JTH

TSP Legend

- Reaction score

- 1,158

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Tom, I'd like an advance on my coffee cup

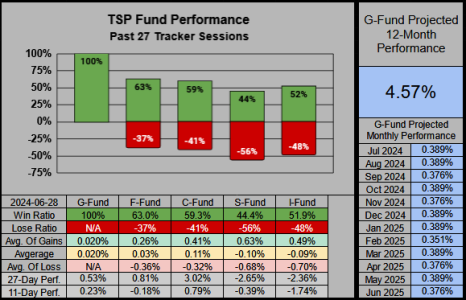

IFT EoB 100C

Always a glutton for punishment... IFT EoB 100G

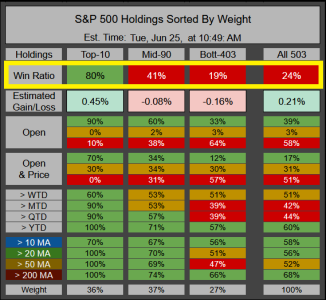

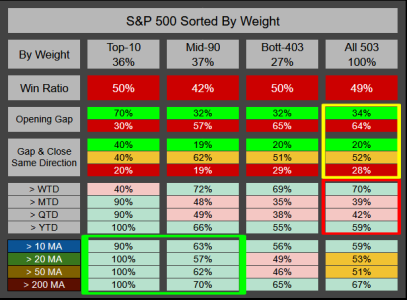

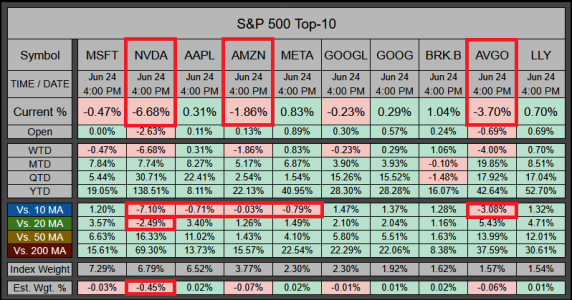

I'm not adding anything of interest, but I never noticed that GOOGL (#6) and GOOG (#7) are both in the top 10. I guess that makes Alphabet #4 on the list combined.