JTH

TSP Legend

- Reaction score

- 1,158

Sunday

Good Sunday

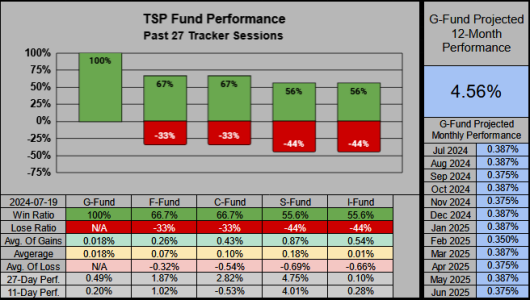

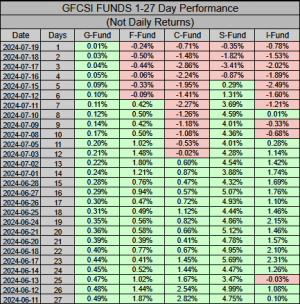

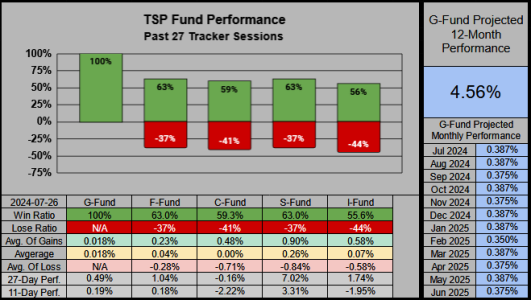

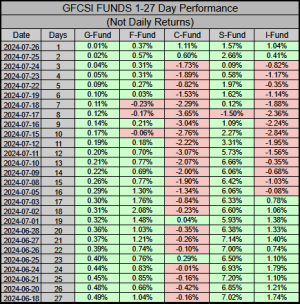

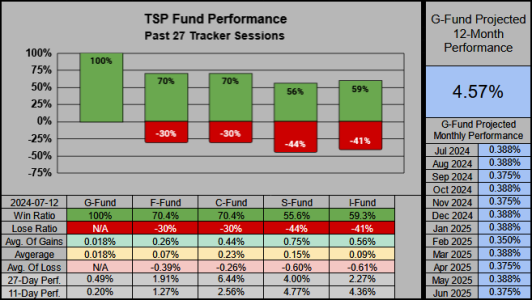

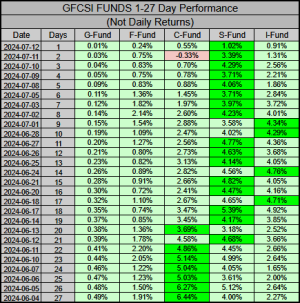

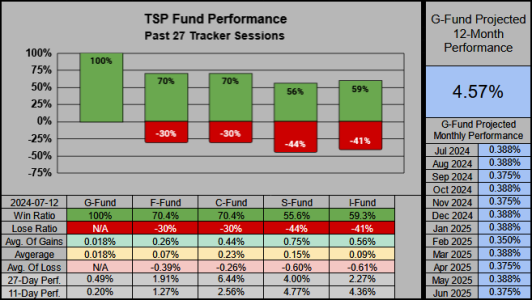

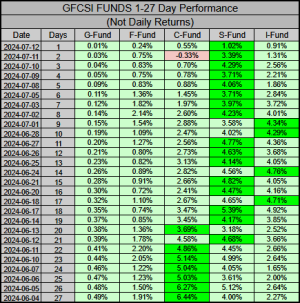

This week (for the 2nd consecutive time) the F & C Funds have the best 27-Day win ratio @ 70.4% The C-Fund has the most gains @ 6.44% followed by the S-Fund @ 4.00%

Performance wise, Only the 2-day performance of the C-Fund is in the red. Everything else is in the green, which is the most green we’ve seen since posting this data.

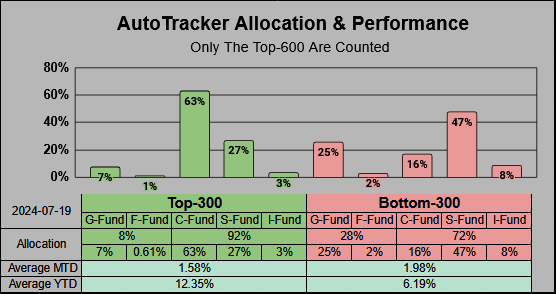

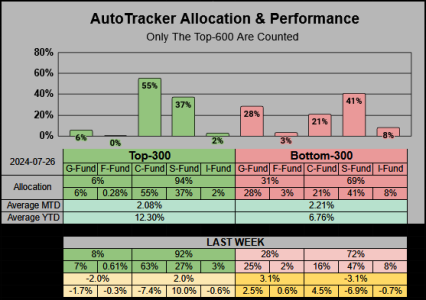

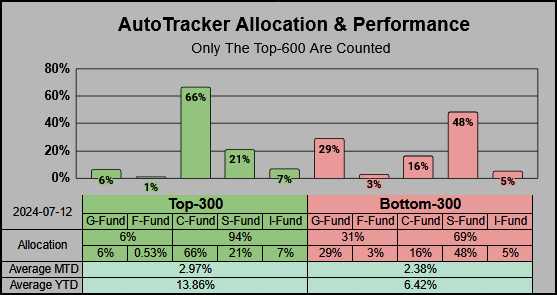

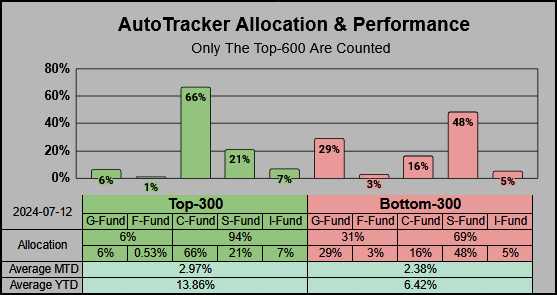

Although the S-Fund gained 4.06% last week, it wasn't enough to push the S-Fund crowd into the Top-300, but there was a modest allocation increase of 2.8% from the previous week.

Noteworthy: The Top-11 MTD @ 4.34% are all-in on the I-Fund. One of the elders & moderators of the forum, user member Frixxxx is sitting in the #1 slot.

Papohotel66 is in the #2 slot, and had an impressive 30.24% return last year.

Good Sunday

This week (for the 2nd consecutive time) the F & C Funds have the best 27-Day win ratio @ 70.4% The C-Fund has the most gains @ 6.44% followed by the S-Fund @ 4.00%

Performance wise, Only the 2-day performance of the C-Fund is in the red. Everything else is in the green, which is the most green we’ve seen since posting this data.

Although the S-Fund gained 4.06% last week, it wasn't enough to push the S-Fund crowd into the Top-300, but there was a modest allocation increase of 2.8% from the previous week.

Noteworthy: The Top-11 MTD @ 4.34% are all-in on the I-Fund. One of the elders & moderators of the forum, user member Frixxxx is sitting in the #1 slot.

Papohotel66 is in the #2 slot, and had an impressive 30.24% return last year.