James48843

TSP Talk Royalty

- Reaction score

- 951

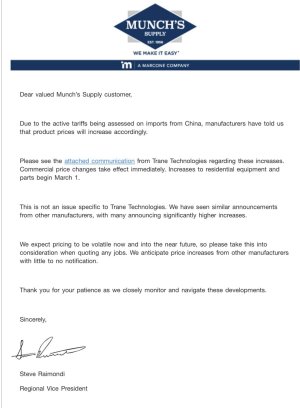

My Heating /Cooling company sent this letter out this morning. They sell TRANE furnace and air conditioners. Due to tariffs, they are jumping up prices effective immediately for commercial companies, and on March 1 for residential retail customers.

Furnaces / Air now will be 10% to 25% more expensive than last week.

Furnaces / Air now will be 10% to 25% more expensive than last week.

[emoji6

[emoji6 ]

] ][emoji[emoji6

][emoji[emoji6