JTH

TSP Legend

- Reaction score

- 1,158

Time to March

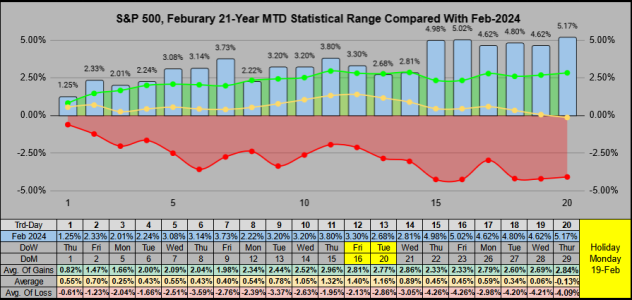

That's it February is in the books.

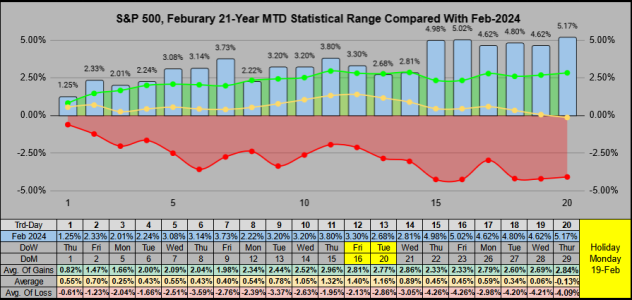

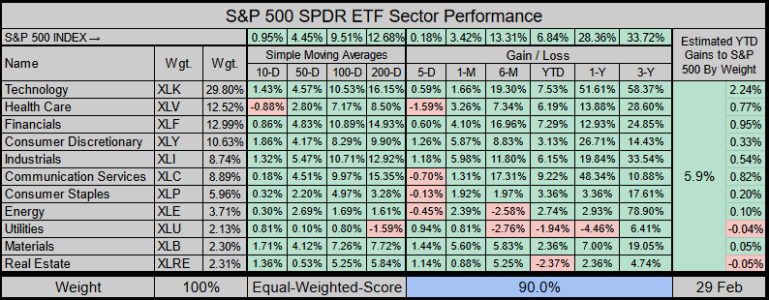

"This Feb ranked as the 7th best of 64 Februaries with a 5.17% monthly gain.

Jan & Feb together rank as the 13th best of 64 with a 6.84% YTD gain."

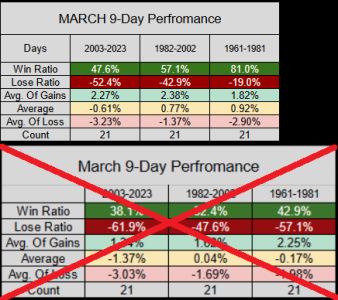

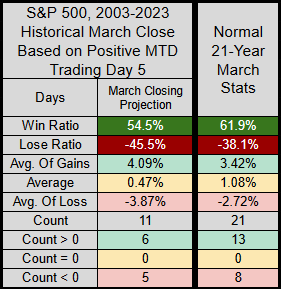

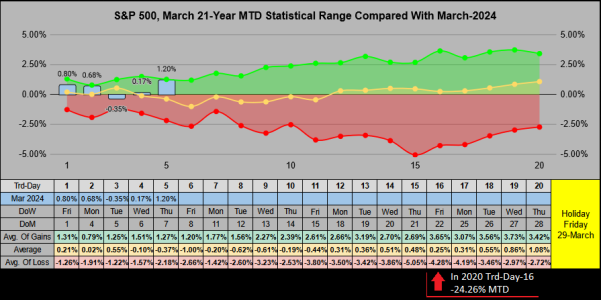

BLOG: Stats for March

That's it February is in the books.

"This Feb ranked as the 7th best of 64 Februaries with a 5.17% monthly gain.

Jan & Feb together rank as the 13th best of 64 with a 6.84% YTD gain."

BLOG: Stats for March