- Reaction score

- 857

Re: Sunday

The Solar System is out of whack.

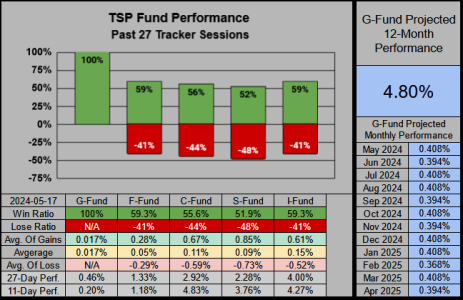

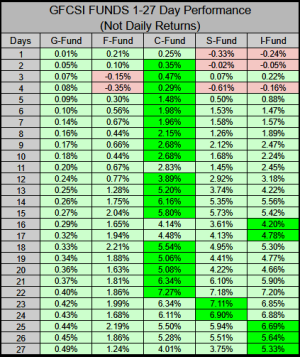

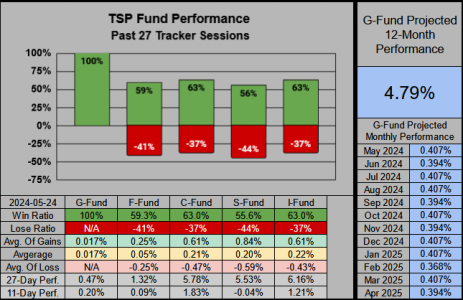

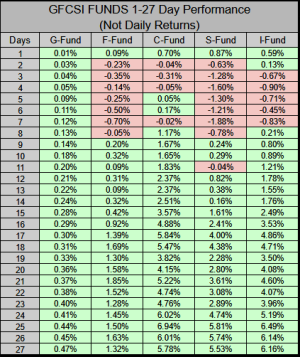

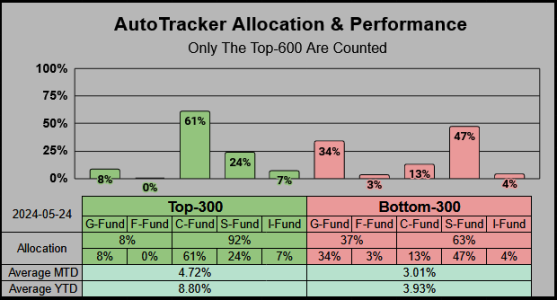

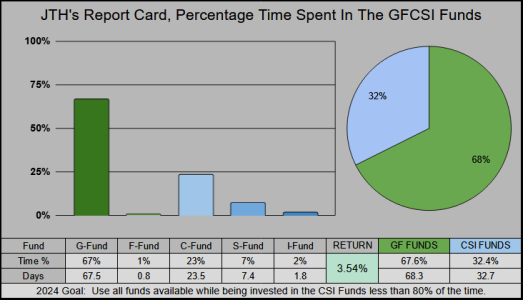

Normally the "S" fund is the place to be with the "C" fund then the "I" fund following.

Get me out of this twilight zone, it isn't Kansas anymore.

AAAAAAAHHHHHHHHH!!!!

Good Afternoon

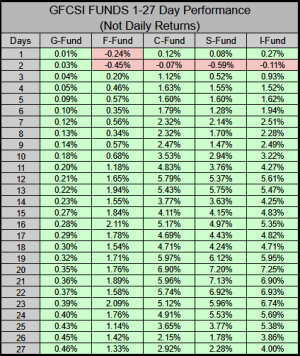

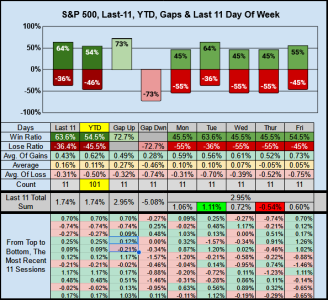

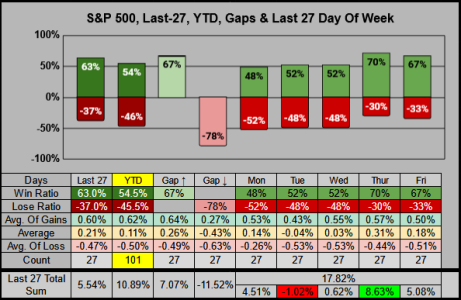

The I-Fund has been doing a good job of keeping up with the C-Fund.

The Solar System is out of whack.

Normally the "S" fund is the place to be with the "C" fund then the "I" fund following.

Get me out of this twilight zone, it isn't Kansas anymore.

AAAAAAAHHHHHHHHH!!!!