FAAM

TSP Strategist

- Reaction score

- 117

Re: Friday

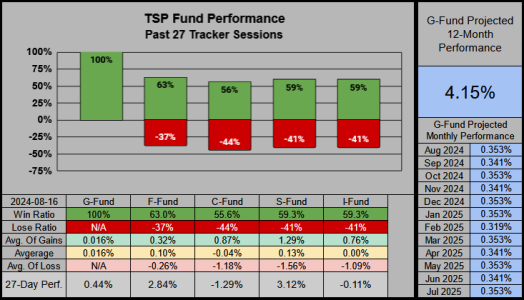

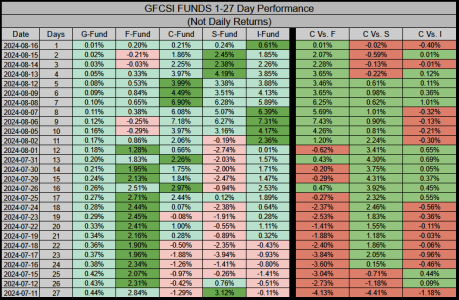

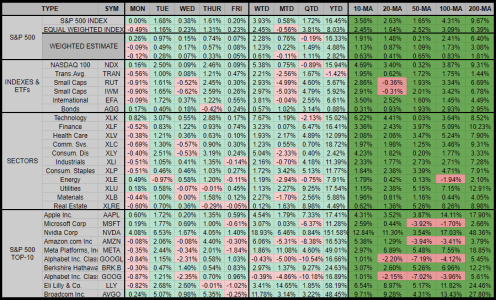

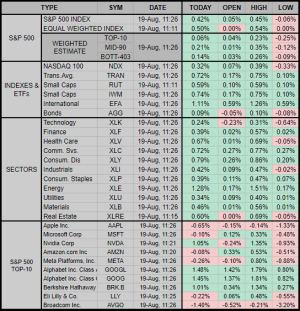

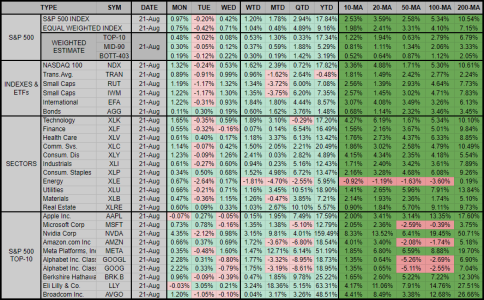

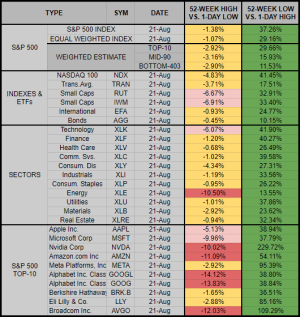

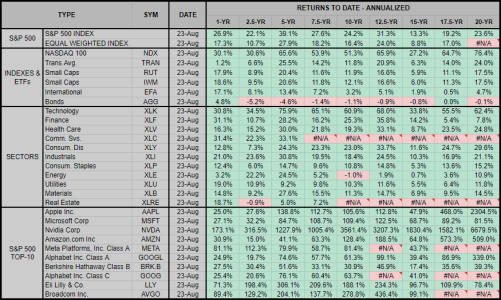

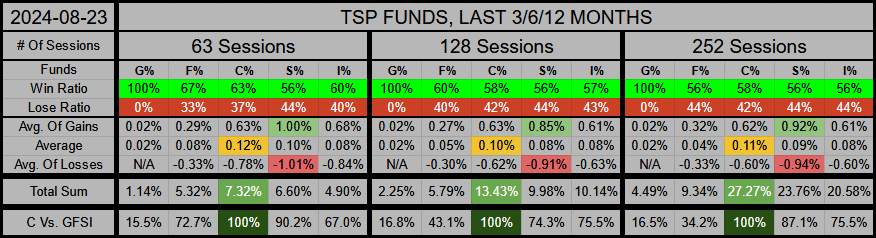

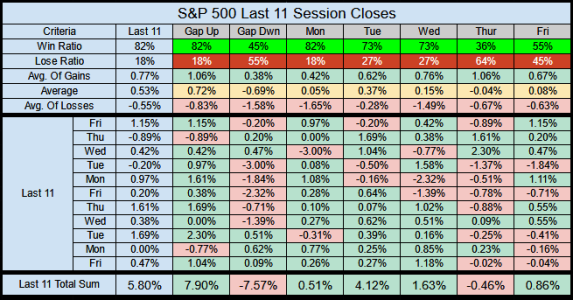

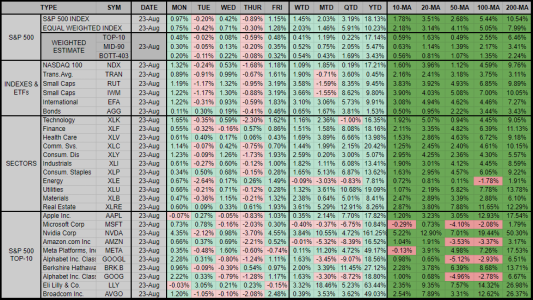

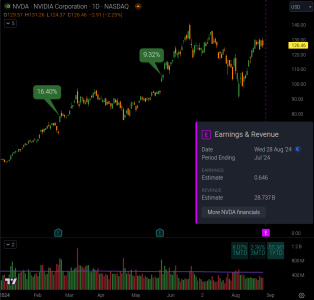

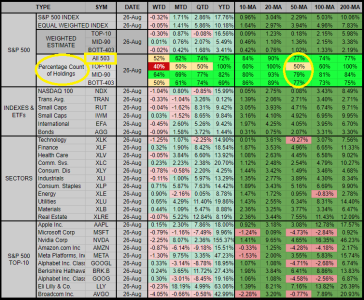

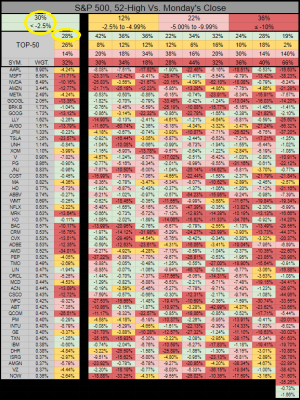

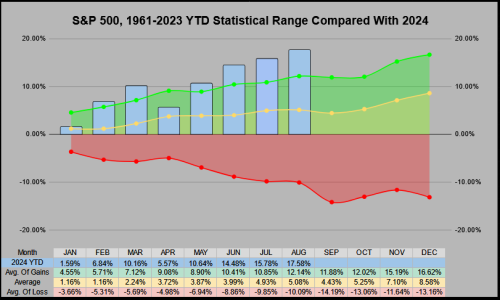

Just back from 3-wks travel out-of-country & largely ignoring national/ world news except some of the Olympics... so in the meanwhile, what happened to ye 'old Stock EFTs? Looks like they did Olympic high-dive / deep-dive and back to the surface... looks about similar shares-wise as when I left.

Anyway, have to also say -- I LOVE THE CABIN & the "WOOD"! Thanks again for posting great stuff, and ENJOY!

Just back from 3-wks travel out-of-country & largely ignoring national/ world news except some of the Olympics... so in the meanwhile, what happened to ye 'old Stock EFTs? Looks like they did Olympic high-dive / deep-dive and back to the surface... looks about similar shares-wise as when I left.

Anyway, have to also say -- I LOVE THE CABIN & the "WOOD"! Thanks again for posting great stuff, and ENJOY!