JTH

TSP Legend

- Reaction score

- 1,158

Post 2 of 2

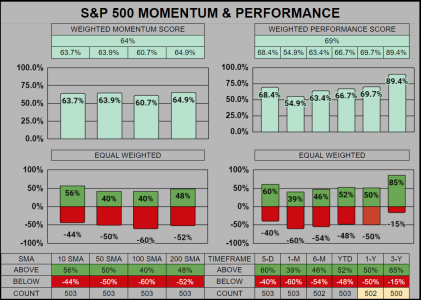

Over the past 5 sessions we've been in a tight 1.35% range, and volume has been light (under the 50-SMA-VOL).

SPX_DAILY

___

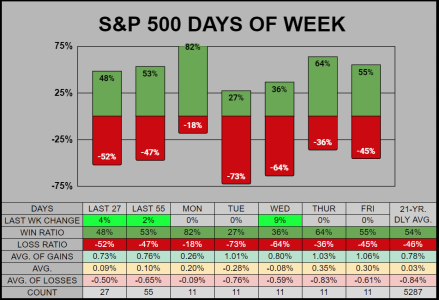

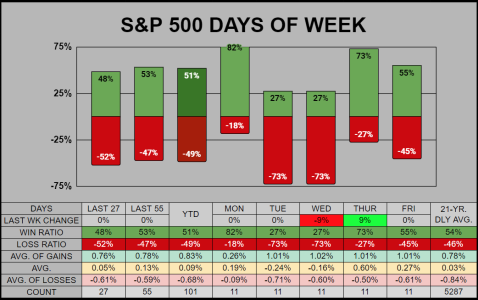

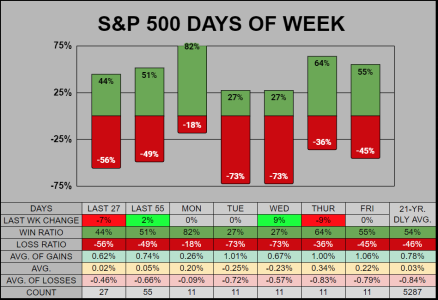

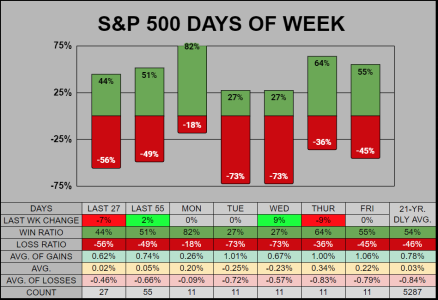

Statistically speaking, it's much the same as I've reported over the previous 3 weeks, Mon/Thur good, Tue/Wed bad, Fri meh. The last 7 of 11 days down, last 3 Tue down, last 2 Thur down.

___

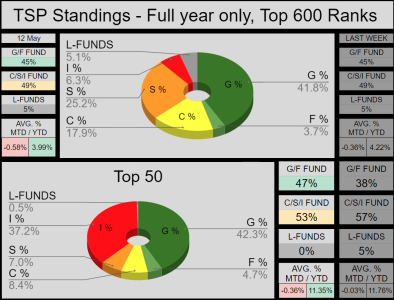

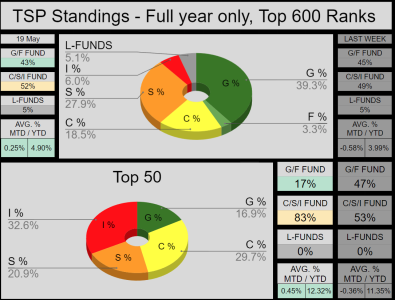

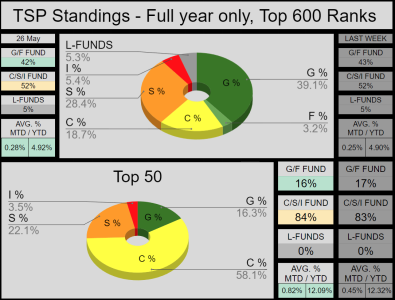

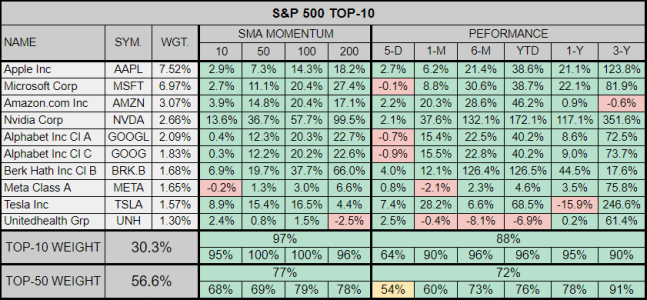

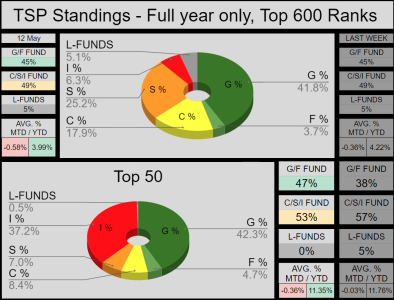

The AT's Top-600 lost -.24% last week, while the Top-50 lost -.41%

Over the past 5 sessions we've been in a tight 1.35% range, and volume has been light (under the 50-SMA-VOL).

SPX_DAILY

___

Statistically speaking, it's much the same as I've reported over the previous 3 weeks, Mon/Thur good, Tue/Wed bad, Fri meh. The last 7 of 11 days down, last 3 Tue down, last 2 Thur down.

___

The AT's Top-600 lost -.24% last week, while the Top-50 lost -.41%