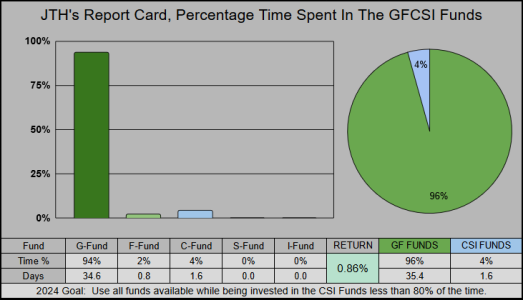

JTH

TSP Legend

- Reaction score

- 1,158

Good morning

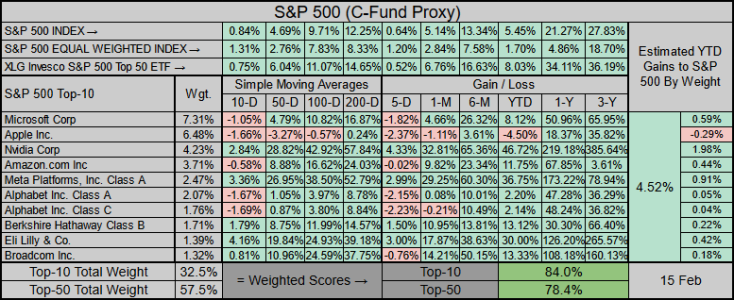

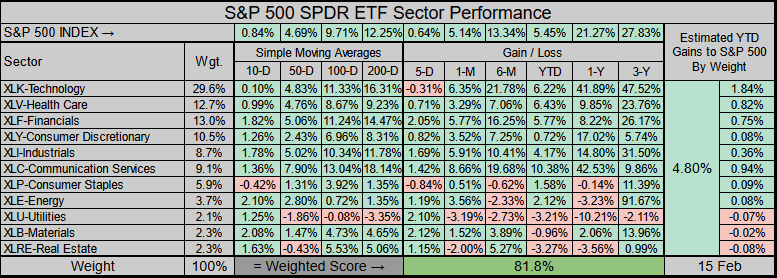

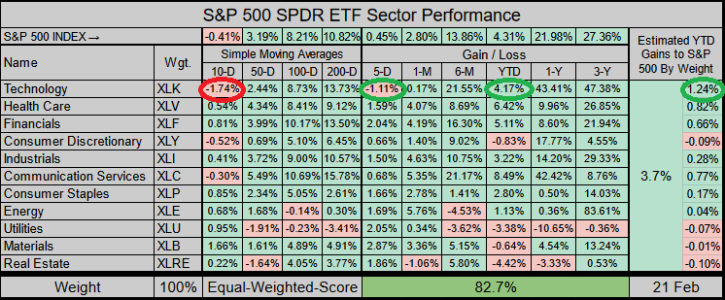

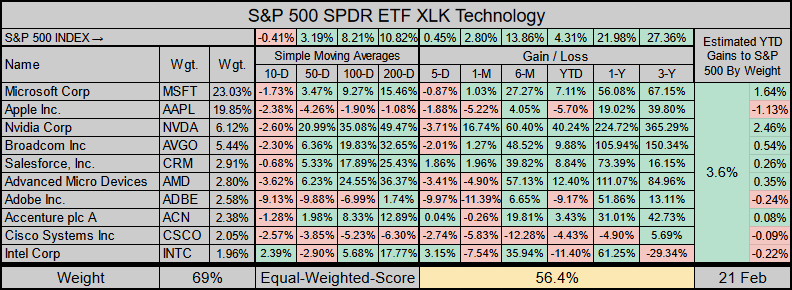

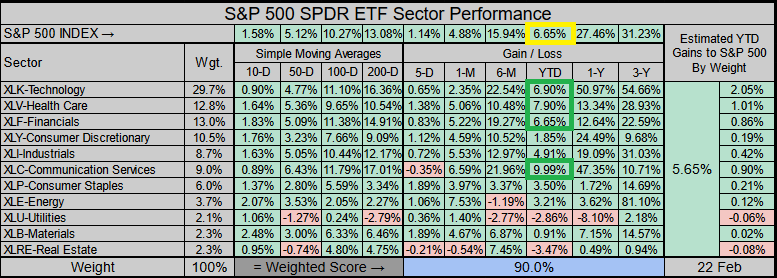

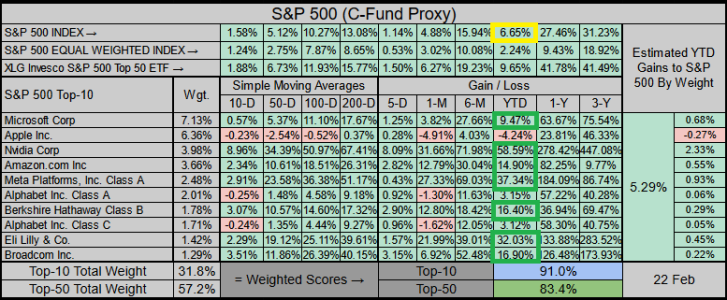

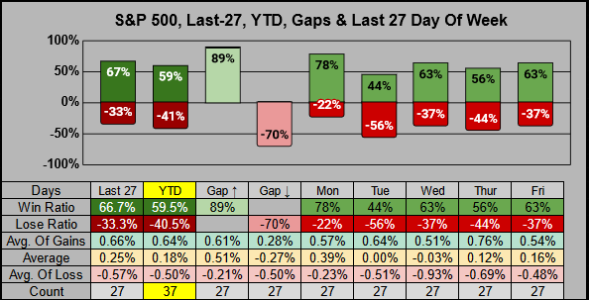

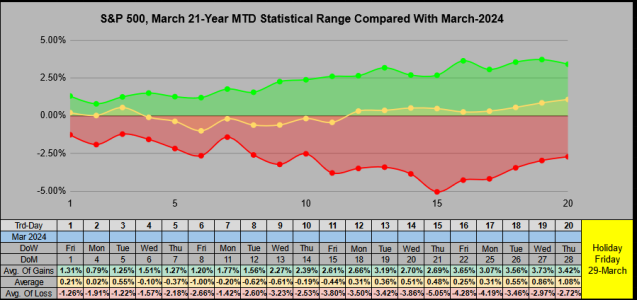

The futures this morning have been north of flat about .10 to .20% much of the session. The sectors look good, but Apple, Nvidia, AMD, Amazon & Google are down at the moment.

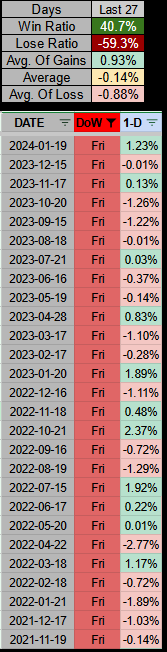

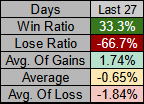

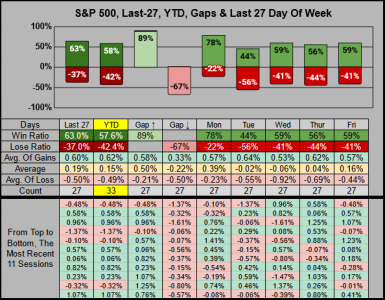

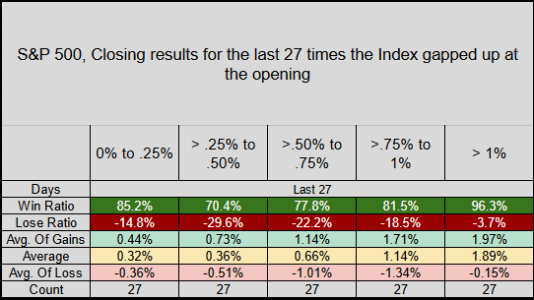

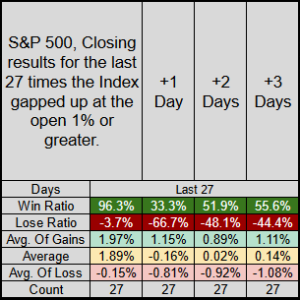

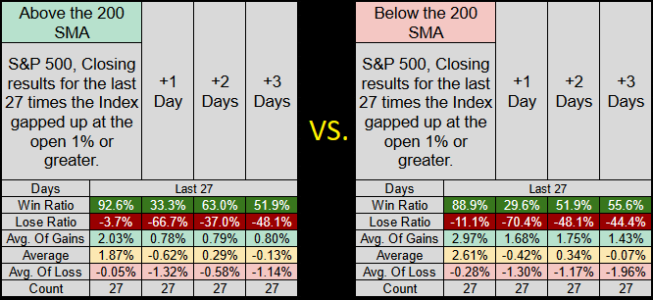

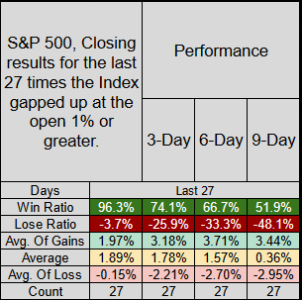

If I had to guess, then today would be a good day for a fakeout where we gap up at the open but close down. I’ve also finally remembered this Friday is Options Expiration, so here’s the results of those last 27 events. 7 of the last 11 closed down with 3 of those 7 less than -1% losses, but our last one in Jan closed up 1.23%