- Reaction score

- 821

Re: MONTHS

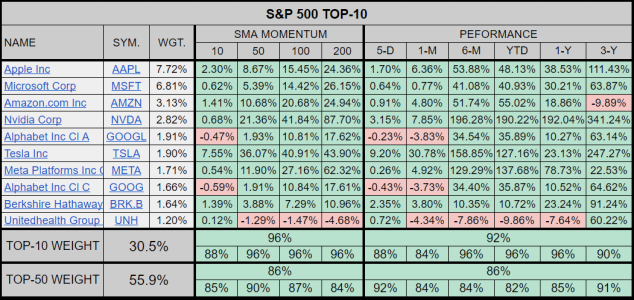

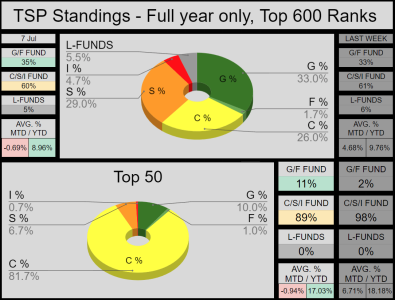

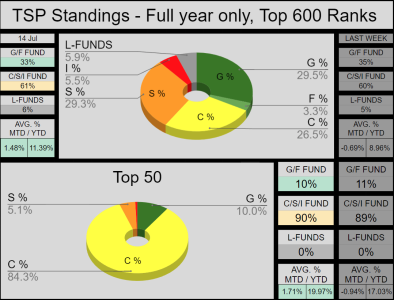

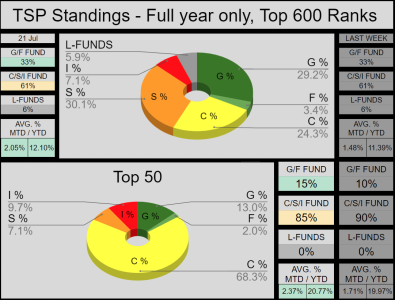

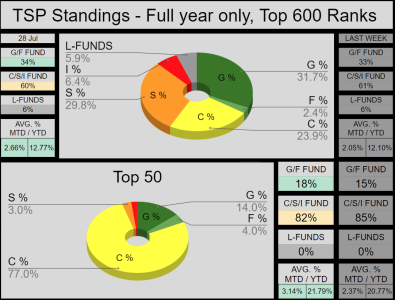

100% "S" fund, 11.90% YTD. Still down 24.18% from my high back in November 2021. If I get my act together, I will be 100% out of TSP by the end of summer. Going to roll everything over to my Edward Jones account. Next year I am going to have to start taking money out and I don't want to do it from two different accounts.

100% "S" fund, 11.90% YTD. Still down 24.18% from my high back in November 2021. If I get my act together, I will be 100% out of TSP by the end of summer. Going to roll everything over to my Edward Jones account. Next year I am going to have to start taking money out and I don't want to do it from two different accounts.