JTH

TSP Legend

- Reaction score

- 1,158

Tuesday

Good morning

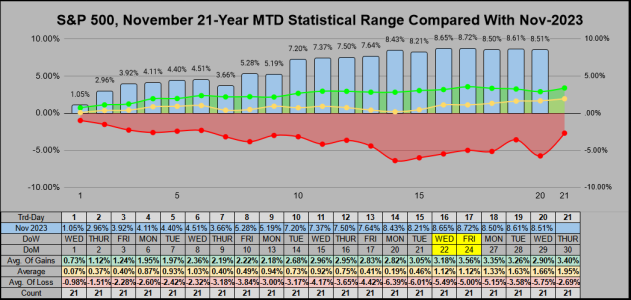

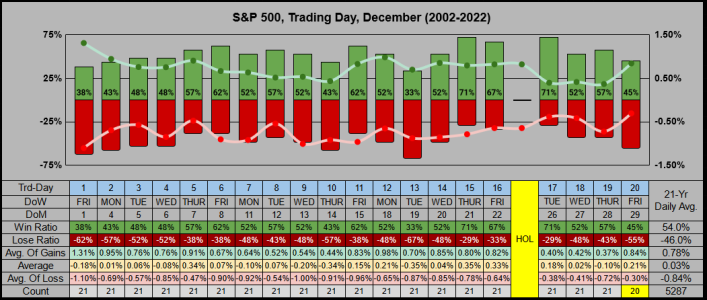

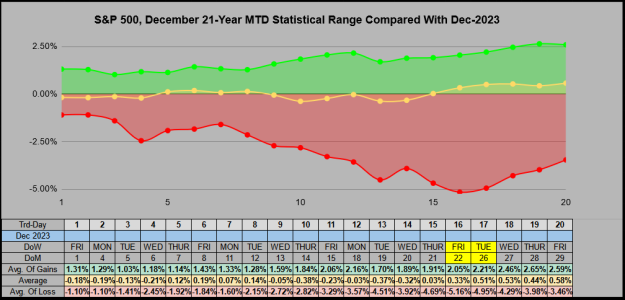

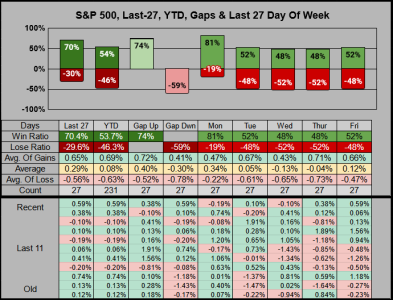

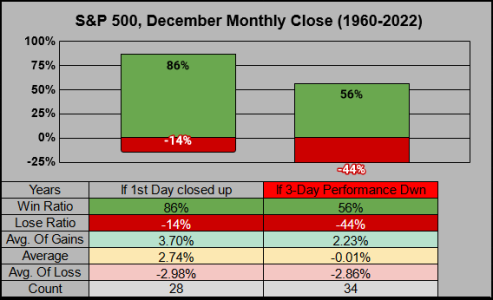

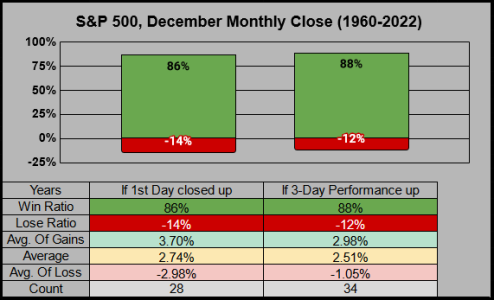

Seasonally speaking, the beginning of December starts off weak.

From 63 years, When the last day of November closed up, the 1st Day of Dec closed up 37% of the time. If the last day of November closed down, then the 1st day of Dec closed up 52% of the time.

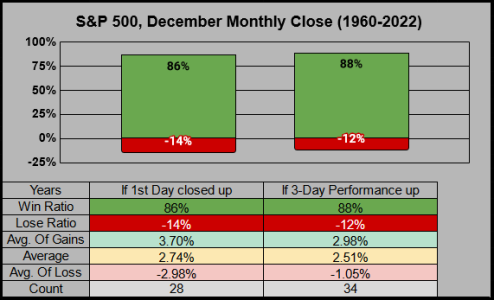

But when the 1st Day of Dec closed up, the Month closed up 86% of the time, and when the 3-Day performance was up, the month closed up 88% of the time.

Good morning

Seasonally speaking, the beginning of December starts off weak.

From 63 years, When the last day of November closed up, the 1st Day of Dec closed up 37% of the time. If the last day of November closed down, then the 1st day of Dec closed up 52% of the time.

But when the 1st Day of Dec closed up, the Month closed up 86% of the time, and when the 3-Day performance was up, the month closed up 88% of the time.