JTH

TSP Legend

- Reaction score

- 1,158

Thursday

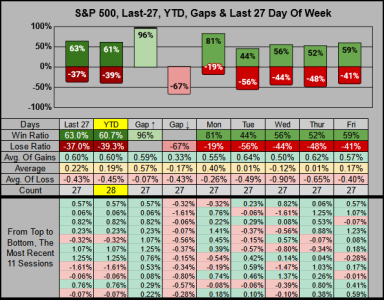

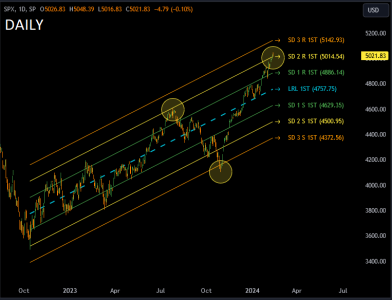

Good morning (Important, mark this level 4682.11 )

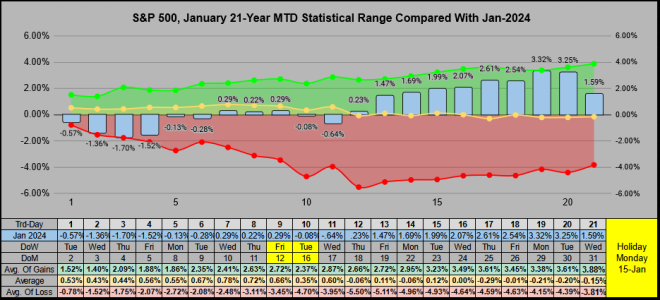

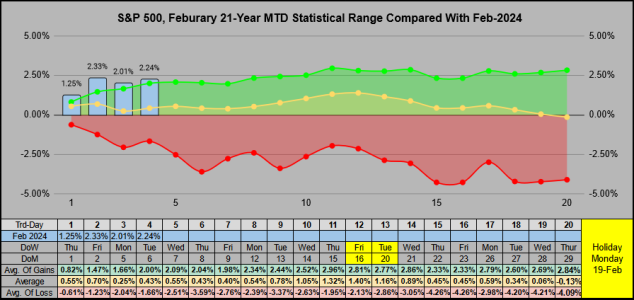

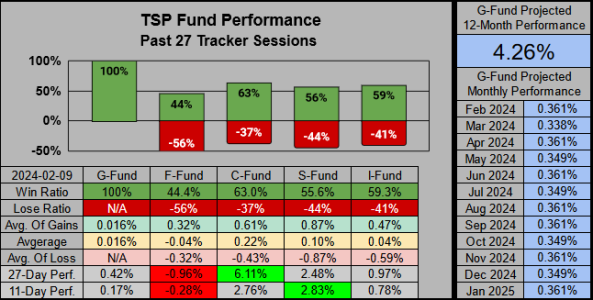

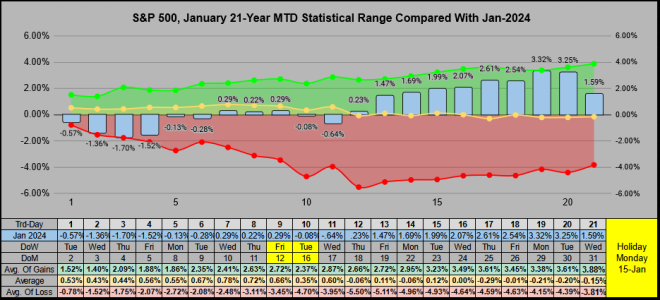

It was the best of times it was the worst of times, but statistically speaking January was not a volatile month, (although it did switch sides more than once). IMHO (for February) the most important level to watch on the S&P 500 is the Jan 5th Intra-low of 4682.11

Why? Over the past 63-years, Feb breached the Jan Low 24 times, of which 12 times the year closed down. That drops the yearly win ratio from 75% to 50% (across 24 years).

To put it another way, from 63-years (1961-2023), the S&P 500 closed down 16 times, from this 12 of those times Feb breached the Jan low. The average close of those 16-down years was -13.98% the average Intra-year low was -22.34%. It is Important to consider, of those 16 years, 8 were what we would call "life changing events".

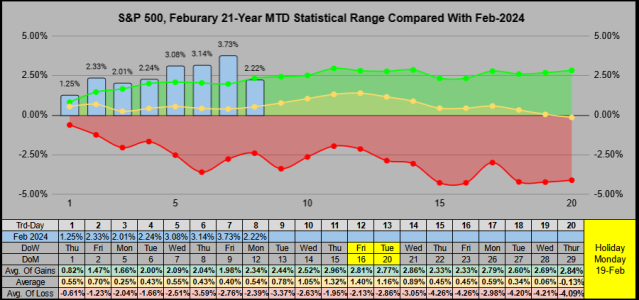

Anyways, have a great day, here's the latest blog: Stats for February

Good morning (Important, mark this level 4682.11 )

It was the best of times it was the worst of times, but statistically speaking January was not a volatile month, (although it did switch sides more than once). IMHO (for February) the most important level to watch on the S&P 500 is the Jan 5th Intra-low of 4682.11

Why? Over the past 63-years, Feb breached the Jan Low 24 times, of which 12 times the year closed down. That drops the yearly win ratio from 75% to 50% (across 24 years).

To put it another way, from 63-years (1961-2023), the S&P 500 closed down 16 times, from this 12 of those times Feb breached the Jan low. The average close of those 16-down years was -13.98% the average Intra-year low was -22.34%. It is Important to consider, of those 16 years, 8 were what we would call "life changing events".

Anyways, have a great day, here's the latest blog: Stats for February