JTH

TSP Legend

- Reaction score

- 1,170

Tuesday

Good morning

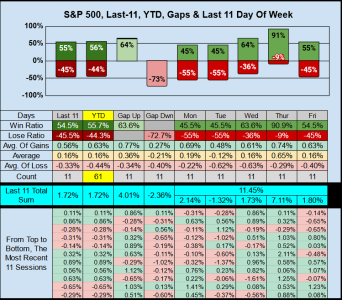

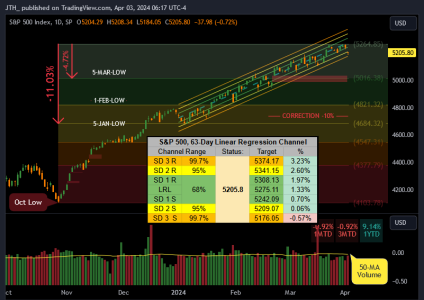

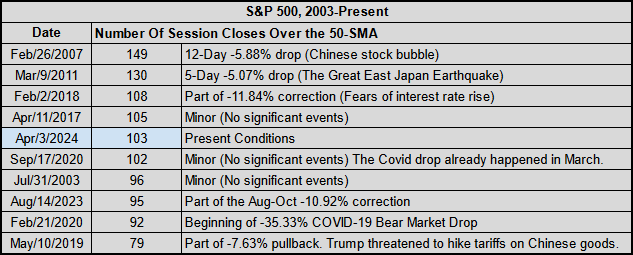

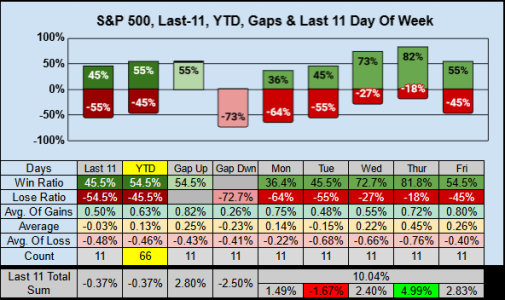

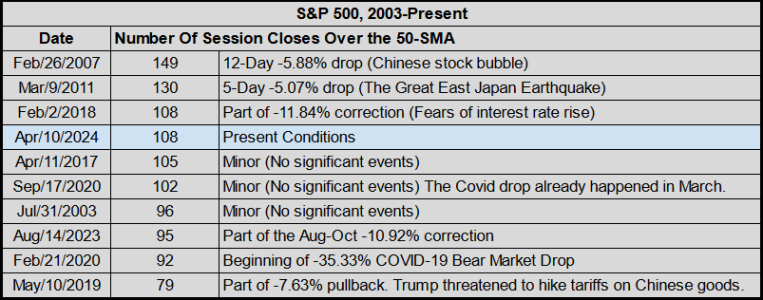

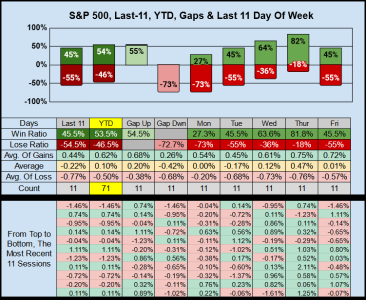

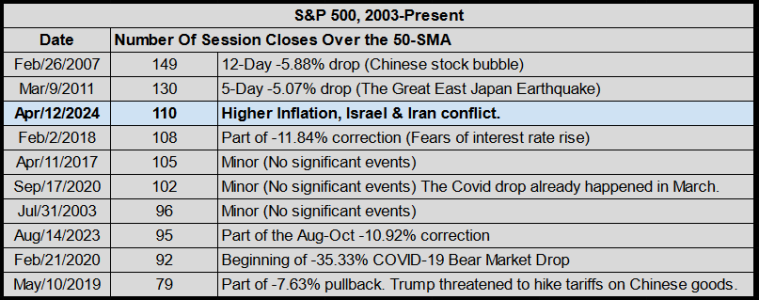

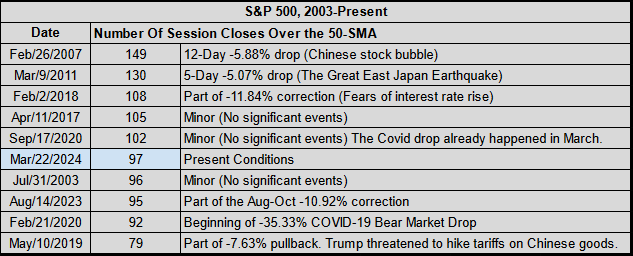

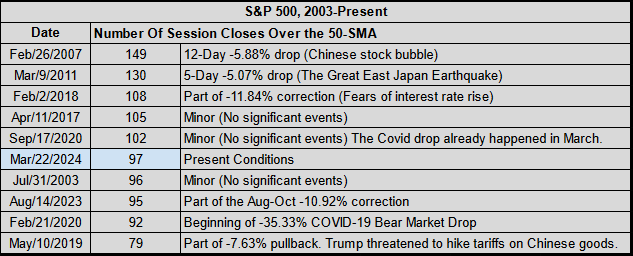

Monday marked 97 closes above the 50-Day-SMA, ranking as the 6th best since 2003.

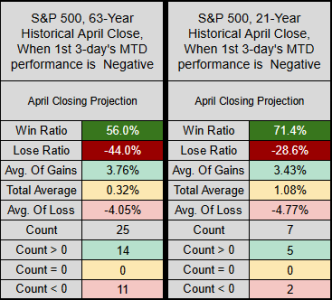

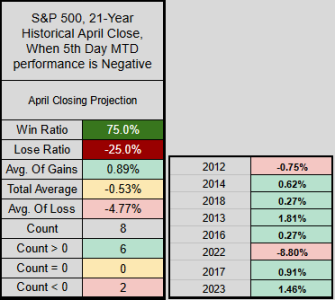

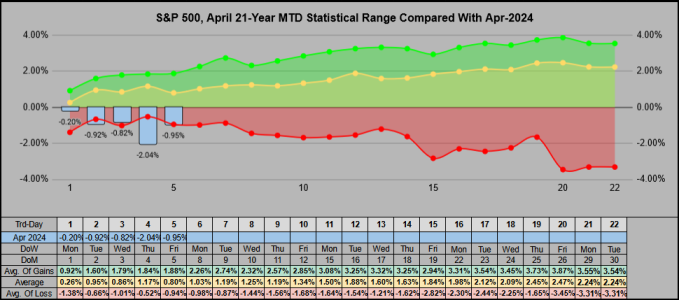

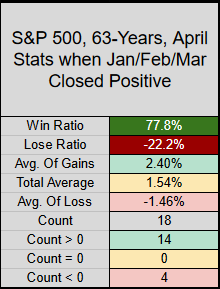

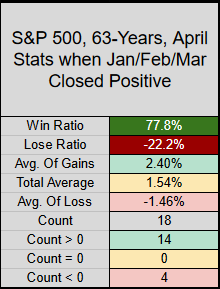

From 63 years, Jan/Feb/Mar closed positive 18 times. From this, April's win ratio was 77.8% with an average 2.40% gain, or a -22.2% lose ratio with an average -1.46% lose.

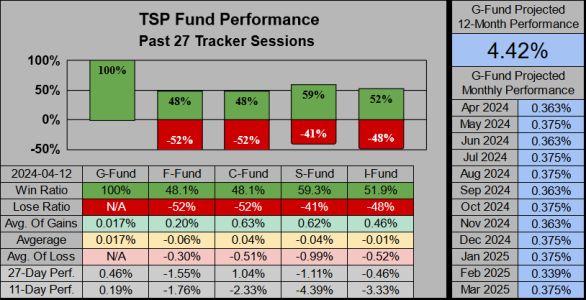

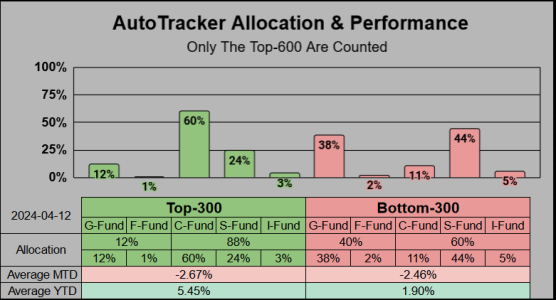

IFT EOB Today, 15 Each CSI.

Good morning

Monday marked 97 closes above the 50-Day-SMA, ranking as the 6th best since 2003.

From 63 years, Jan/Feb/Mar closed positive 18 times. From this, April's win ratio was 77.8% with an average 2.40% gain, or a -22.2% lose ratio with an average -1.46% lose.

IFT EOB Today, 15 Each CSI.