JTH

TSP Legend

- Reaction score

- 1,158

Thursday

Good morning

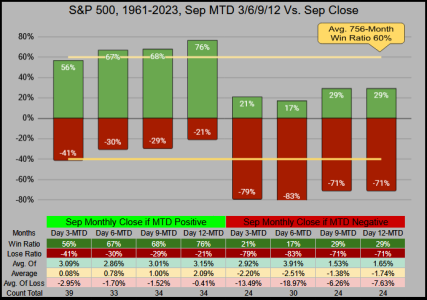

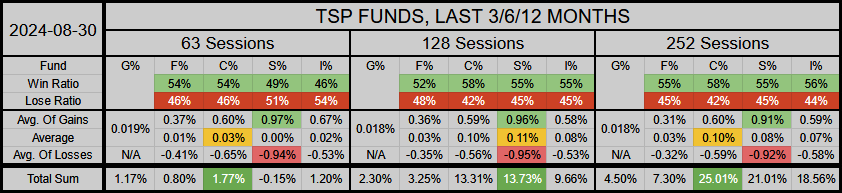

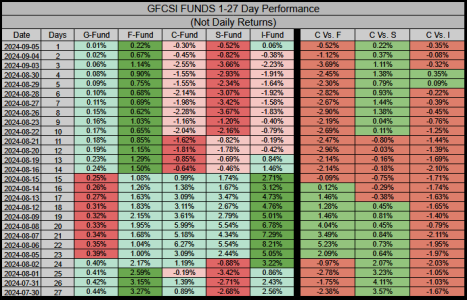

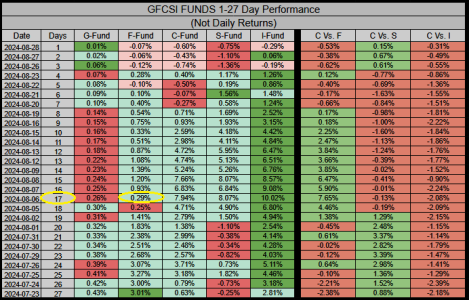

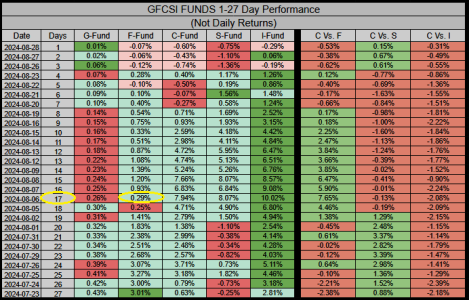

My 17-Sessions in the F-Fund has yielded a .29% gain (an insignificant edge over the G-Fund's .26%). With 2 sessions left this Month, I have 1 IFT left, but I'm not happy with the choices we have at the moment. I may either sit on my hands, or park into the G-Fund and wait for a better setup.

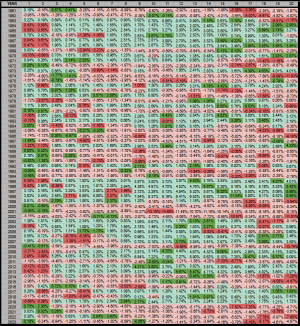

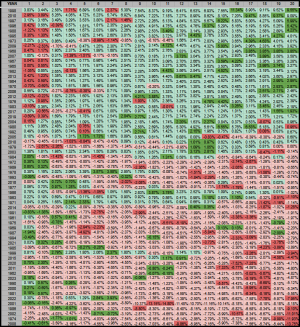

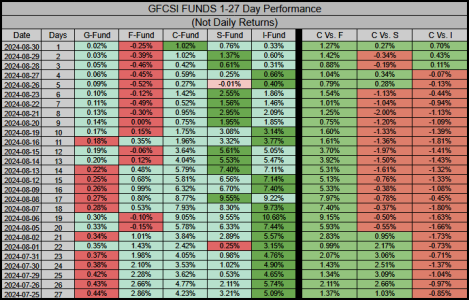

On the 1 to 27 Session Performance scale, we can see the I-Fund is the most dominant gainer.

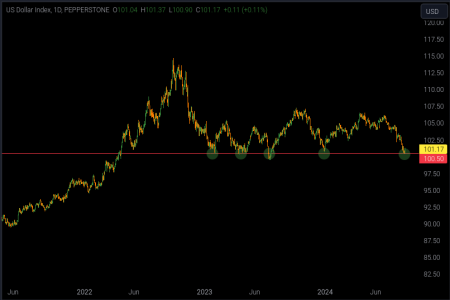

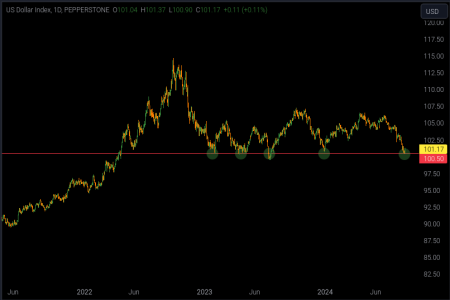

Although the I-Fund has been doing great, the US Dollar is playing at key lows, which makes me wonder if we're setup for a bounce.

Good morning

My 17-Sessions in the F-Fund has yielded a .29% gain (an insignificant edge over the G-Fund's .26%). With 2 sessions left this Month, I have 1 IFT left, but I'm not happy with the choices we have at the moment. I may either sit on my hands, or park into the G-Fund and wait for a better setup.

On the 1 to 27 Session Performance scale, we can see the I-Fund is the most dominant gainer.

Although the I-Fund has been doing great, the US Dollar is playing at key lows, which makes me wonder if we're setup for a bounce.