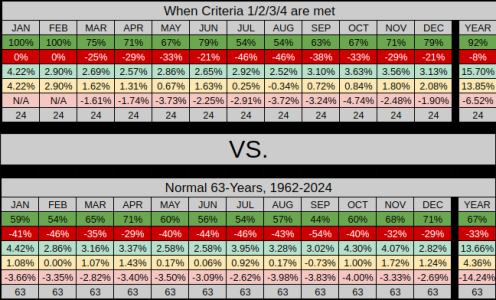

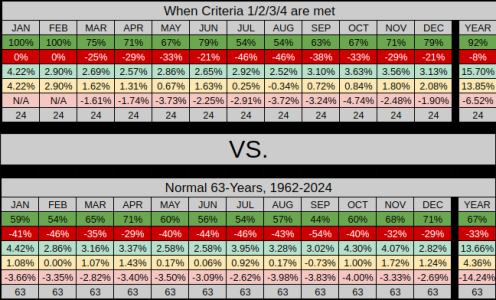

Under those criteria, from the previous 63-Years, this has happened 30 of 63 times.

The result for February was an 80% win ratio with an average gain of 2.90%

Vs. a 20% lose ratio with an average loss of -2.34%

But wait! It gets better... Of the 5 times where criteria 1/2/3 were met, but February closed the month down, all 5 years closed positive for an average gain of 16.34%

So now we ask the question, what are the results of what happens when the first 3 criteria are met, + February closed

higher than January.

This has happened 24 of 63 years where...

1. January closed positive

2. The February High is higher than the January High

3. The February Low is higher than the January Low

4. February closed higher than January

For the following 10 months the monthly win ratios were higher 9 of 10 months (Aug was slightly lower).

Interestingly, the average gains were only higher on 4 of 10 months, but the yearly win ratio and average yearly gains are higher.