James48843

TSP Talk Royalty

- Reaction score

- 951

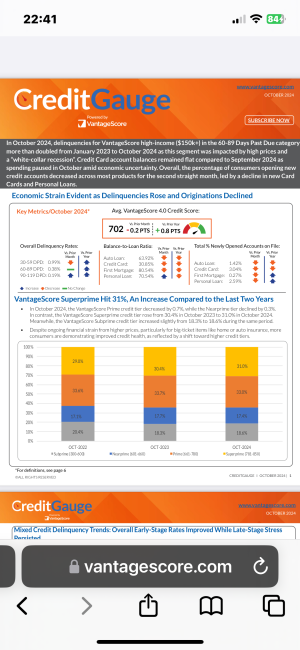

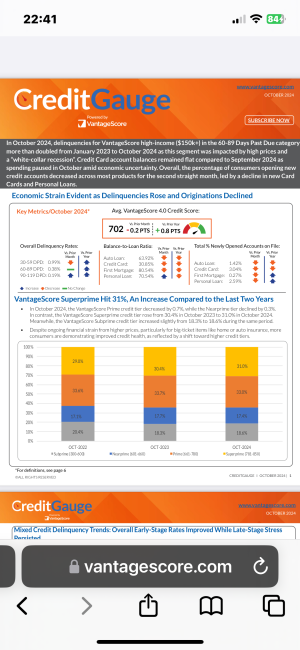

Interesting data point- those with great credit- are suddenly bigger credit risks. The number of 780-850 credit score who are now behind on payments suddenly doubled in the last three months.

Overall delinquency over the past year is DOUBLE for 30, 60 and 90 days past due.

That’s new. High income people don’t just normally stop paying their bills. Something is changing. Watch credit sensitive stocks.

Overall delinquency over the past year is DOUBLE for 30, 60 and 90 days past due.

That’s new. High income people don’t just normally stop paying their bills. Something is changing. Watch credit sensitive stocks.

Last edited: