JTH

TSP Legend

- Reaction score

- 1,170

Good morning

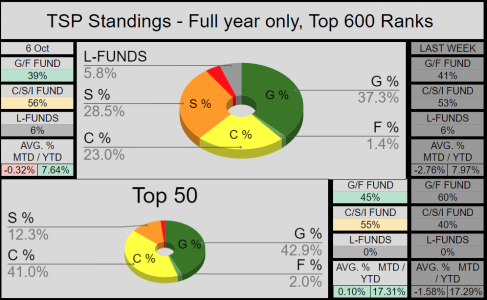

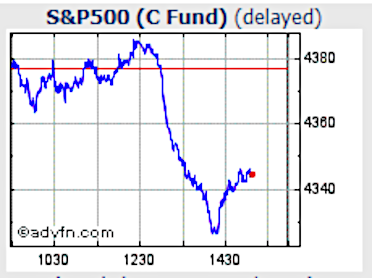

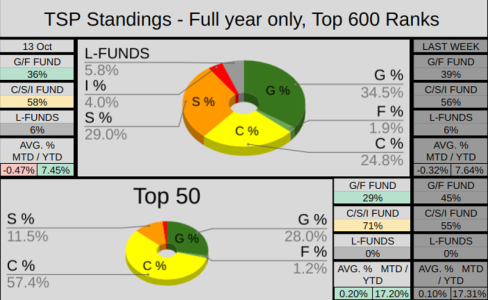

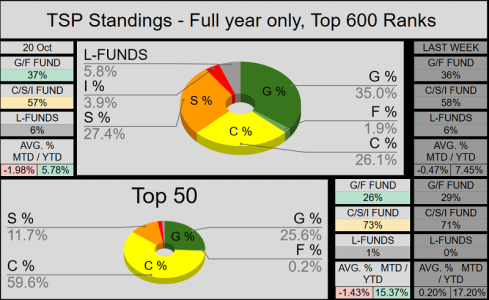

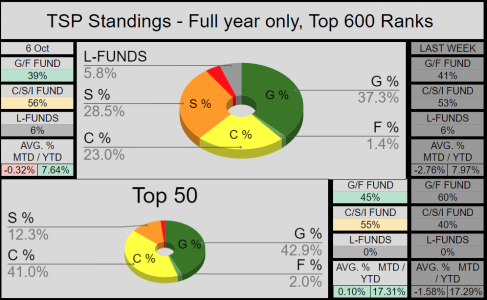

From the Top-600 perspective, 6% of you are outperforming the C-Fund. Id estimate those numbers are impressive when you consider the limited fund options along with the 2-IFT limit. Frankly, I just don't think many fund managers could do much better (given those circumstances).

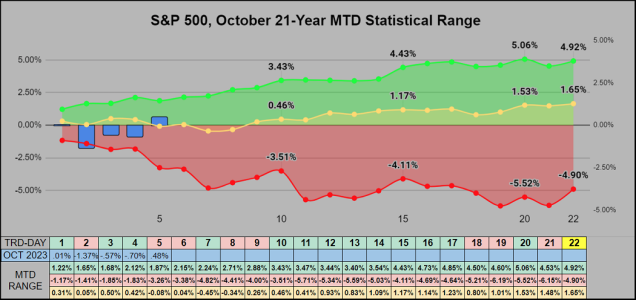

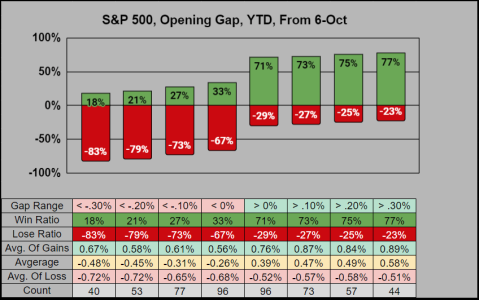

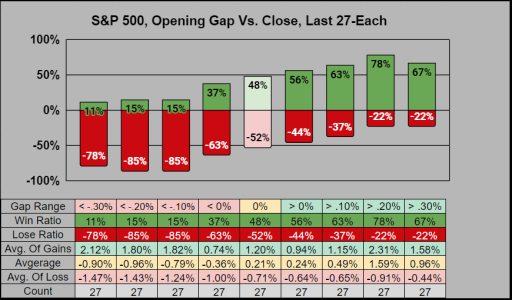

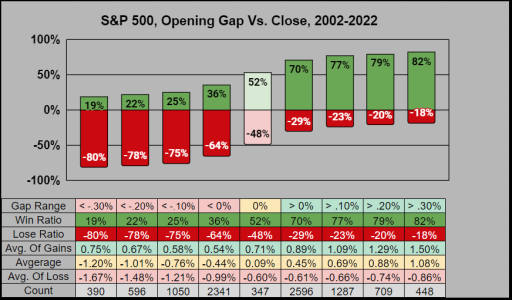

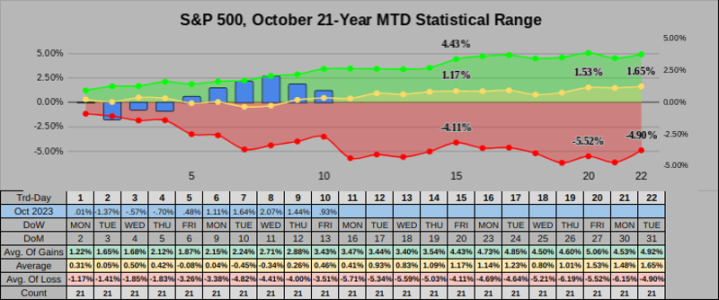

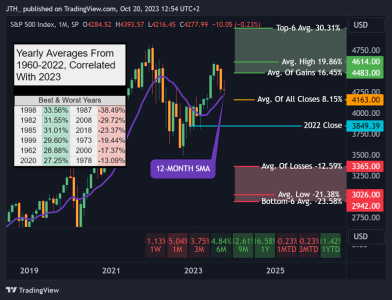

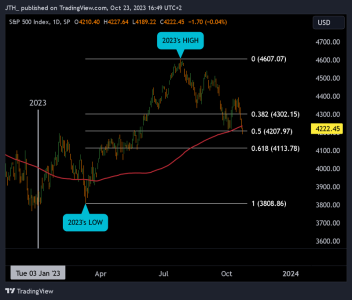

Quarter 4 is here, which traditionally provides the best opportunities of the year. BLOG: STATS FOR Q4

From the Top-600 perspective, 6% of you are outperforming the C-Fund. Id estimate those numbers are impressive when you consider the limited fund options along with the 2-IFT limit. Frankly, I just don't think many fund managers could do much better (given those circumstances).

Quarter 4 is here, which traditionally provides the best opportunities of the year. BLOG: STATS FOR Q4