JTH

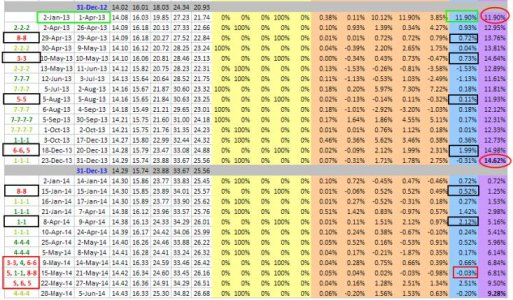

TSP Legend

- Reaction score

- 1,158

I'm not sure if it will be fun, but it will definitely play out............

It's funny, I'm currently sitting in the G fund and up over 9% for the year while the S fund was up 2.11% as of yesterday, of course it will be up more today, but now I get upset subscribers saying that it is just like last year and I keep missing "all" the rallies and telling me how much my system sux. Some even suggest that I do! You sure you don't wanna be a premium service?

Funny, I think we always knew customer service was never your strong suite, but when the hard decisions need to be made, that's where you shine and I think most folks would agree with me. I was writing in my trading journal the other day because this very topic was on my mind, I originally didn't plan on posting it because it would probably come off as arrogant, but since you opened the door, I'll share the excerpt.

___

Short-term thinking leads to short-term results.

Two intrafund transfers a month with a 4-hour gap between the initiation & execution of price, does not a short-term trading system make. People who fail to identify & determine if their goals are compatible with TSP’s long-term trading platform will struggle to be successful. When a person seeks to impose their short-term views over a long-term system, they will fail to perform because the two timeframes are largely incompatible.

I wanted to add one more thing, here's a set of open questions to the forum.

Would it be wise for me to use an IFT with a 4-hour time gap to chase stocks, trying to catch this rally when stocks are already overbought & at 52-week highs?

What would I do if I jumped in and the markets reversed?

What option would be left for me if this happened?

Should I exit and take a loss or absorb the loss?

Would it perhaps be wiser for me to be patient and let the markets come back to me or should I chase the markets?