JTH

TSP Legend

- Reaction score

- 1,158

Tuesday

Good morning

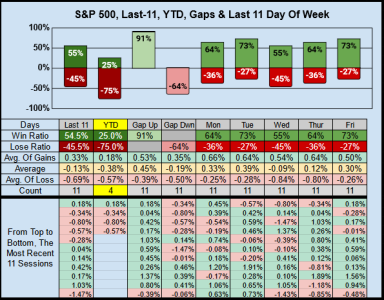

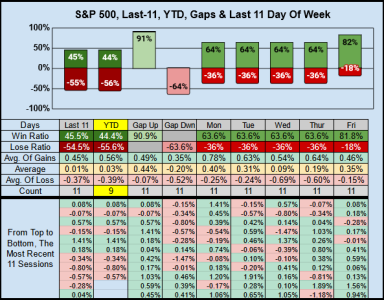

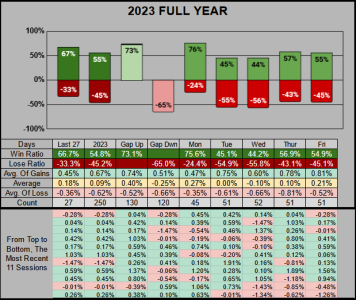

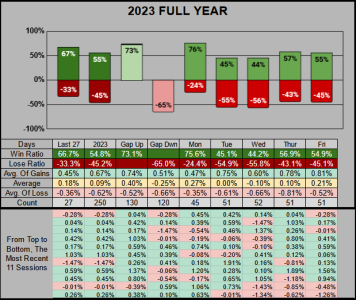

After cranking out 3 blogs and prepping for the new year, I’m ready to get back to the normalcy of trading. Here’s the finalized results for 2023. Our daily win ratio across 250 sessions was 54.8% with an average gain of .09%. Perhaps the usual in a bull market, the opening gaps up (leading to a positive close) was stronger than the gaps down (leading to a negative close). And of course there was our marvelous Monday with a 75.6% win ratio, contributing the most gains to the S&P 500 with 12.01%.

Tuesday gave us a flat .17%

Wednesday sunk us by -5.39%

Thursday gave us 5.03%

Friday gifted us 10.03%

From this perspective, nearly all of 2023's gains came from Monday & Friday.

___

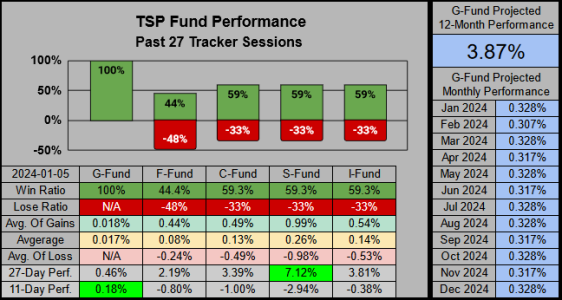

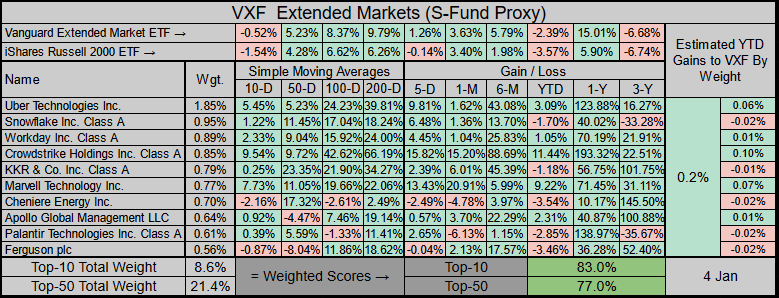

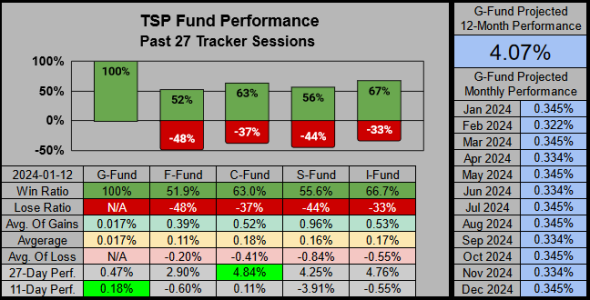

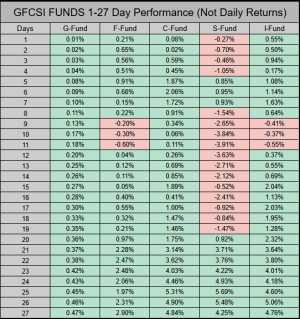

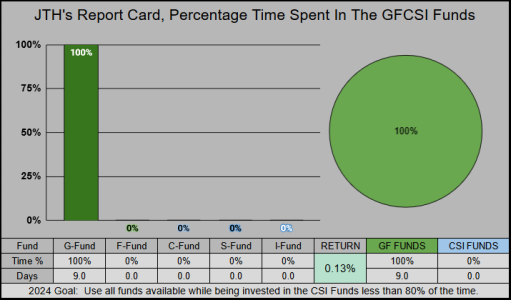

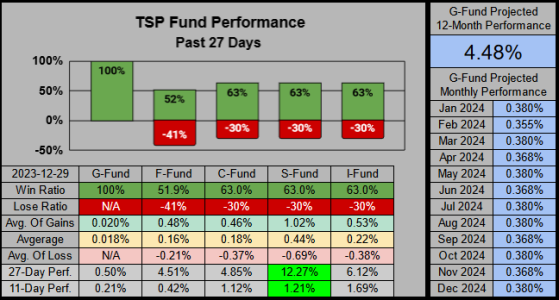

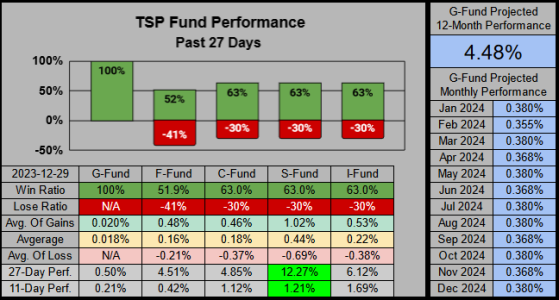

For the TSP Funds, our beloved S-Fund is kicking azz and taking names, but keep an eye on the I-Fund, which is outperforming on the 1-10 day timeframe.

___

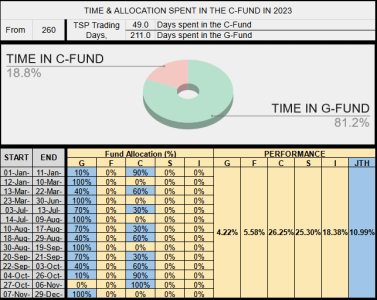

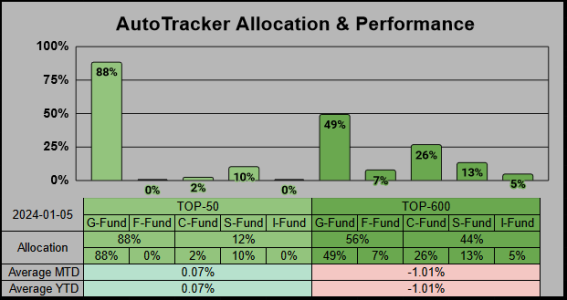

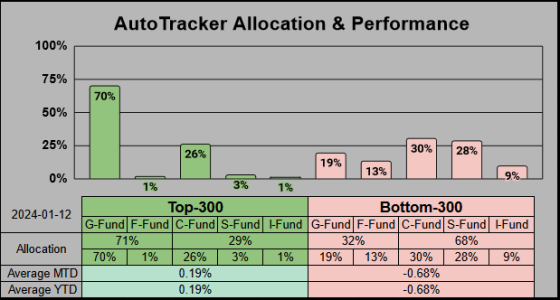

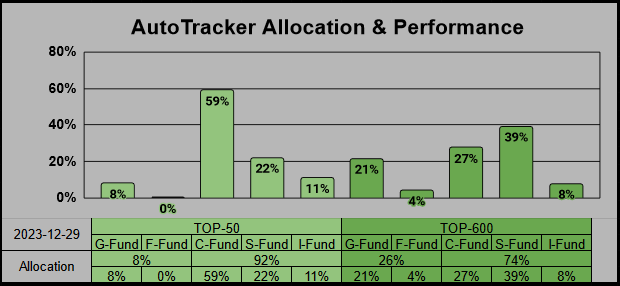

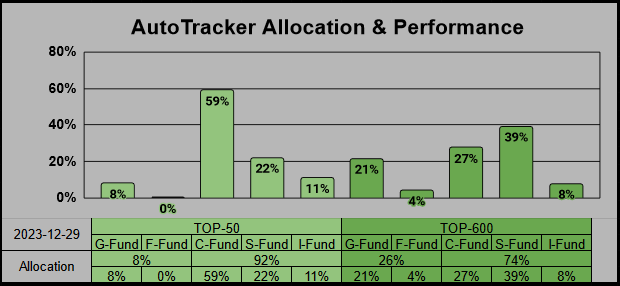

Kicking off a fresh 2024, it looks like the majority of Tracker participants have decided to go “Risk On” with the C/S funds. The F-Fund gets no love, but for 2023 it did earn 5.58% outperforming the G-Funds’s 4.22%

___

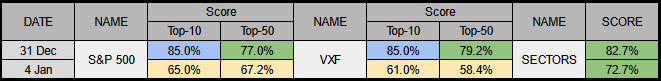

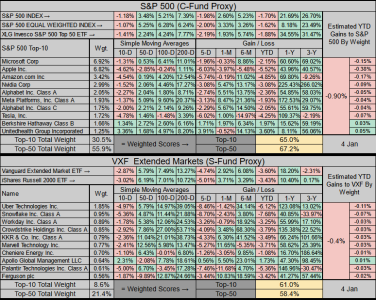

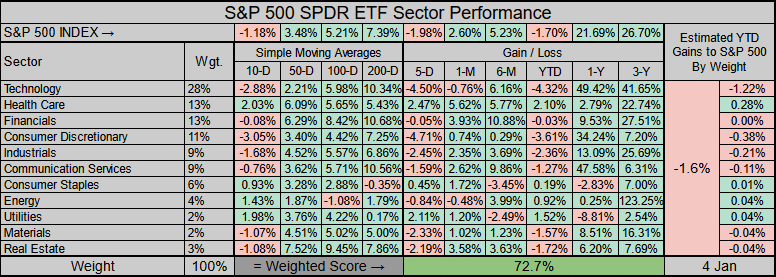

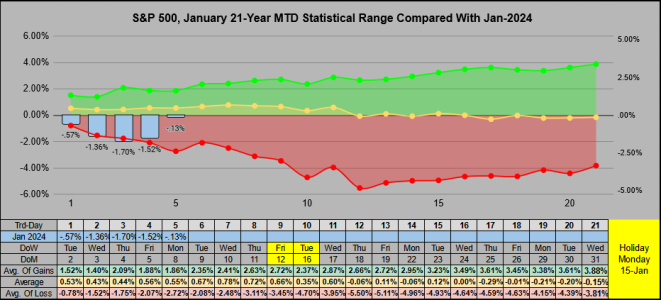

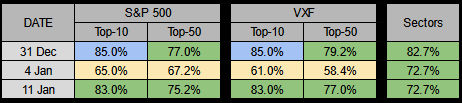

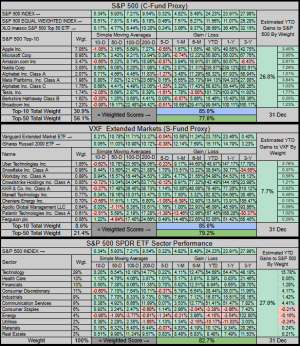

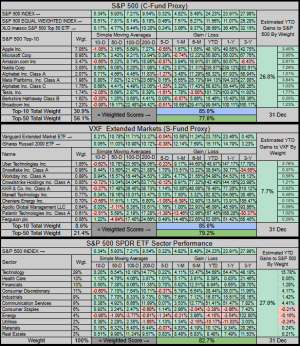

Here’s a consolidated view of the S&P 500, the Extended Markets, and the Sectors. From these numbers, I would gauge we are somewhat overbought, but not in an extreme condition (the 85-100% range). I'll have to work on the chart size (it's a bit too small).

Have a great week!

Good morning

After cranking out 3 blogs and prepping for the new year, I’m ready to get back to the normalcy of trading. Here’s the finalized results for 2023. Our daily win ratio across 250 sessions was 54.8% with an average gain of .09%. Perhaps the usual in a bull market, the opening gaps up (leading to a positive close) was stronger than the gaps down (leading to a negative close). And of course there was our marvelous Monday with a 75.6% win ratio, contributing the most gains to the S&P 500 with 12.01%.

Tuesday gave us a flat .17%

Wednesday sunk us by -5.39%

Thursday gave us 5.03%

Friday gifted us 10.03%

From this perspective, nearly all of 2023's gains came from Monday & Friday.

___

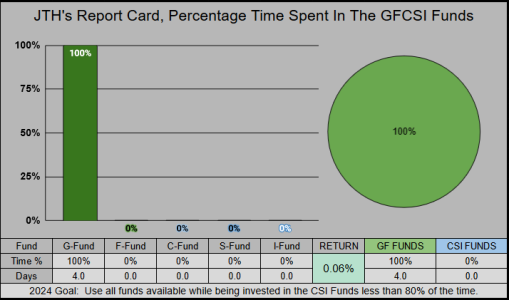

For the TSP Funds, our beloved S-Fund is kicking azz and taking names, but keep an eye on the I-Fund, which is outperforming on the 1-10 day timeframe.

___

Kicking off a fresh 2024, it looks like the majority of Tracker participants have decided to go “Risk On” with the C/S funds. The F-Fund gets no love, but for 2023 it did earn 5.58% outperforming the G-Funds’s 4.22%

___

Here’s a consolidated view of the S&P 500, the Extended Markets, and the Sectors. From these numbers, I would gauge we are somewhat overbought, but not in an extreme condition (the 85-100% range). I'll have to work on the chart size (it's a bit too small).

Have a great week!