WorkFE

TSP Legend

- Reaction score

- 523

Re: TGIF

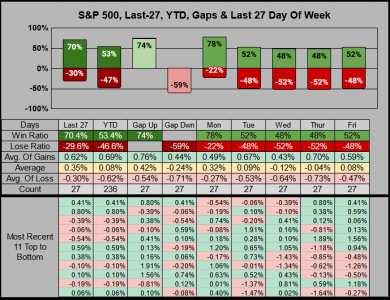

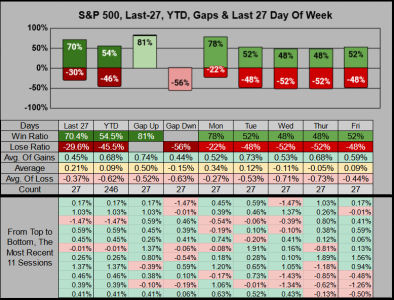

I see that as acceptable risk if one was inclined to roll the dice.

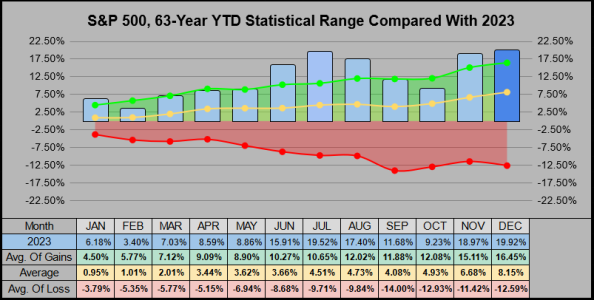

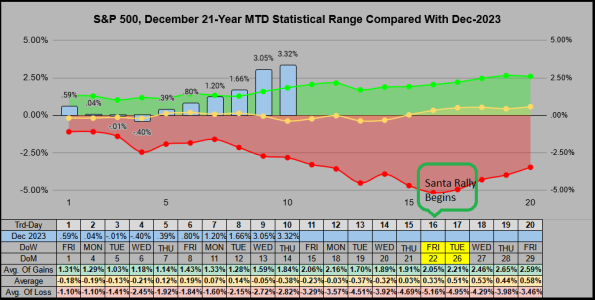

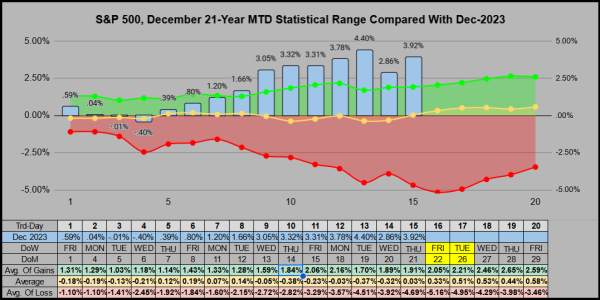

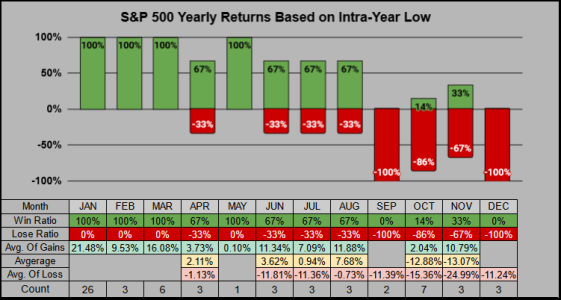

Previously, December’s positive Day-5 closed the month up 11 times for an average 2.93% gain, or closed the month down 3 times for an average -.46% loss.

I see that as acceptable risk if one was inclined to roll the dice.