THANKS,

For your help with this. I’m a computer programmer for SSA, who continually keeps taking classes at community colleges to keep up on the latest.stuff.

D

You're welcome, I had originally intended to be a programmer, but I didn't have the skill-set, motivation, or talent

My step dad was a programmer starting in the 70s, he bought me my first PC the Commodore 64, I programed around with Basic (bought the game programing mags), but then puberty hit (started chasing girls) and I didn't get back into computers until 97. I did end up working & retiring out of Cyber Security, but it wasn't my bag, I was a much better manager than technician.

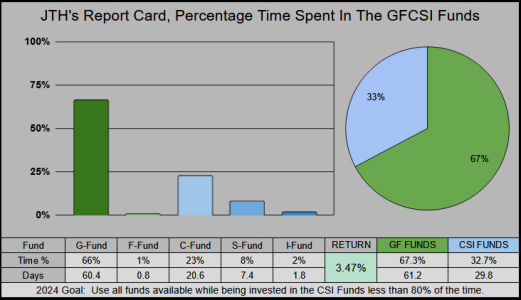

My biggest problem with working in this field was knowing a great deal of everything I learned today, would become obsolete tomorrow. While I've forgotten more than most of the younger guys might learn, if I stepped back in today, I'd be a dinosaur. The whole "Continuous Education" and constantly chasing the next certification didn't make me happy, so here I am plugging away at excel sheets (simple but relaxing).

Thanks for keeping that SSA Sh!t together, I don't even want to imagine how many holes have to be plugged to keep us all from sinking...