JTH

TSP Legend

- Reaction score

- 1,158

Good morning

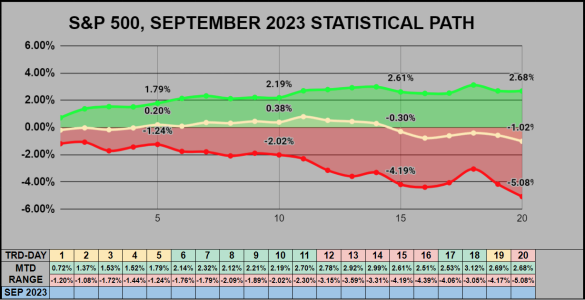

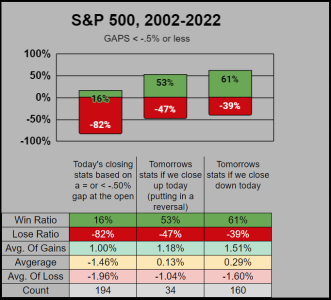

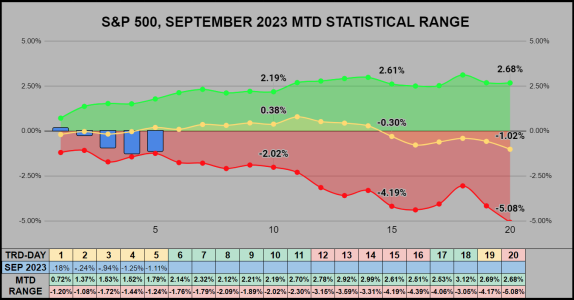

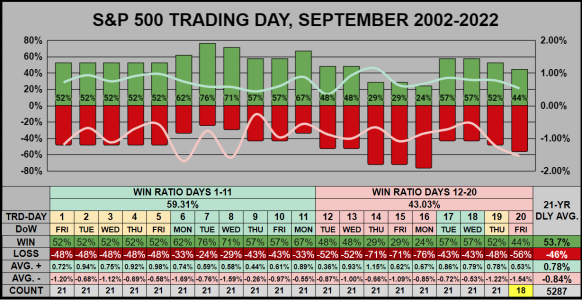

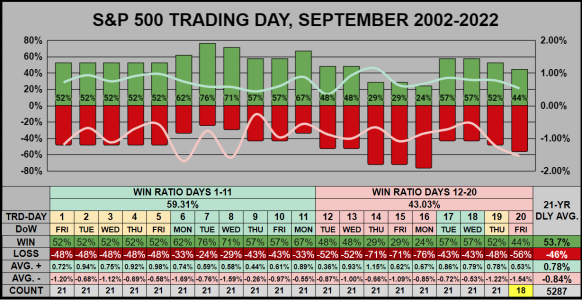

From the past 21-Years, September tends to start the 1st 5 days flat. Perhaps there's a Labor Day holiday effect where students are back in school, vacations have ended, and maybe hedge fund managers start looking for ways to take off risk.

Overall, the first 11 trading days have a statistically higher win ratio, with the last 9 trading days dropping off. Over the past 21 years, September has averaged -1.02% which is the worst 21-year monthly average of all 12 months.

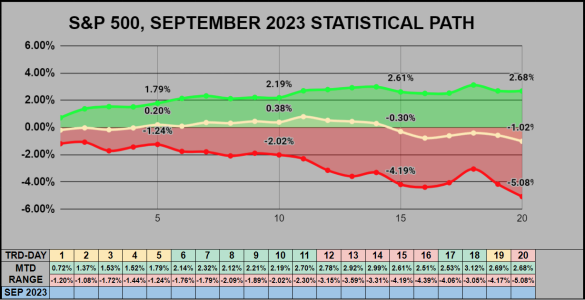

This 2nd chart, is an inbred concoction of compounded statistics. This is the path I'm guessing September can navigate and close in.

From the past 21-Years, September tends to start the 1st 5 days flat. Perhaps there's a Labor Day holiday effect where students are back in school, vacations have ended, and maybe hedge fund managers start looking for ways to take off risk.

Overall, the first 11 trading days have a statistically higher win ratio, with the last 9 trading days dropping off. Over the past 21 years, September has averaged -1.02% which is the worst 21-year monthly average of all 12 months.

This 2nd chart, is an inbred concoction of compounded statistics. This is the path I'm guessing September can navigate and close in.