James48843

TSP Talk Royalty

- Reaction score

- 951

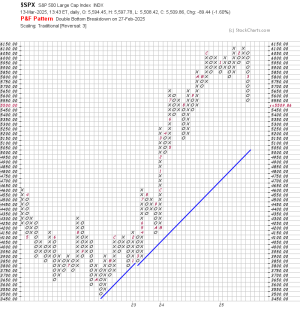

Ok- I’m seeing the following two things:

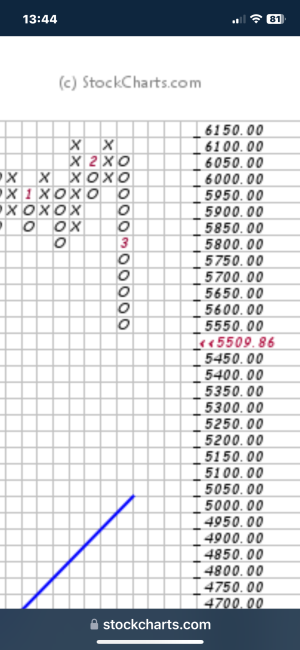

1. There is resistance today - now - just below where we are at. At the S&P 500 level of 5500 there is resistance, and then again at about 5250 there is another resistance point.

I’m thinking that the 5500/5475 area will likely form a brief hold this week, but it may sink again next week towards that 5250 area.

Whether that one holds is unknown.

Here is the P&F chart showing those two.

1. There is resistance today - now - just below where we are at. At the S&P 500 level of 5500 there is resistance, and then again at about 5250 there is another resistance point.

I’m thinking that the 5500/5475 area will likely form a brief hold this week, but it may sink again next week towards that 5250 area.

Whether that one holds is unknown.

Here is the P&F chart showing those two.