JTH

TSP Legend

- Reaction score

- 1,170

Good morning

These past few weeks my google spreadsheets (which pull data from google finance), have been unable to load quickly. I've tried switching browsers, and also tried breaking up the spreadsheets into smaller chunks, but nothing has helped. Usually the page just times out and fails to load. If I make a minor change like changing the WTD date, then the whole process starts over. Eventually it does load, but it's becoming a PIA because I prefer to close the browser tabs when they aren't being used.

I may have to consider a complete rebuild, and/or less features.

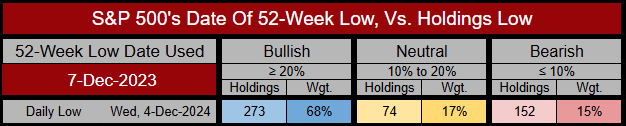

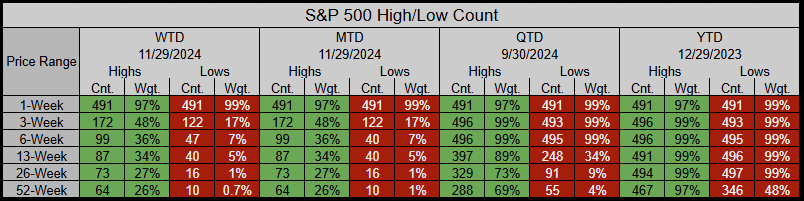

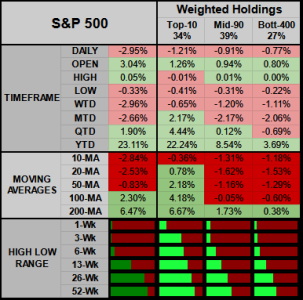

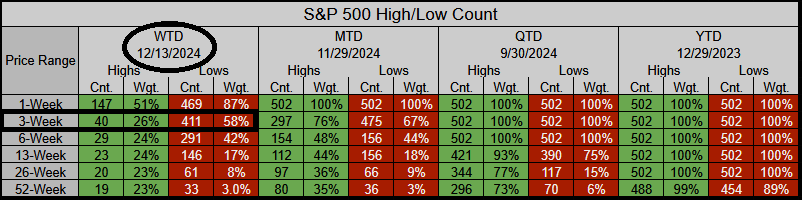

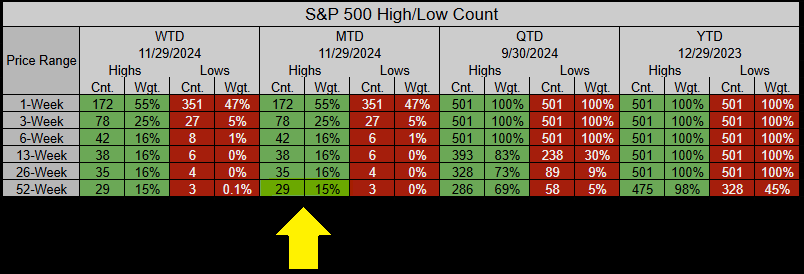

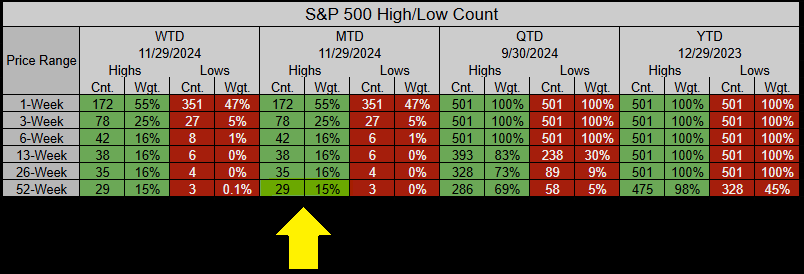

MTD we have 29 new 52-Week Highs weighted at 15% of the index.

Have a great week.

These past few weeks my google spreadsheets (which pull data from google finance), have been unable to load quickly. I've tried switching browsers, and also tried breaking up the spreadsheets into smaller chunks, but nothing has helped. Usually the page just times out and fails to load. If I make a minor change like changing the WTD date, then the whole process starts over. Eventually it does load, but it's becoming a PIA because I prefer to close the browser tabs when they aren't being used.

I may have to consider a complete rebuild, and/or less features.

MTD we have 29 new 52-Week Highs weighted at 15% of the index.

Have a great week.