ravensfan

Market Veteran

- Reaction score

- 287

Re: Wenesday

Wow! That's a huge commitment...:nuts:

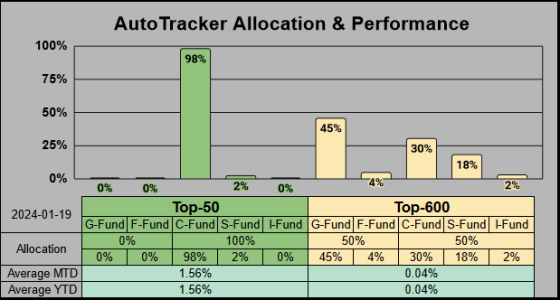

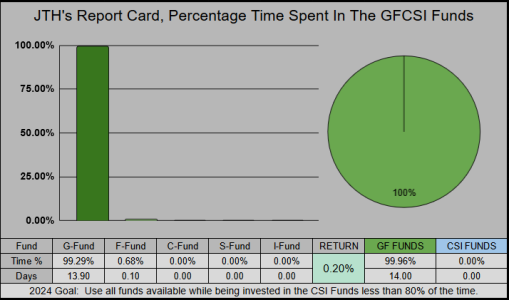

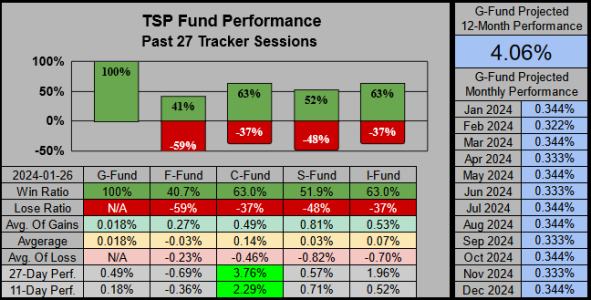

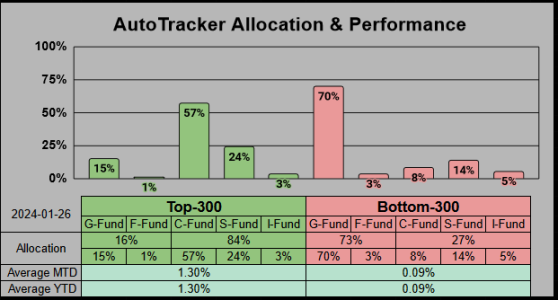

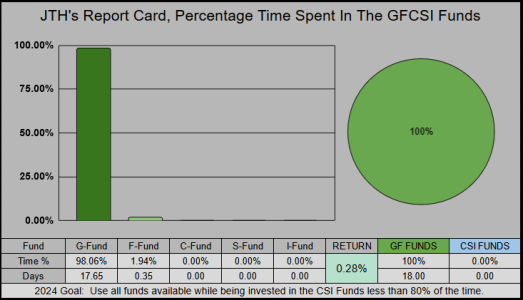

Tired of hanging out with all the G-Funders

IFT EoB today from 100G to 95G/5F

Wow! That's a huge commitment...:nuts: