JTH

TSP Legend

- Reaction score

- 1,158

Friday

I've been out of town this week, so my participation in the markets has been limited.

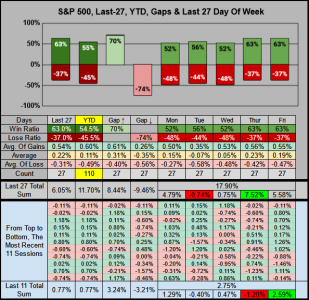

Anyhow, today is our last session of May. As it stands, on the weekly chart (not shown) we'll likely close with both a lower weekly high & low, thus last week's outside daily reversal was confirmed. But on positive note, for the 52-Week and 63-Day linear regression channels, we are close to the fair value middle line (line of best fit), so prices are on track (neither oversold nor overbought).

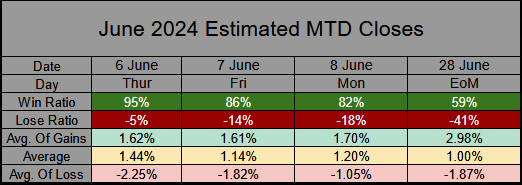

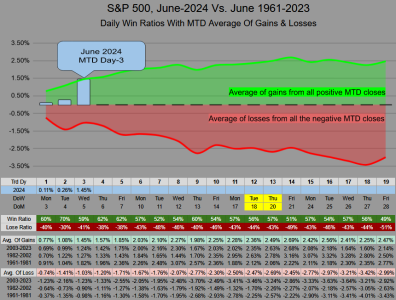

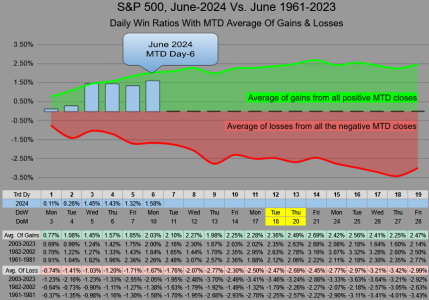

While June is my least favorite month, there isn't much here to get me alarmed. Even a healthy -5% pullback is still above the Mar/Apr/May monthly lows, those are the key levels I'm most concerned with.

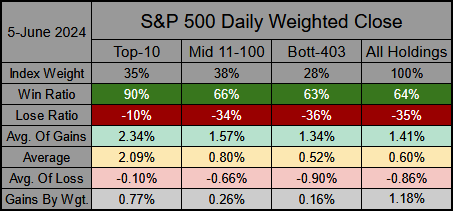

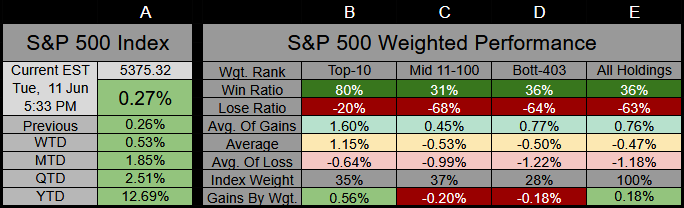

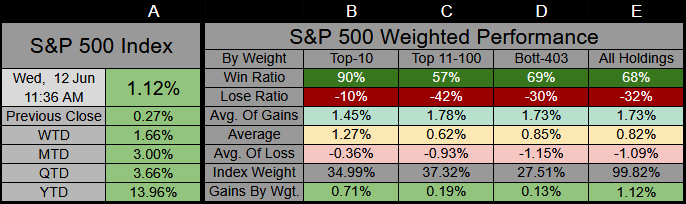

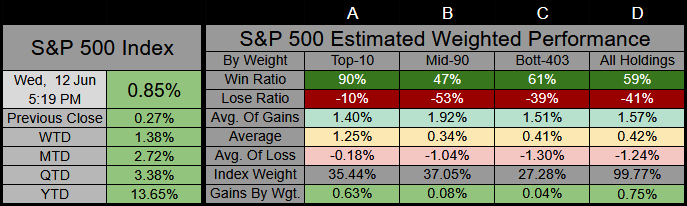

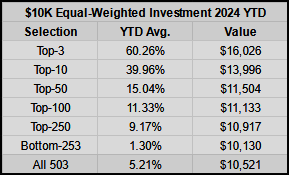

Of Note, on Thursday SPX lost -.60%, the Top-50 ETF XLG lost -1.26%, while R2K closed up 1%. Is this the small cap rotation we've been waiting for?

I've been out of town this week, so my participation in the markets has been limited.

Anyhow, today is our last session of May. As it stands, on the weekly chart (not shown) we'll likely close with both a lower weekly high & low, thus last week's outside daily reversal was confirmed. But on positive note, for the 52-Week and 63-Day linear regression channels, we are close to the fair value middle line (line of best fit), so prices are on track (neither oversold nor overbought).

While June is my least favorite month, there isn't much here to get me alarmed. Even a healthy -5% pullback is still above the Mar/Apr/May monthly lows, those are the key levels I'm most concerned with.

Of Note, on Thursday SPX lost -.60%, the Top-50 ETF XLG lost -1.26%, while R2K closed up 1%. Is this the small cap rotation we've been waiting for?

Last edited: