JTH

TSP Legend

- Reaction score

- 1,158

Good morning

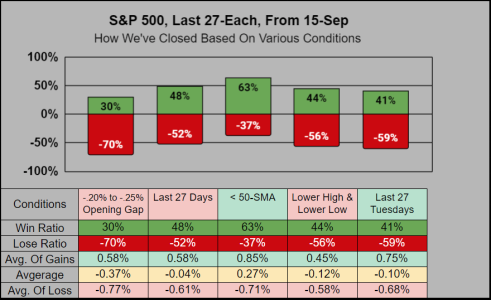

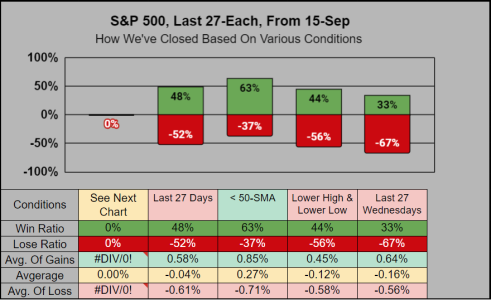

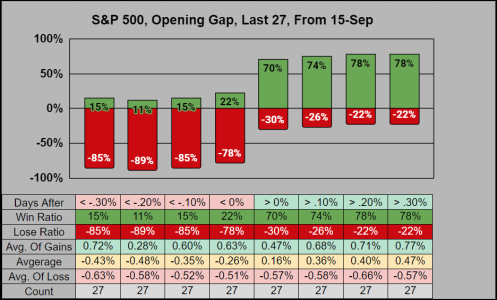

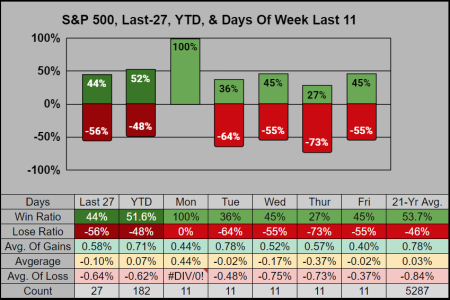

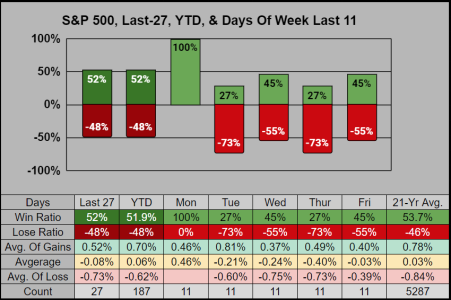

Friday fell short of my expectations, I hadn’t realized why, until Tom mentioned something in his Market Talk thread.

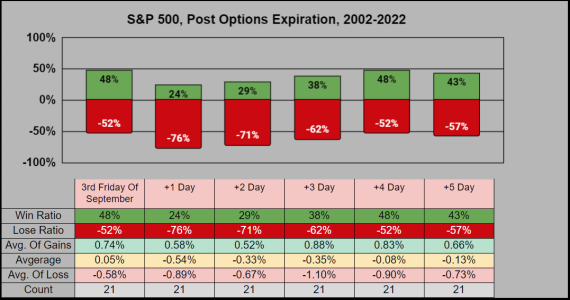

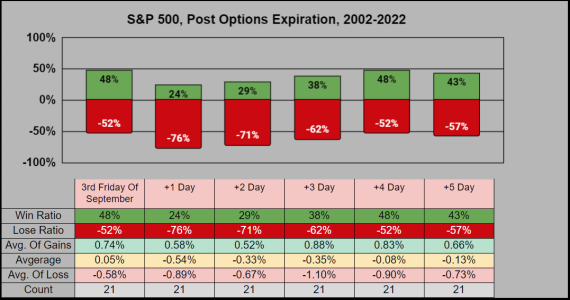

“The recent track record of Friday quadruple witching expiration day in September has been pretty bad, and next week (post Sep expiration week) has a negative bias, and a poor one at that, but sometimes the Monday of post expiration Sep is actually up before a decline into the rest of the week.”

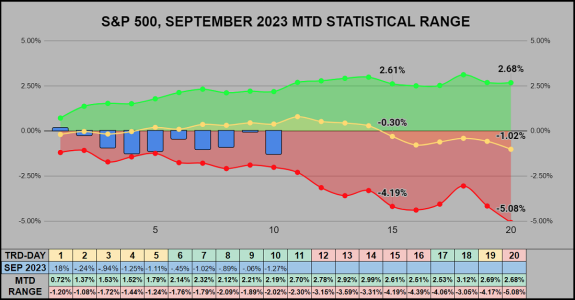

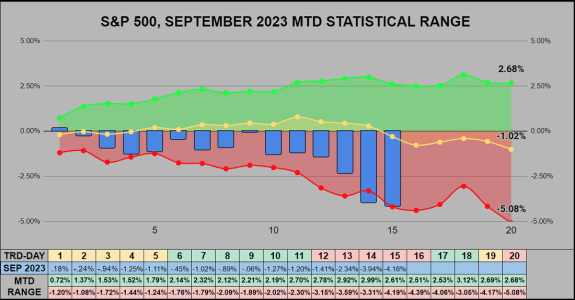

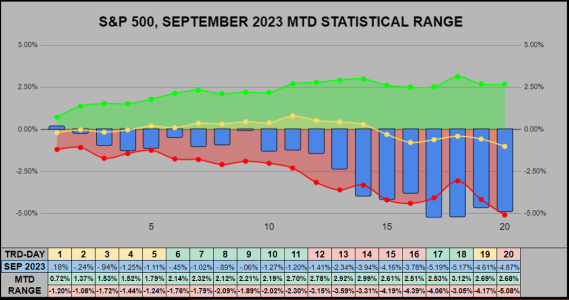

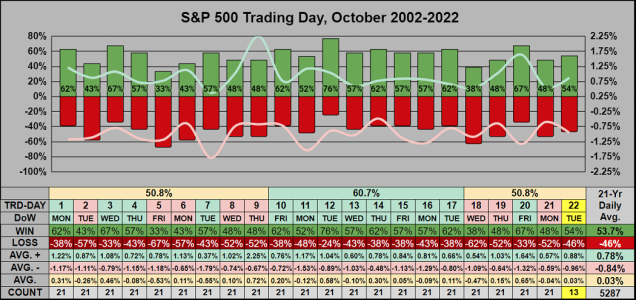

I don’t normally track Options Expiration, but inlight of getting blindsided, I thought I should post September's Historical stats based on the 3rd Friday’s Expiration, and the following 5 trading days after. This somewhat falls inline with trading days 12-16 (Tue to Mon) being statistically the weakest period of September.

Friday fell short of my expectations, I hadn’t realized why, until Tom mentioned something in his Market Talk thread.

“The recent track record of Friday quadruple witching expiration day in September has been pretty bad, and next week (post Sep expiration week) has a negative bias, and a poor one at that, but sometimes the Monday of post expiration Sep is actually up before a decline into the rest of the week.”

I don’t normally track Options Expiration, but inlight of getting blindsided, I thought I should post September's Historical stats based on the 3rd Friday’s Expiration, and the following 5 trading days after. This somewhat falls inline with trading days 12-16 (Tue to Mon) being statistically the weakest period of September.