-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

JTH's Account Talk

- Thread starter JTH

- Start date

JTH

TSP Legend

- Reaction score

- 1,158

Re: Tuesday

Yea, an interesting day, darn near everything was green on the pre-markets, it looked like it could be a +1% day, but then the inflation news dropped us and flipped everything over.

What a difference a few hours make. :smashfreakB:

Yea, an interesting day, darn near everything was green on the pre-markets, it looked like it could be a +1% day, but then the inflation news dropped us and flipped everything over.

JTH

TSP Legend

- Reaction score

- 1,158

Friday

Good morning (the sky is falling)

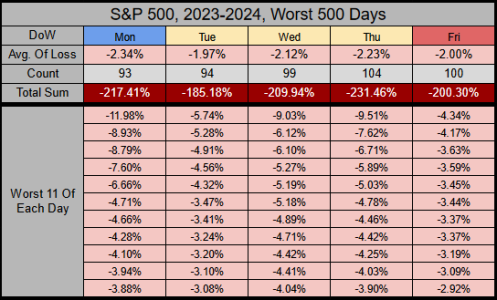

As a habit, I tend to avoid buying anything on a Friday. Reason being, bad news gets slipped in on Friday (hoping to be digested over the weekend). Add to this, if there were a significant disaster, there’s a 28% chance it falls over the weekend. Thus if something bad happens over the weekend, you could end up absorbing losses before the markets open.

Not that any of us could out-race a selling algorithm, but damn if you’re in TSP, you’re in a tough spot as you watch prices fall for 6.5 hours before you can shelve those funds.

So I figured if I’m gonna have this predisposition, I should at least see what the statistics say.

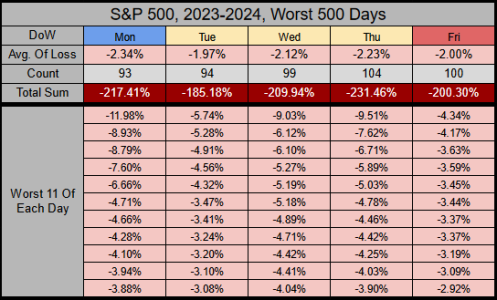

So most of these days are fairly split across the 500 worst days, but we can see Monday has the worst average-of-losses at -2.34% and the 2nd worst Total sum at -217.41%. But, only 93 of the 500 are the worst, so it did happen less often by a smaller margin.

Also, of the Top-10 worst days, 5 fell on a Monday, 6 in 2008, & 3 in 2020

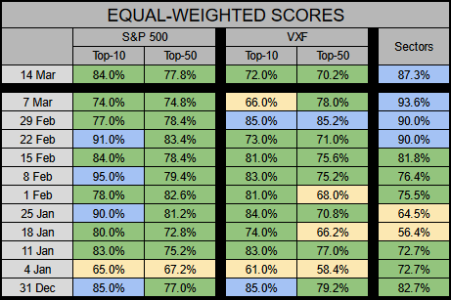

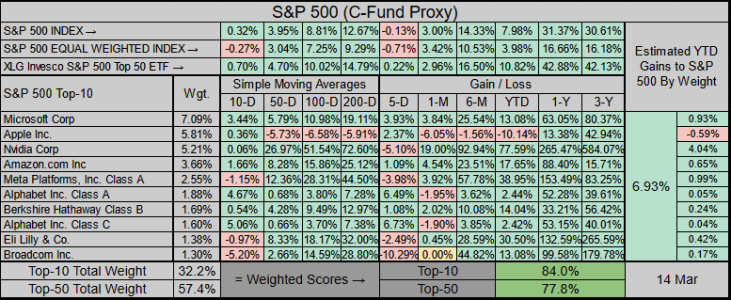

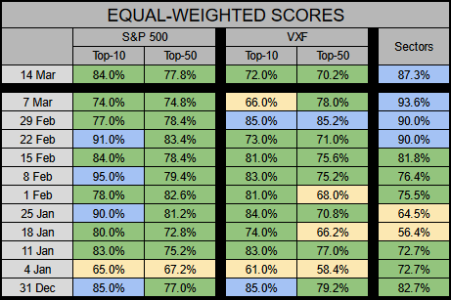

Rotation this week has been a bit mixed, my impression is that buyers are shifting back into large-cap quality.

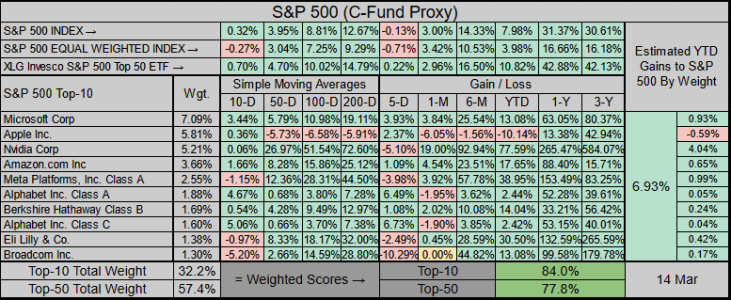

YTD the Top-50 ETF is 10.82% (which is higher than the S&P 500 index at 7.98%). The equal weighted index is almost half at 3.98%

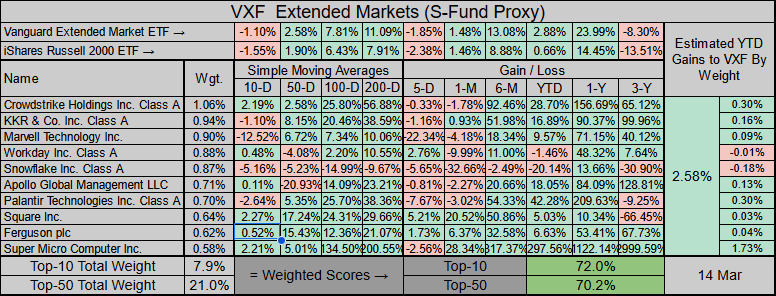

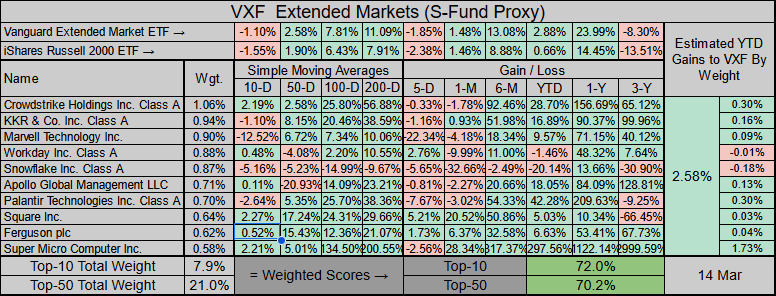

The Small Caps show more weakness, it seems it’s been a zig & zag sorta week.

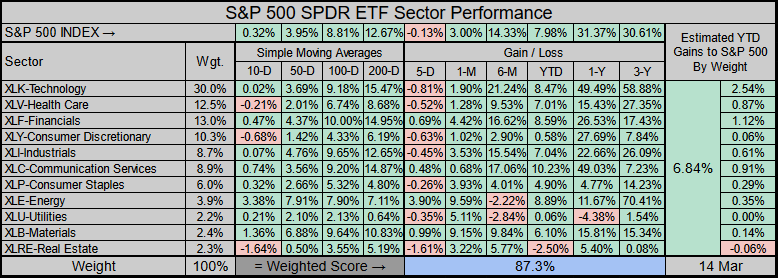

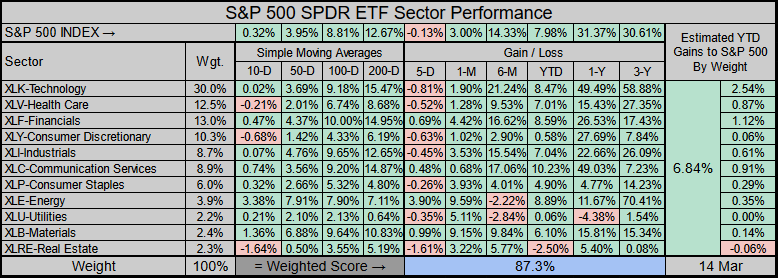

For the Sectors, on the 5-day timeframe, we can see Tech has been selling off. Nvidia lost -5.10%, Broadcom lost -10.29%, AMD lost -11.51%. Combined these 3 stocks make up 15.87% of the sector.

That’s it, have a great non-disastrous weekend!

Good morning (the sky is falling)

As a habit, I tend to avoid buying anything on a Friday. Reason being, bad news gets slipped in on Friday (hoping to be digested over the weekend). Add to this, if there were a significant disaster, there’s a 28% chance it falls over the weekend. Thus if something bad happens over the weekend, you could end up absorbing losses before the markets open.

Not that any of us could out-race a selling algorithm, but damn if you’re in TSP, you’re in a tough spot as you watch prices fall for 6.5 hours before you can shelve those funds.

So I figured if I’m gonna have this predisposition, I should at least see what the statistics say.

So most of these days are fairly split across the 500 worst days, but we can see Monday has the worst average-of-losses at -2.34% and the 2nd worst Total sum at -217.41%. But, only 93 of the 500 are the worst, so it did happen less often by a smaller margin.

Also, of the Top-10 worst days, 5 fell on a Monday, 6 in 2008, & 3 in 2020

Rotation this week has been a bit mixed, my impression is that buyers are shifting back into large-cap quality.

YTD the Top-50 ETF is 10.82% (which is higher than the S&P 500 index at 7.98%). The equal weighted index is almost half at 3.98%

The Small Caps show more weakness, it seems it’s been a zig & zag sorta week.

For the Sectors, on the 5-day timeframe, we can see Tech has been selling off. Nvidia lost -5.10%, Broadcom lost -10.29%, AMD lost -11.51%. Combined these 3 stocks make up 15.87% of the sector.

That’s it, have a great non-disastrous weekend!

JTH

TSP Legend

- Reaction score

- 1,158

JTH

TSP Legend

- Reaction score

- 1,158

Sunday

Good Morning

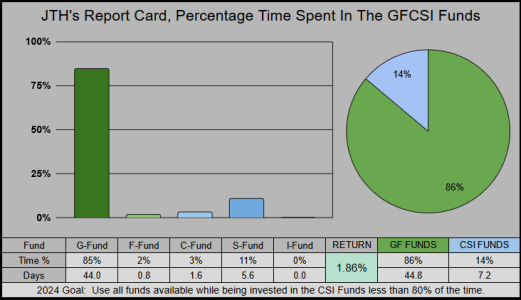

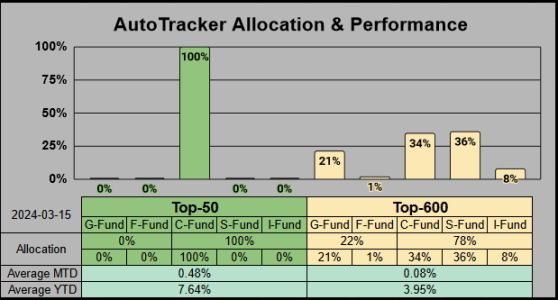

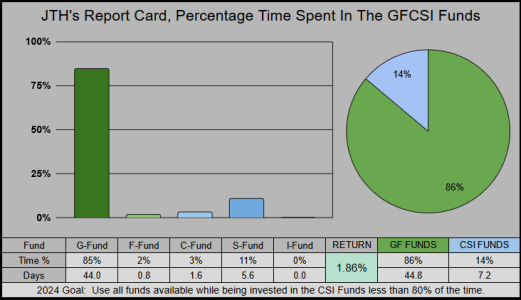

Currently 1.86% YTD, 100G, with 1 IFT. I’m looking for a 1st quarter 3% gain, (achievable) we just need a good run into the end of the month.

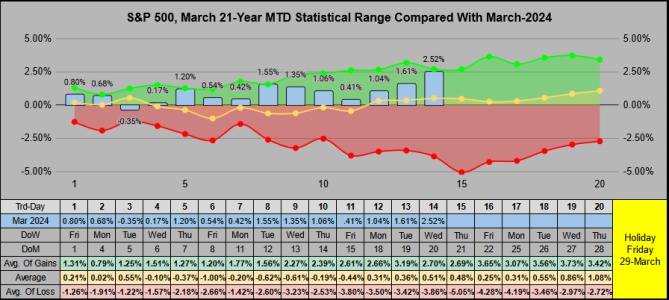

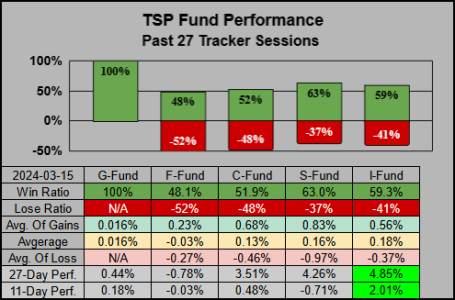

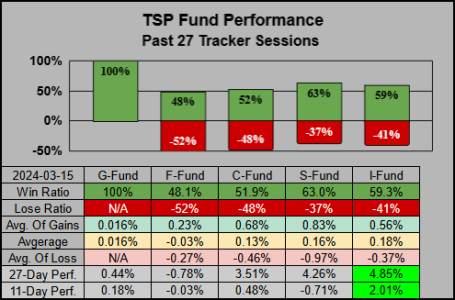

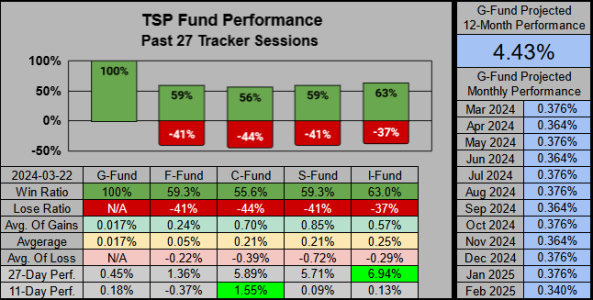

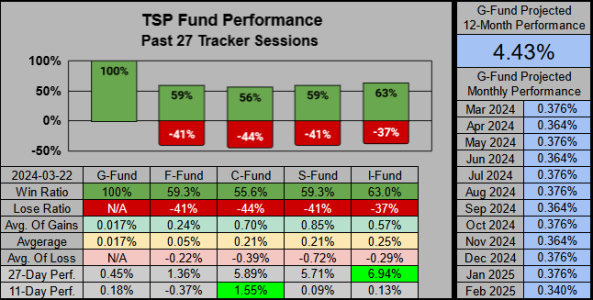

It was a red week, the F-Fund closed down every day this week. The C&I Funds closed down the last 5 of 6 days, with the S-Fund down the last 4 of 6. The S-Fund has traded opposite of the C-Fund 5 of 27 sessions (4 of those for a positive gain).

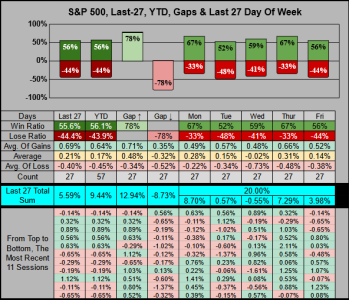

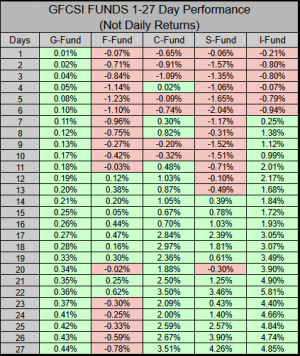

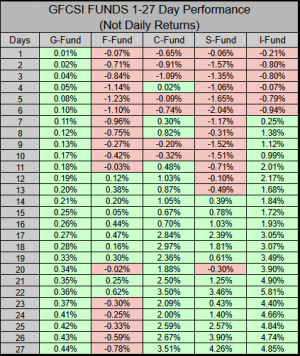

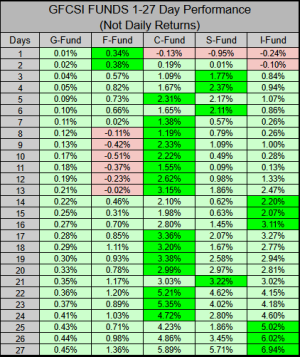

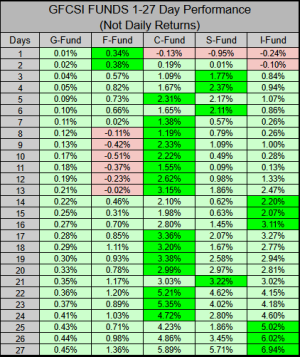

On the 1-27 Day Performance scale, the F-Fund is bleeding red on both sides of the spectrum, while the I-Fund appears to be the better of the 3 risk-on funds.

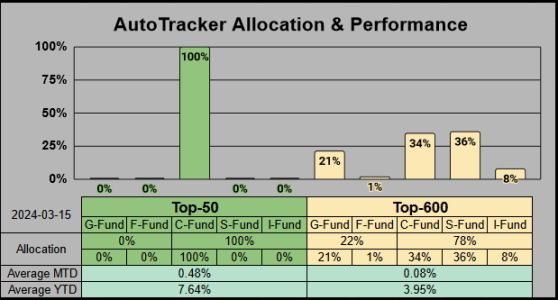

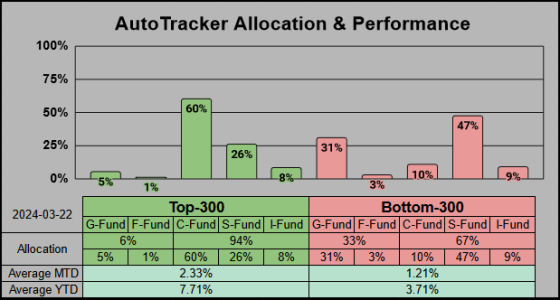

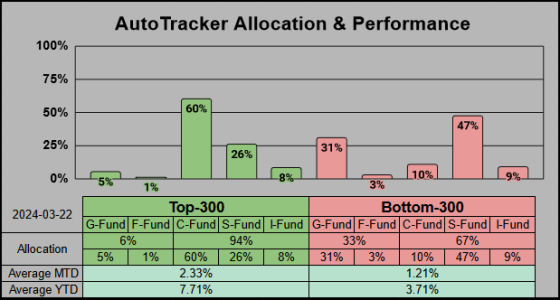

The Top-300 are 60% in the C-Fund while the Bottom-300 are 47% in the S-Fund. All of the Top-50 are 100% in the C-Fund. Making it interesting, only 1 member is beating the C-Fund and they are currently in the L45 Fund.

Have a great Sunday!

Good Morning

Currently 1.86% YTD, 100G, with 1 IFT. I’m looking for a 1st quarter 3% gain, (achievable) we just need a good run into the end of the month.

It was a red week, the F-Fund closed down every day this week. The C&I Funds closed down the last 5 of 6 days, with the S-Fund down the last 4 of 6. The S-Fund has traded opposite of the C-Fund 5 of 27 sessions (4 of those for a positive gain).

On the 1-27 Day Performance scale, the F-Fund is bleeding red on both sides of the spectrum, while the I-Fund appears to be the better of the 3 risk-on funds.

The Top-300 are 60% in the C-Fund while the Bottom-300 are 47% in the S-Fund. All of the Top-50 are 100% in the C-Fund. Making it interesting, only 1 member is beating the C-Fund and they are currently in the L45 Fund.

Have a great Sunday!

JTH

TSP Legend

- Reaction score

- 1,158

Monday

Good morning

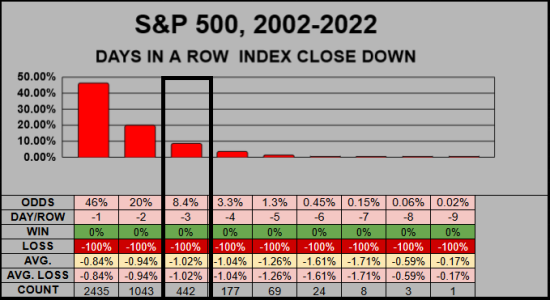

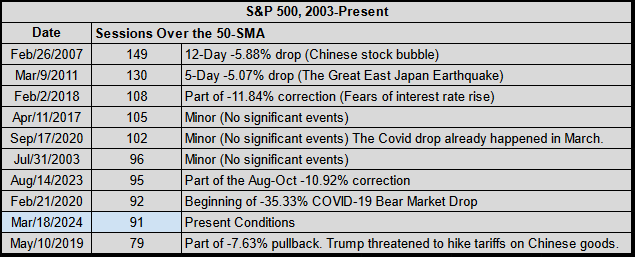

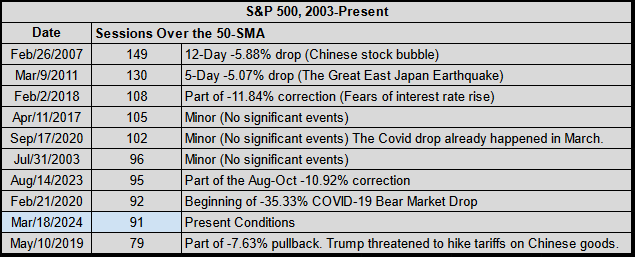

We’ve closed 91 sessions over the 50-SMA, today will be a tie-breaker for 8th place across the previous 21-years.

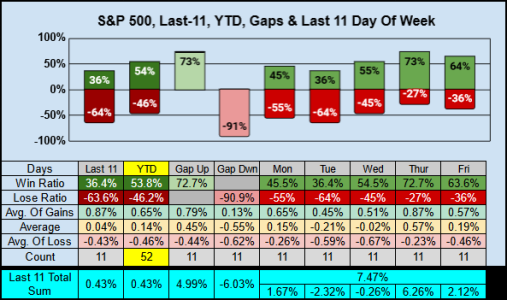

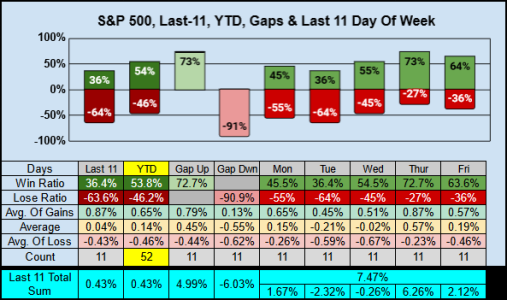

On the last 11 Chart:

_Last 3 consecutive days closed down (1st time since 4-Jan-24).

_An opening gap down has closed the day down the last 10 of 11 times.

_Our last 5 Mondays have closed down.

_Tuesday stinks with a 36.4% win ratio, losing -2.32% over the last 11 sessions.

_Thursday is the strongest with a 72.7% win ratio and 6.26% total sum gains.

Have a great week!

Good morning

We’ve closed 91 sessions over the 50-SMA, today will be a tie-breaker for 8th place across the previous 21-years.

On the last 11 Chart:

_Last 3 consecutive days closed down (1st time since 4-Jan-24).

_An opening gap down has closed the day down the last 10 of 11 times.

_Our last 5 Mondays have closed down.

_Tuesday stinks with a 36.4% win ratio, losing -2.32% over the last 11 sessions.

_Thursday is the strongest with a 72.7% win ratio and 6.26% total sum gains.

Have a great week!

JTH

TSP Legend

- Reaction score

- 1,158

Tuesday

Good morning (FOMC fun)

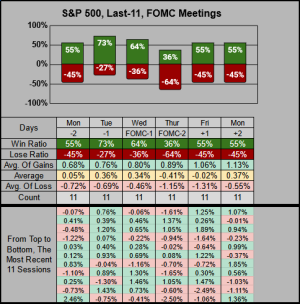

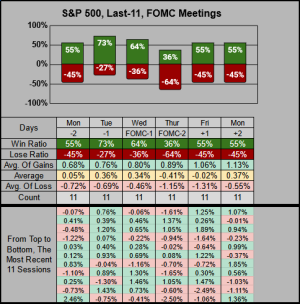

Economics are not really in my wheelhouse, but given the circumstances, I thought I’d dig into the last 11 FOMC meetings. This takes us back to Nov-2022 and since the FOMC falls within the same days of the week (Wed/Thur) this gives us a consistent set of data to work with.

From the data we can see today (the day prior to the meeting) has a high 73% win ratio, and day 1 of the meeting has 64%. The 2nd day of the meeting has a low 36% win ratio, and while Friday is average at 55%, the losses on down days are strong.

Good morning (FOMC fun)

Economics are not really in my wheelhouse, but given the circumstances, I thought I’d dig into the last 11 FOMC meetings. This takes us back to Nov-2022 and since the FOMC falls within the same days of the week (Wed/Thur) this gives us a consistent set of data to work with.

From the data we can see today (the day prior to the meeting) has a high 73% win ratio, and day 1 of the meeting has 64%. The 2nd day of the meeting has a low 36% win ratio, and while Friday is average at 55%, the losses on down days are strong.

JTH

TSP Legend

- Reaction score

- 1,158

Re: Tuesday

Yea, I have no idea why folks would want to buy prior to the meeting. Since everyone has an expectation for the FOMC, I'll speculate the algorithms are pricing in no bad news or good news, then selling it off.

Very interesting observation JTH! I would have thought the market would be cautious before and during the meeting days. thank you.

Yea, I have no idea why folks would want to buy prior to the meeting. Since everyone has an expectation for the FOMC, I'll speculate the algorithms are pricing in no bad news or good news, then selling it off.

JTH

TSP Legend

- Reaction score

- 1,158

Wednesday

Good morning

Last year I transferred the TSP to an IRA, this year I'm planning to rollover the IRA to a Roth. Only problem is the tax hit. Unfortunately I'll need to transfer over in chunks (over years) to avoid hitting the next higher tax bracket. Anyone else do this, how'd it work out?

SPY pre-markets opened below Tuesday's close, then flipped over, and under again. Perhaps this will make for an interesting tug-of-war session.

Good morning

Last year I transferred the TSP to an IRA, this year I'm planning to rollover the IRA to a Roth. Only problem is the tax hit. Unfortunately I'll need to transfer over in chunks (over years) to avoid hitting the next higher tax bracket. Anyone else do this, how'd it work out?

SPY pre-markets opened below Tuesday's close, then flipped over, and under again. Perhaps this will make for an interesting tug-of-war session.

FAAM

TSP Strategist

- Reaction score

- 117

Re: Wednesday

Big Thx again JTH for all your data-crunching, compiling & sharing... helps with details/views that most of us would rarely if ever see otherwise.

... And, YES - I am retired & in multi-year process (like you & for same reasoning I presume) of Converting my Traditional-TSP/IRA amounts to ROTH (or most if not all of it - Lord willing & the creek don't rise & take me away). I'm not a super-data guru & don't have my numbers on top of my head, though I've converted about a third of it so far, & paying those taxes now is "ouch". Only about 20% of my TSP was ROTH at retirement (2+yrs ago age 62.3), so a lot to transfer from TSP & then to convert. I have left about 15% of my TSP un-transfered & about a quarter of that is ROTH-TSP.

.... I'm converting to ROTH assuming: I &/or my wife & heirs will live long enough for the tax hit now to pay off to yield tax-free withdrawals &/or inheritance; that taxes/ brackets for me (jointly with my wife) will at least remain about what they are now (might go down slightly when she retires in a couple years, slightly & for a little while) yet likely I believe & think it necessary to some degree that income/retirement taxes will increase (to some degree for various reasons) sometime over the next 10-to-20 years. [PS: also assume of course, that my ROTH investments will have gains on average over the next couple decades that make 0-tax on those worthwhile.]

..... Let me know if you are thinking significantly different on the matter. Best of luck and successes to you on your conversions & strategies!

Big Thx again JTH for all your data-crunching, compiling & sharing... helps with details/views that most of us would rarely if ever see otherwise.

... And, YES - I am retired & in multi-year process (like you & for same reasoning I presume) of Converting my Traditional-TSP/IRA amounts to ROTH (or most if not all of it - Lord willing & the creek don't rise & take me away). I'm not a super-data guru & don't have my numbers on top of my head, though I've converted about a third of it so far, & paying those taxes now is "ouch". Only about 20% of my TSP was ROTH at retirement (2+yrs ago age 62.3), so a lot to transfer from TSP & then to convert. I have left about 15% of my TSP un-transfered & about a quarter of that is ROTH-TSP.

.... I'm converting to ROTH assuming: I &/or my wife & heirs will live long enough for the tax hit now to pay off to yield tax-free withdrawals &/or inheritance; that taxes/ brackets for me (jointly with my wife) will at least remain about what they are now (might go down slightly when she retires in a couple years, slightly & for a little while) yet likely I believe & think it necessary to some degree that income/retirement taxes will increase (to some degree for various reasons) sometime over the next 10-to-20 years. [PS: also assume of course, that my ROTH investments will have gains on average over the next couple decades that make 0-tax on those worthwhile.]

..... Let me know if you are thinking significantly different on the matter. Best of luck and successes to you on your conversions & strategies!

Last edited:

JTH

TSP Legend

- Reaction score

- 1,158

Re: Wednesday

Thanks for the feedback. I'm somewhat in the same boat, I already have a ROTH, but with the Traditional IRA I'm trying my best to reduce the long-term tax liabilities. Although I'm 50, I'm actively retired (no working income) so I can't contribute anything to either the IRA/ROTH. Since I'm an active trader, I'm already taking sizable hits on the taxable account, and the hits are getting bigger each year, so I need to develop a regimen to balance this out with the rollover.

Either ways (since I can't predict the markets) it's an interesting and hard to predict conundrum. If I stop Short-term capital gains trading, then I can reduce the taxes, but at the cost of slower growth in the taxable account. At the same time, if I slow roll into the IRA over the next 5 years (it will still be painful), and I'll still get pushed into the next upper bracket.

The thing I don't want is the stress of thinking "I need to make an extra XXX to help pay off the extra XXX in taxes".

Big Thx again JTH for all your data-crunching, compiling & sharing... helps with details/views that most of us would rarely if ever see otherwise.

... And, YES - I am retired & in multi-year process (like you & for same reasoning I presume) of Converting my Traditional-TSP/IRA amounts to ROTH (or most if not all of it - Lord willing & the creek don't rise & take me away). I'm not a super-data guru & don't have my numbers on top of my head, though I've converted about a third of it so far, & paying those taxes now is "ouch". Only about 20% of my TSP was ROTH at retirement (2+yrs ago age 62.3), so a lot to transfer from TSP & then to convert. I have left about 15% of my TSP un-transfered & about a quarter of that is ROTH-TSP.

.... I'm converting to ROTH assuming: I &/or my wife & heirs will live long enough for the tax hit now to pay off to yield tax-free withdrawals &/or inheritance; that taxes/ brackets for me (jointly with my wife) will at least remain about what they are now (might go down slightly when she retires in a couple years, slightly & for a little while) yet likely I believe & think it necessary to some degree that income/retirement taxes will increase (to some degree for various reasons) sometime over the next 10-to-20 years. [PS: also assume of course, that my ROTH investments will have gains on average over the next couple decades that make 0-tax on those worthwhile.]

..... Let me know if you are thinking significantly different on the matter. Best of luck and successes to you on your conversions & strategies!

Thanks for the feedback. I'm somewhat in the same boat, I already have a ROTH, but with the Traditional IRA I'm trying my best to reduce the long-term tax liabilities. Although I'm 50, I'm actively retired (no working income) so I can't contribute anything to either the IRA/ROTH. Since I'm an active trader, I'm already taking sizable hits on the taxable account, and the hits are getting bigger each year, so I need to develop a regimen to balance this out with the rollover.

Either ways (since I can't predict the markets) it's an interesting and hard to predict conundrum. If I stop Short-term capital gains trading, then I can reduce the taxes, but at the cost of slower growth in the taxable account. At the same time, if I slow roll into the IRA over the next 5 years (it will still be painful), and I'll still get pushed into the next upper bracket.

The thing I don't want is the stress of thinking "I need to make an extra XXX to help pay off the extra XXX in taxes".

FAAM

TSP Strategist

- Reaction score

- 117

Re: Wednesday

Yes, our situations similar & different. You said "I'm already taking sizable hits on the taxable account, and the hits are getting bigger each year, "; sounds kinda like a nice problem to have actually, like you are blessed to have significant successes in growing shorter-term gains: one could consider the taxes on that to be just an overhead/cost of doing business, and perhaps even a relatively reasonable one in contrast to what tax rates could be and what many in developed countries with decent-performing governments and economies pay in tax rates. Yet of course it is fine to play within the rules and try to optimize the rates one pays overall in taxes. If I recall correctly, the tax-brackets go from 22 to 24 and then jump to 32 percent (or such); thus we (joint tax filing) only convert to ROTH an amount that will surely keep us below the 32% tax threshold each year; can accept the 2% jump but not a 6% or 8% jump.

... Ha ha... there are other "yens and yangs"... one is that I started claiming my SS at age 63 based on some future value of alternatives computations I did (rather than claim later); anyway, the blessing of having a nice FERS pension/annuity after nearly 40-years of federal service (income for tax purposes) results in my having to pay federal tax at the highest marginal rate for me, for 75% of the SS I get... I haven't been able to avoid that. Though - in context this is a nice problem to have, Again, I wish you more success!

Yes, our situations similar & different. You said "I'm already taking sizable hits on the taxable account, and the hits are getting bigger each year, "; sounds kinda like a nice problem to have actually, like you are blessed to have significant successes in growing shorter-term gains: one could consider the taxes on that to be just an overhead/cost of doing business, and perhaps even a relatively reasonable one in contrast to what tax rates could be and what many in developed countries with decent-performing governments and economies pay in tax rates. Yet of course it is fine to play within the rules and try to optimize the rates one pays overall in taxes. If I recall correctly, the tax-brackets go from 22 to 24 and then jump to 32 percent (or such); thus we (joint tax filing) only convert to ROTH an amount that will surely keep us below the 32% tax threshold each year; can accept the 2% jump but not a 6% or 8% jump.

... Ha ha... there are other "yens and yangs"... one is that I started claiming my SS at age 63 based on some future value of alternatives computations I did (rather than claim later); anyway, the blessing of having a nice FERS pension/annuity after nearly 40-years of federal service (income for tax purposes) results in my having to pay federal tax at the highest marginal rate for me, for 75% of the SS I get... I haven't been able to avoid that. Though - in context this is a nice problem to have, Again, I wish you more success!

Last edited:

JTH

TSP Legend

- Reaction score

- 1,158

Re: Wednesday

It sounds like you've worked it out rather well, I have some time to think about it. I still need to do 2023's taxes, the crypto trading is hot a mess, but this next year with no crypto trading, the taxes will be easier to work with. I've made it a point to keep about 80% of my taxable trades long-term, I may just increase this to 90% to help offset the tax liability.

Thanks for the insights!

Yes, our situations similar & different. You said "I'm already taking sizable hits on the taxable account, and the hits are getting bigger each year, "; sounds kinda like a nice problem to have actually, like you are blessed to have significant successes in growing shorter-term gains: one could consider the taxes on that to be just an overhead/cost of doing business, and perhaps even a relatively reasonable one in contrast to what tax rates could be and what many in developed countries with decent-performing governments and economies pay in tax rates. Yet of course it is fine to play within the rules and try to optimize the rates one pays overall in taxes. If I recall correctly, the tax-brackets go from 22 to 24 and then jump to 32 percent (or such); thus we (joint tax filing) only convert to ROTH an amount that will surely keep us below the 32% tax threshold each year; can accept the 2% jump but not a 6% or 8% jump.

... Ha ha... there are other "yens and yangs"... one is that I started claiming my SS at age 63 based on some future value of alternatives computations I did (rather than claim later); anyway, the blessing of having a nice FERS pension/annuity after nearly 40-years of federal service (income for tax purposes) results in my having to pay federal tax at the highest marginal rate for me, for 75% of the SS I get... I haven't been able to avoid that. Though - in context this is a nice problem to have, Again, I wish you more success!

It sounds like you've worked it out rather well, I have some time to think about it. I still need to do 2023's taxes, the crypto trading is hot a mess, but this next year with no crypto trading, the taxes will be easier to work with. I've made it a point to keep about 80% of my taxable trades long-term, I may just increase this to 90% to help offset the tax liability.

Thanks for the insights!

JTH

TSP Legend

- Reaction score

- 1,158

JTH

TSP Legend

- Reaction score

- 1,158

Sunday

Good Morning

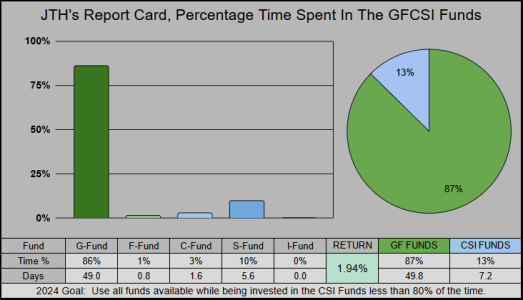

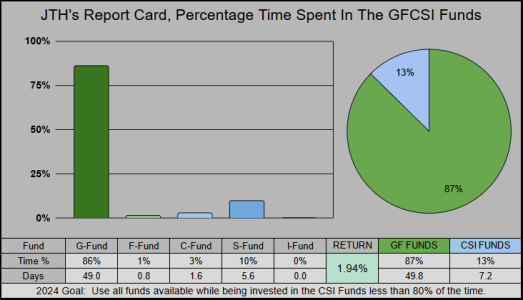

Currently 1.86% YTD, with 87% of the time spent in the G/F Funds (low risk, low reward).

It was a green week, with all the funds making money. On the 27-day timeframe, the I-Fund has the best win ratio, while the S-Fund has the highest average-of-gains.

If you’re having trouble deciding which fund is performing the best, you’re not alone. Overall, the C-Fund has been the most consistent, while the S & I Funds have had intermittent spurts of performance.

Not much movement in the allocations, the Top-300 are 60% in the C-Fund while the Bottom-300 are 47% in the S-Fund.

Have a great holiday week!

Good Morning

Currently 1.86% YTD, with 87% of the time spent in the G/F Funds (low risk, low reward).

It was a green week, with all the funds making money. On the 27-day timeframe, the I-Fund has the best win ratio, while the S-Fund has the highest average-of-gains.

If you’re having trouble deciding which fund is performing the best, you’re not alone. Overall, the C-Fund has been the most consistent, while the S & I Funds have had intermittent spurts of performance.

Not much movement in the allocations, the Top-300 are 60% in the C-Fund while the Bottom-300 are 47% in the S-Fund.

Have a great holiday week!

JTH

TSP Legend

- Reaction score

- 1,158

Re: Sunday

Yea, I feel ya, given the current conditions I would have thought it'd be the S-Fund at the top of the tracker. Just gotta wait for that rotation, it's only trailing by about 5%, that performance gap could get closed quickly.

So, at 100% "S" fund I guess I'm in the middle 300 since the "S" fund is 328 on the tracker.

Yea, I feel ya, given the current conditions I would have thought it'd be the S-Fund at the top of the tracker. Just gotta wait for that rotation, it's only trailing by about 5%, that performance gap could get closed quickly.

- Reaction score

- 821

Re: Sunday

I thought about jumping from S to C but my luck that is when S would leave C in the dust. I'm getting close to moving my TSP to my 401K account pretty soon, so I'll bite the bullet and wait it out.

Yea, I feel ya, given the current conditions I would have thought it'd be the S-Fund at the top of the tracker. Just gotta wait for that rotation, it's only trailing by about 5%, that performance gap could get closed quickly.

I thought about jumping from S to C but my luck that is when S would leave C in the dust. I'm getting close to moving my TSP to my 401K account pretty soon, so I'll bite the bullet and wait it out.

Similar threads

- Replies

- 0

- Views

- 86

- Replies

- 0

- Views

- 87

- Replies

- 0

- Views

- 108

- Replies

- 1

- Views

- 213