JTH

TSP Legend

- Reaction score

- 1,158

Monday

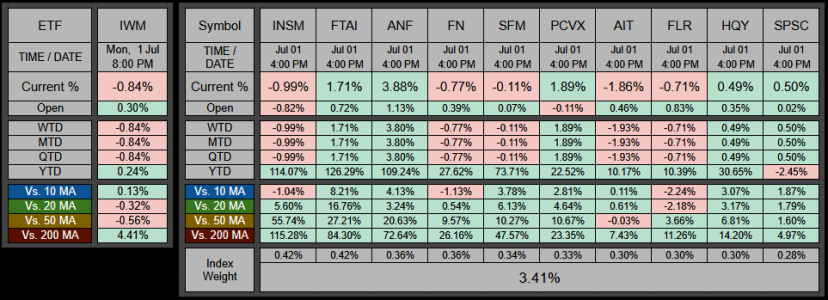

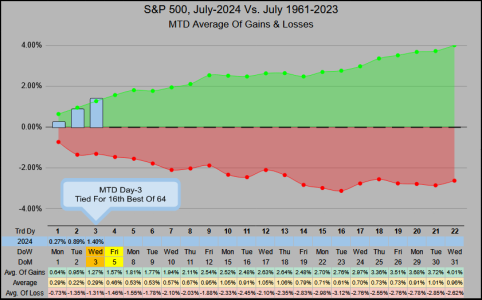

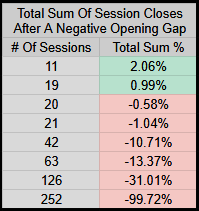

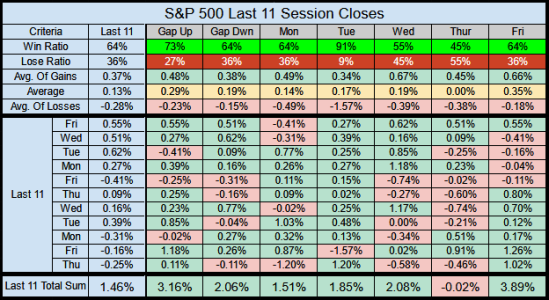

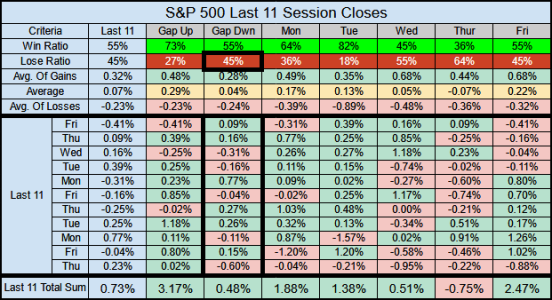

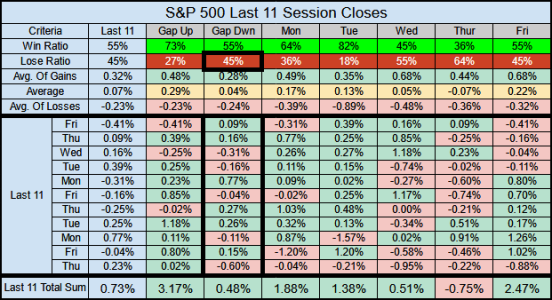

The last 11 times the Index gapped down at the open, it closed the session down 45% of the time. Typically this stats runs at 70% down, so (at this time) IFT buyers have been at a disadvantage when trying to scoop up lower prices.

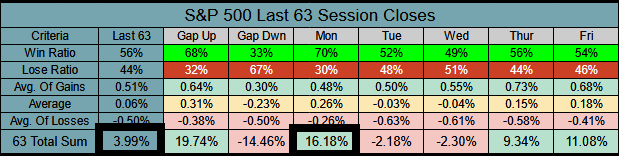

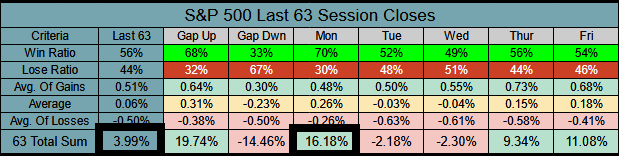

Over the past 63 sessions, the S&P 500 has a cumulative gain of 3.99%, but the past 63 Mondays have been the most profitable at 16.18%

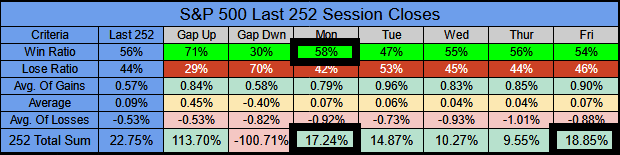

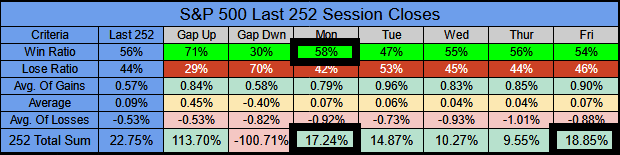

The past 252 Mondays have the best Day-of-Week win ratio and 2nd best gains, with Friday having the best gains.

The last 11 times the Index gapped down at the open, it closed the session down 45% of the time. Typically this stats runs at 70% down, so (at this time) IFT buyers have been at a disadvantage when trying to scoop up lower prices.

Over the past 63 sessions, the S&P 500 has a cumulative gain of 3.99%, but the past 63 Mondays have been the most profitable at 16.18%

The past 252 Mondays have the best Day-of-Week win ratio and 2nd best gains, with Friday having the best gains.